"Scuba rice" - adron.sr

"Scuba rice" - adron.sr

"Scuba rice" - adron.sr

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

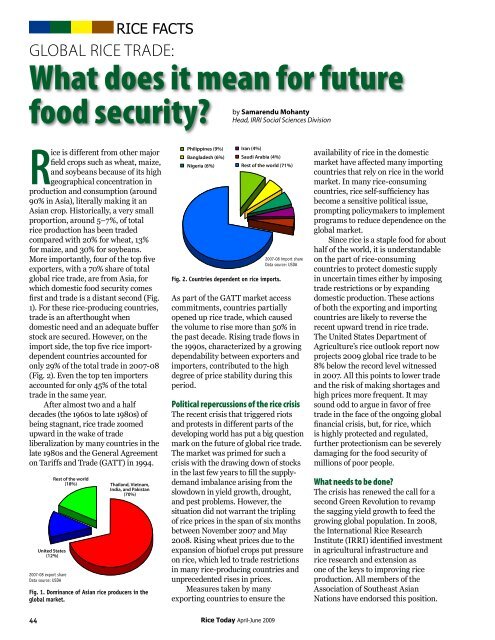

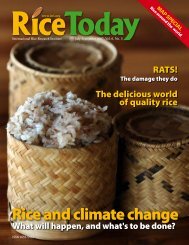

RICE FACTSGlobal rice trade:What does it mean for futurefood security?Rice is different from other majorfield crops such as wheat, maize,and soybeans because of its highgeographical concentration inproduction and consumption (around90% in Asia), literally making it anAsian crop. Historically, a very smallproportion, around 5–7%, of totalrice production has been tradedcompared with 20% for wheat, 13%for maize, and 30% for soybeans.More importantly, four of the top fiveexporters, with a 70% share of totalglobal rice trade, are from Asia, forwhich domestic food security comesfirst and trade is a distant second (Fig.1). For these rice-producing countries,trade is an afterthought whendomestic need and an adequate bufferstock are secured. However, on theimport side, the top five rice importdependentcountries accounted foronly 29% of the total trade in 2007-08(Fig. 2). Even the top ten importersaccounted for only 45% of the totaltrade in the same year.After almost two and a halfdecades (the 1960s to late 1980s) ofbeing stagnant, rice trade zoomedupward in the wake of tradeliberalization by many countries in thelate 1980s and the General Agreementon Tariffs and Trade (GATT) in 1994.2007-08 export shareData source: USDAFig. 1. Dominance of Asian rice producers in theglobal market.Fig. 2. Countries dependent on rice imports.by Samarendu MohantyHead, IRRI Social Sciences Division2007-08 import shareData source: USDAAs part of the GATT market accesscommitments, countries partiallyopened up rice trade, which causedthe volume to rise more than 50% inthe past decade. Rising trade flows inthe 1990s, characterized by a growingdependability between exporters andimporters, contributed to the highdegree of price stability during thisperiod.Political repercussions of the rice crisisThe recent crisis that triggered riotsand protests in different parts of thedeveloping world has put a big questionmark on the future of global rice trade.The market was primed for such acrisis with the drawing down of stocksin the last few years to fill the supplydemandimbalance arising from theslowdown in yield growth, drought,and pest problems. However, thesituation did not warrant the triplingof rice prices in the span of six monthsbetween November 2007 and May2008. Rising wheat prices due to theexpansion of biofuel crops put pressureon rice, which led to trade restrictionsin many rice-producing countries andunprecedented rises in prices.Measures taken by manyexporting countries to ensure theavailability of rice in the domesticmarket have affected many importingcountries that rely on rice in the worldmarket. In many rice-consumingcountries, rice self-sufficiency hasbecome a sensitive political issue,prompting policymakers to implementprograms to reduce dependence on theglobal market.Since rice is a staple food for abouthalf of the world, it is understandableon the part of rice-consumingcountries to protect domestic supplyin uncertain times either by imposingtrade restrictions or by expandingdomestic production. These actionsof both the exporting and importingcountries are likely to reverse therecent upward trend in rice trade.The United States Department ofAgriculture’s rice outlook report nowprojects 2009 global rice trade to be8% below the record level witnessedin 2007. All this points to lower tradeand the risk of making shortages andhigh prices more frequent. It maysound odd to argue in favor of freetrade in the face of the ongoing globalfinancial crisis, but, for rice, whichis highly protected and regulated,further protectionism can be severelydamaging for the food security ofmillions of poor people.What needs to be done?The crisis has renewed the call for asecond Green Revolution to revampthe sagging yield growth to feed thegrowing global population. In 2008,the International Rice ResearchInstitute (IRRI) identified investmentin agricultural infrastructure andrice research and extension asone of the keys to improving riceproduction. All members of theAssociation of Southeast AsianNations have endorsed this position.Several constraints, including landand water scarcity, environmentaldegradation, and high input prices,will make achieving higher rice yieldschallenging. But, we have