united-utilities-annual-report-2015

united-utilities-annual-report-2015

united-utilities-annual-report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

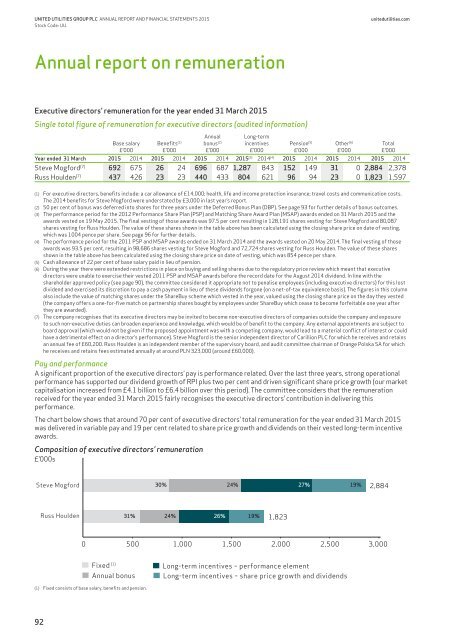

UNITED UTILITIES GROUP PLC ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2015</strong>Stock Code: UU.<strong>united</strong><strong>utilities</strong>.comAnnual <strong>report</strong> on remunerationExecutive directors’ remuneration for the year ended 31 March <strong>2015</strong>Single total figure of remuneration for executive directors (audited information)Base salary£’000Benefits (1)£’000Annualbonus (2)£’000Long-termincentives£’000Pension (5)£’000Year ended 31 March <strong>2015</strong> 2014 <strong>2015</strong> 2014 <strong>2015</strong> 2014 <strong>2015</strong> (3) 2014 (4) <strong>2015</strong> 2014 <strong>2015</strong> 2014 <strong>2015</strong> 2014Steve Mogford (7) 692 675 26 24 696 687 1,287 843 152 149 31 0 2,884 2,378Russ Houlden (7) 437 426 23 23 440 433 804 621 96 94 23 0 1,823 1,597Other (6)£’000Total£’000(1) For executive directors, benefits include: a car allowance of £14,000; health, life and income protection insurance; travel costs and communication costs.The 2014 benefits for Steve Mogford were understated by £3,000 in last year’s <strong>report</strong>.(2) 50 per cent of bonus was deferred into shares for three years under the Deferred Bonus Plan (DBP). See page 93 for further details of bonus outcomes.(3) The performance period for the 2012 Performance Share Plan (PSP) and Matching Share Award Plan (MSAP) awards ended on 31 March <strong>2015</strong> and theawards vested on 19 May <strong>2015</strong>. The final vesting of those awards was 97.5 per cent resulting in 128,191 shares vesting for Steve Mogford and 80,087shares vesting for Russ Houlden. The value of these shares shown in the table above has been calculated using the closing share price on date of vesting,which was 1004 pence per share. See page 96 for further details.(4) The performance period for the 2011 PSP and MSAP awards ended on 31 March 2014 and the awards vested on 20 May 2014. The final vesting of thoseawards was 93.5 per cent, resulting in 98,686 shares vesting for Steve Mogford and 72,724 shares vesting for Russ Houlden. The value of these sharesshown in the table above has been calculated using the closing share price on date of vesting, which was 854 pence per share.(5) Cash allowance of 22 per cent of base salary paid in lieu of pension.(6) During the year there were extended restrictions in place on buying and selling shares due to the regulatory price review which meant that executivedirectors were unable to exercise their vested 2011 PSP and MSAP awards before the record date for the August 2014 dividend. In line with theshareholder approved policy (see page 90), the committee considered it appropriate not to penalise employees (including executive directors) for this lostdividend and exercised its discretion to pay a cash payment in lieu of these dividends forgone (on a net-of-tax equivalence basis). The figures in this columnalso include the value of matching shares under the ShareBuy scheme which vested in the year, valued using the closing share price on the day they vested(the company offers a one-for-five match on partnership shares bought by employees under ShareBuy which cease to become forfeitable one year afterthey are awarded).(7) The company recognises that its executive directors may be invited to become non-executive directors of companies outside the company and exposureto such non-executive duties can broaden experience and knowledge, which would be of benefit to the company. Any external appointments are subject toboard approval (which would not be given if the proposed appointment was with a competing company, would lead to a material conflict of interest or couldhave a detrimental effect on a director’s performance). Steve Mogford is the senior independent director of Carillion PLC for which he receives and retainsan <strong>annual</strong> fee of £60,200. Russ Houlden is an independent member of the supervisory board, and audit committee chairman of Orange Polska SA for whichhe receives and retains fees estimated <strong>annual</strong>ly at around PLN 323,000 (around £60,000).Pay and performanceA significant proportion of the executive directors’ pay is performance related. Over the last three years, strong operationalperformance has supported our dividend growth of RPI plus two per cent and driven significant share price growth (our marketcapitalisation increased from £4.1 billion to £6.4 billion over this period). The committee considers that the remunerationreceived for the year ended 31 March <strong>2015</strong> fairly recognises the executive directors’ contribution in delivering thisperformance.The chart below shows that around 70 per cent of executive directors’ total remuneration for the year ended 31 March <strong>2015</strong>was delivered in variable pay and 19 per cent related to share price growth and dividends on their vested long-term incentiveawards.Composition of executive directors’ remuneration£’000sSteve Mogford 30% 24% 27% 19% 2,884Russ Houlden 31% 24% 26% 19% 1,8230 500 1,000 1,500 2,000 2,500 3,000Fixed(1)Annual bonusLong-term incentives – performance elementLong-term incentives – share price growth and dividends(1) Fixed consists of base salary, benefits and pension.92