Modeling drawdowns and drawups in financial markets - Risk.net

Modeling drawdowns and drawups in financial markets - Risk.net

Modeling drawdowns and drawups in financial markets - Risk.net

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

58<br />

Beatriz Vaz de Melo Mendes <strong>and</strong> V<strong>in</strong>icius Ratton Br<strong>and</strong>i<br />

( ) ↑<br />

⎧ yγ<br />

−1<br />

ξ<br />

⎪<br />

1− 1+<br />

ξ , if ξ 0<br />

ψ<br />

G( γ, ξ, ψ;<br />

y)<br />

= ⎨<br />

yγ<br />

⎪ −<br />

ψ<br />

⎩⎪<br />

1−<br />

e , if ξ=0<br />

where γ > 0, <strong>and</strong> ψ > 0 is a scale parameter. We observe that the GPD (2) may be<br />

obta<strong>in</strong>ed from (3) by lett<strong>in</strong>g γ = 1, <strong>and</strong> that the stretched exponential corresponds<br />

to ξ = 0. As po<strong>in</strong>ted out by the referee, fitt<strong>in</strong>g the MGPD to Y is equivalent to<br />

tak<strong>in</strong>g a Box–Cox transformation of Y, <strong>and</strong> model<strong>in</strong>g Y γ us<strong>in</strong>g equation (2). We<br />

chose to keep the r<strong>and</strong>om variable Y, the drawdown or drawup, <strong>and</strong> to fit the large<br />

family MGPD, which allowed us to pursue st<strong>and</strong>ard log-likelihood nested statistical<br />

tests.<br />

The MGPD density function is given by<br />

−1− ξ<br />

⎧<br />

⎪<br />

g( γ, ξ, ψ;<br />

y)<br />

( ξψ yγ ξ ) ψ γ yγ<br />

=<br />

1+ −1 −1 −1,<br />

if ξ ↑ 0<br />

⎨<br />

e− ψ−1y γ<br />

ψ−1γ γ −1<br />

⎩⎪<br />

y ξ<br />

( ) , if =0<br />

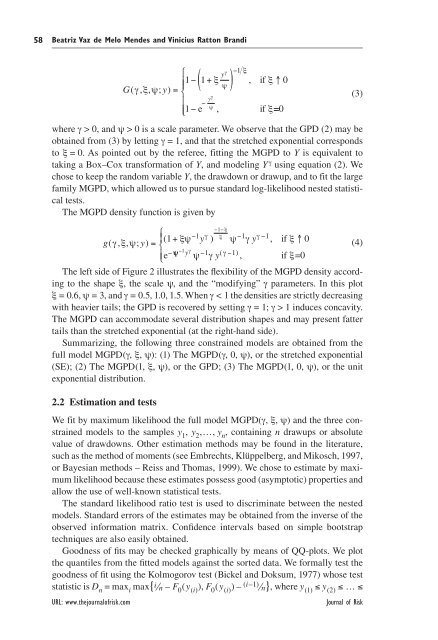

The left side of Figure 2 illustrates the flexibility of the MGPD density accord<strong>in</strong>g<br />

to the shape ξ, the scale ψ, <strong>and</strong> the “modify<strong>in</strong>g” γ parameters. In this plot<br />

ξ = 0.6, ψ = 3, <strong>and</strong> γ = 0.5, 1.0, 1.5. When γ < 1 the densities are strictly decreas<strong>in</strong>g<br />

with heavier tails; the GPD is recovered by sett<strong>in</strong>g γ = 1; γ > 1 <strong>in</strong>duces concavity.<br />

The MGPD can accommodate several distribution shapes <strong>and</strong> may present fatter<br />

tails than the stretched exponential (at the right-h<strong>and</strong> side).<br />

Summariz<strong>in</strong>g, the follow<strong>in</strong>g three constra<strong>in</strong>ed models are obta<strong>in</strong>ed from the<br />

full model MGPD(γ, ξ, ψ): (1) The MGPD(γ, 0, ψ), or the stretched exponential<br />

(SE); (2) The MGPD(1, ξ, ψ), or the GPD; (3) The MGPD(1, 0, ψ), or the unit<br />

exponential distribution.<br />

2.2 Estimation <strong>and</strong> tests<br />

We fit by maximum likelihood the full model MGPD(γ, ξ, ψ) <strong>and</strong> the three constra<strong>in</strong>ed<br />

models to the samples y 1 , y 2 ,…, y n , conta<strong>in</strong><strong>in</strong>g n <strong>drawups</strong> or absolute<br />

value of <strong>drawdowns</strong>. Other estimation methods may be found <strong>in</strong> the literature,<br />

such as the method of moments (see Embrechts, Klüppelberg, <strong>and</strong> Mikosch, 1997,<br />

or Bayesian methods – Reiss <strong>and</strong> Thomas, 1999). We chose to estimate by maximum<br />

likelihood because these estimates possess good (asymptotic) properties <strong>and</strong><br />

allow the use of well-known statistical tests.<br />

The st<strong>and</strong>ard likelihood ratio test is used to discrim<strong>in</strong>ate between the nested<br />

models. St<strong>and</strong>ard errors of the estimates may be obta<strong>in</strong>ed from the <strong>in</strong>verse of the<br />

observed <strong>in</strong>formation matrix. Confidence <strong>in</strong>tervals based on simple bootstrap<br />

techniques are also easily obta<strong>in</strong>ed.<br />

Goodness of fits may be checked graphically by means of QQ-plots. We plot<br />

the quantiles from the fitted models aga<strong>in</strong>st the sorted data. We formally test the<br />

goodness of fit us<strong>in</strong>g the Kolmogorov test (Bickel <strong>and</strong> Doksum, 1977) whose test<br />

statistic is D n = max i max{i⁄n – F 0 (y (i) ), F 0 (y (i) ) – (i–1) ⁄n}, where y (1) ≤ y (2) ≤ … ≤<br />

URL: www.thejournalofrisk.com Journal of <strong>Risk</strong><br />

(3)<br />

(4)