proven oursuccess in delivering research-drivensolutions to farmers that increase yieldand, with further investment, we cancontinue to do this. However, noneof this is possible without supportivepolices and institutions in place.Apart from revamping the yieldgrowth, the conduct of the world ricemarket, which played an importantrole in magnifying the intensity ofthe recent crisis, needs to be reinedin if future crises are to be averted.The rice crisis starkly reminded usthat the current structure, in whichthe majority of exporters are residualsuppliers, does not bode well for thefuture of the global rice market. Thefuture stability of the rice marketclearly hinges on re-establishing therelationships between exporters andimporters. It may be worthwhile tohold a summit of major riceexportingand -importingcountries to build thoserelationships, and at the sametime collaboratively developsome basic rules in ricetrading. Another option, whichcould be expensive but worthconsidering, is to rebuildbuffer stocks in the majorrice-producing countries,particularly in China andIndia, to have a calming effecton the market.Aside from makinginvestments and changes toincrease rice yield withinAsia, another potentiallong-term solution to thisproblem lies in developingrice exporters outside Asiawhere rice can be producedprimarily for export. Thetransformation of the globalsoybean market threedecades ago may give a clueas to what is needed in therice market. In the soybeanmarket, the United Statesused to be the big guy on theblock, accounting for around80% of world productionand 95% of total exports throughoutthe 1960s and 1970s. The ban onsoybean exports imposed by the U.S.in the early 1970s changed the entirelandscape of soybean production andtrade when other countries startedlooking for alternative suppliers ofsoybeans. Although the soybean crisisended in a few months, the confidencein the U.S. as a reliable supplier wasgone. Two South American neighbors,Argentina and Brazil, emerged fromthis crisis to become formidablecompetitors for the U.S. in the worldsoybean market. Currently, these twocountries account for around half ofthe global soybean trade (Fig. 3). Theemergence of multiple dependablesuppliers also convinced manycountries, including China, Japan, theEuropean Union countries, Taiwan,South Korea, and others, to liberalizetheir oilseed sector and depend onimports. This is clearly evident forChina, with 38 million tons of importsin 2007-08, accounting for 76% of theData source: USDAFig. 3. Transformation of the global soybean market.Data source: USDAFig. 4. Chinese dependence on foreign soybeans.total domestic consumption (Fig. 4).It is true that the current situation,in terms of land and water availability,is quite different from what it wasin the 1970s and 1980s. Nobodyexpects countries to give up riceproduction and become dependent onthe international market even if newsuppliers emerge. But, more surplu<strong>sr</strong>ice produced by new suppliers couldhelp stabilize the market and reassurethe importing countries.Within Asia, Myanmar andCambodia potentially seem tohave surplus rice production. Riceproduction in these countries canbe expanded through intensificationand by bringing additional fallowland into production. However, this ispossible only under stable political andeconomic conditions. Outside Asia, thepotential to increase rice productionexists primarily in South Americaand Africa. Currently, South Americais more or less self-sufficient in riceand has the land mass to expand riceproduction if the underlyingeconomics make sense.Africa, on the other hand,probably has more potentialthan even South Americabecause of its underusedland and water resources.But, Africa requires a stablepolitical environment andthe necessary investment forinfrastructure and marketdevelopment to boost its riceproduction.Nonetheless, the bottomline is that the rice supplyneeds to increase to improvefuture food security. Riceyields within existing ricegrowingregions in Asia canbe increased if technologydrivensolutions are deliveredto growers through effectiveextension mechanisms, and ifinvestments are made. Betteragricultural infrastructureand policies must supportthis to improve the reliabilityof supply. Finally, newinternational suppliers of ricecould also play an importantrole in providing new sourcesof rice to importers.44 Rice Today April-June 2009 Rice Today April-June 200945