united-utilities-annual-report-2015

united-utilities-annual-report-2015

united-utilities-annual-report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

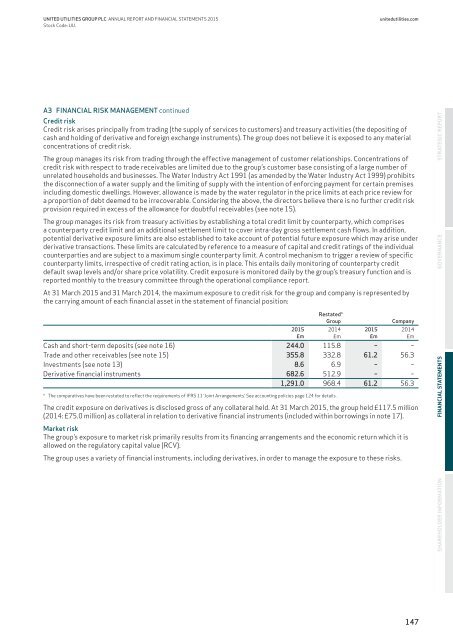

UNITED UTILITIES GROUP PLC ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2015</strong>Stock Code: UU.<strong>united</strong><strong>utilities</strong>.comA3 FINANCIAL RISK MANAGEMENT continuedCredit riskCredit risk arises principally from trading (the supply of services to customers) and treasury activities (the depositing ofcash and holding of derivative and foreign exchange instruments). The group does not believe it is exposed to any materialconcentrations of credit risk.The group manages its risk from trading through the effective management of customer relationships. Concentrations ofcredit risk with respect to trade receivables are limited due to the group’s customer base consisting of a large number ofunrelated households and businesses. The Water Industry Act 1991 (as amended by the Water Industry Act 1999) prohibitsthe disconnection of a water supply and the limiting of supply with the intention of enforcing payment for certain premisesincluding domestic dwellings. However, allowance is made by the water regulator in the price limits at each price review fora proportion of debt deemed to be irrecoverable. Considering the above, the directors believe there is no further credit riskprovision required in excess of the allowance for doubtful receivables (see note 15).The group manages its risk from treasury activities by establishing a total credit limit by counterparty, which comprisesa counterparty credit limit and an additional settlement limit to cover intra-day gross settlement cash flows. In addition,potential derivative exposure limits are also established to take account of potential future exposure which may arise underderivative transactions. These limits are calculated by reference to a measure of capital and credit ratings of the individualcounterparties and are subject to a maximum single counterparty limit. A control mechanism to trigger a review of specificcounterparty limits, irrespective of credit rating action, is in place. This entails daily monitoring of counterparty creditdefault swap levels and/or share price volatility. Credit exposure is monitored daily by the group’s treasury function and is<strong>report</strong>ed monthly to the treasury committee through the operational compliance <strong>report</strong>.At 31 March <strong>2015</strong> and 31 March 2014, the maximum exposure to credit risk for the group and company is represented bythe carrying amount of each financial asset in the statement of financial position:<strong>2015</strong>£mRestated*Group2014£m<strong>2015</strong>£mCompanyCash and short-term deposits (see note 16) 244.0 115.8 – –Trade and other receivables (see note 15) 355.8 332.8 61.2 56.3Investments (see note 13) 8.6 6.9 – –Derivative financial instruments 682.6 512.9 – –1,291.0 968.4 61.2 56.3* The comparatives have been restated to reflect the requirements of IFRS 11 ‘Joint Arrangements’. See accounting policies page 124 for details .The credit exposure on derivatives is disclosed gross of any collateral held. At 31 March <strong>2015</strong>, the group held £117.5 million(2014: £75.0 million) as collateral in relation to derivative financial instruments (included within borrowings in note 17).Market riskThe group’s exposure to market risk primarily results from its financing arrangements and the economic return which it isallowed on the regulatory capital value (RCV).The group uses a variety of financial instruments, including derivatives, in order to manage the exposure to these risks.2014£mSTRATEGIC REPORTSHAREHOLDER INFORMATION FINANCIAL STATEMENTSGOVERNANCE147