How much water does rice need? - adron.sr

How much water does rice need? - adron.sr

How much water does rice need? - adron.sr

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

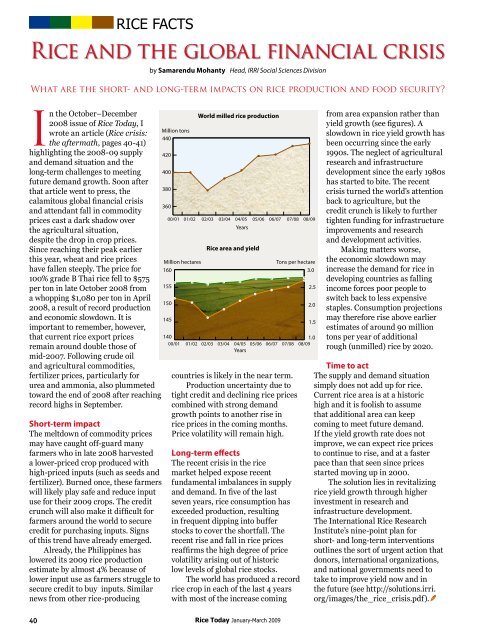

RICE FACTSRice and the global financial crisisby Samarendu Mohanty Head, IRRI Social Sciences DivisionWhat are the short- and long-term impacts on <strong>rice</strong> production and food security?In the October–December2008 issue of Rice Today, Iwrote an article (Rice crisis:the aftermath, pages 40-41)highlighting the 2008-09 supplyand demand situation and thelong-term challenges to meetingfuture demand growth. Soon afterthat article went to press, thecalamitous global financial crisisand attendant fall in commodityp<strong>rice</strong>s cast a dark shadow overthe agricultural situation,despite the drop in crop p<strong>rice</strong>s.Since reaching their peak earlierthis year, wheat and <strong>rice</strong> p<strong>rice</strong>shave fallen steeply. The p<strong>rice</strong> for100% grade B Thai <strong>rice</strong> fell to $575per ton in late October 2008 froma whopping $1,080 per ton in April2008, a result of record productionand economic slowdown. It isimportant to remember, however,that current <strong>rice</strong> export p<strong>rice</strong><strong>sr</strong>emain around double those ofmid-2007. Following crude oiland agricultural commodities,fertilizer p<strong>rice</strong>s, particularly forurea and ammonia, also plummetedtoward the end of 2008 after reachingrecord highs in September.Short-term impactThe meltdown of commodity p<strong>rice</strong>smay have caught off-guard manyfarmers who in late 2008 harvesteda lower-p<strong>rice</strong>d crop produced withhigh-p<strong>rice</strong>d inputs (such as seeds andfertilizer). Burned once, these farmerswill likely play safe and reduce inputuse for their 2009 crops. The creditcrunch will also make it difficult forfarmers around the world to securecredit for purchasing inputs. Signsof this trend have already emerged.Already, the Philippines haslowered its 2009 <strong>rice</strong> productionestimate by almost 4% because oflower input use as farmers struggle tosecure credit to buy inputs. Similarnews from other <strong>rice</strong>-producingMillion tons44042040038036000/01Million hectares16015515014514000/01World milled <strong>rice</strong> production01/02 02/03 03/04 04/05 05/06 06/07 07/08 08/09YearsRice area and yieldYieldAreaTons per hectare3.01.001/02 02/03 03/04 04/05 05/06 06/07 07/08 08/09Yearscountries is likely in the near term.Production uncertainty due totight credit and declining <strong>rice</strong> p<strong>rice</strong>scombined with strong demandgrowth points to another rise in<strong>rice</strong> p<strong>rice</strong>s in the coming months.P<strong>rice</strong> volatility will remain high.Long-term effectsThe recent crisis in the <strong>rice</strong>market helped expose recentfundamental imbalances in supplyand demand. In five of the lastseven years, <strong>rice</strong> consumption hasexceeded production, resultingin frequent dipping into bufferstocks to cover the shortfall. Therecent rise and fall in <strong>rice</strong> p<strong>rice</strong><strong>sr</strong>eaffirms the high degree of p<strong>rice</strong>volatility arising out of historiclow levels of global <strong>rice</strong> stocks.The world has produced a record<strong>rice</strong> crop in each of the last 4 yearswith most of the increase coming2.52.01.5from area expansion rather thanyield growth (see figures). Aslowdown in <strong>rice</strong> yield growth hasbeen occurring since the early1990s. The neglect of agriculturalresearch and infrastructuredevelopment since the early 1980shas started to bite. The recentcrisis turned the world’s attentionback to agriculture, but thecredit crunch is likely to furthertighten funding for infrastructureimprovements and researchand development activities.Making matters worse,the economic slowdown mayincrease the demand for <strong>rice</strong> indeveloping countries as fallingincome forces poor people toswitch back to less expensivestaples. Consumption projectionsmay therefore rise above earlierestimates of around 90 milliontons per year of additionalrough (unmilled) <strong>rice</strong> by 2020.Time to actThe supply and demand situationsimply <strong>does</strong> not add up for <strong>rice</strong>.Current <strong>rice</strong> area is at a historichigh and it is foolish to assumethat additional area can keepcoming to meet future demand.If the yield growth rate <strong>does</strong> notimprove, we can expect <strong>rice</strong> p<strong>rice</strong>sto continue to rise, and at a fasterpace than that seen since p<strong>rice</strong>sstarted moving up in 2000.The solution lies in revitalizing<strong>rice</strong> yield growth through higherinvestment in research andinfrastructure development.The International Rice ResearchInstitute’s nine-point plan forshort- and long-term interventionsoutlines the sort of urgent action thatdonors, international organizations,and national governments <strong>need</strong> totake to improve yield now and inthe future (see http://solutions.irri.org/images/the_<strong>rice</strong>_crisis.pdf).40 Rice Today January-March 2009