Guinness Peat Group plc

Notes to Financial Statements - Guinness Peat Group plc

Notes to Financial Statements - Guinness Peat Group plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

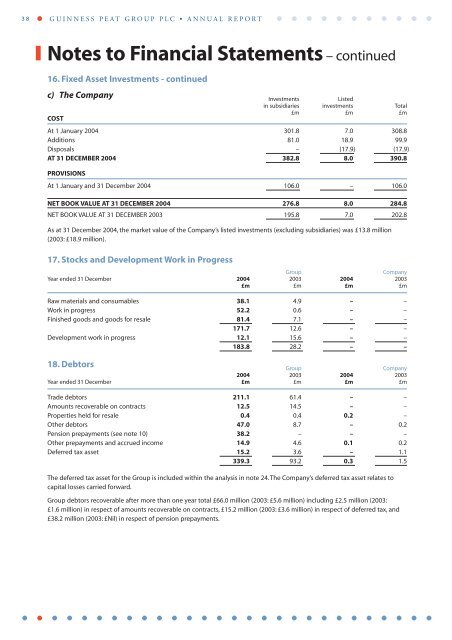

38 GUINNESS PEAT GROUP PLC • ANNUAL REPORTNotes to Financial Statements – continued16. Fixed Asset Investments - continuedc) The CompanyInvestments Listedin subsidiaries investments Total£m £m £mCOSTAt 1 January 2004 301.8 7.0 308.8Additions 81.0 18.9 99.9Disposals – (17.9) (17.9)AT 31 DECEMBER 2004 382.8 8.0 390.8PROVISIONSAt 1 January and 31 December 2004 106.0 – 106.0NET BOOK VALUE AT 31 DECEMBER 2004 276.8 8.0 284.8NET BOOK VALUE AT 31 DECEMBER 2003 195.8 7.0 202.8As at 31 December 2004, the market value of the Company’s listed investments (excluding subsidiaries) was £13.8 million(2003: £18.9 million).17. Stocks and Development Work in Progress<strong>Group</strong>CompanyYear ended 31 December 2004 2003 2004 2003£m £m £m £mRaw materials and consumables 38.1 4.9 – –Work in progress 52.2 0.6 – –Finished goods and goods for resale 81.4 7.1 – –171.7 12.6 – –Development work in progress 12.1 15.6 – –183.8 28.2 – –18. Debtors<strong>Group</strong> Company2004 2003 2004 2003Year ended 31 December £m £m £m £mTrade debtors 211.1 61.4 – –Amounts recoverable on contracts 12.5 14.5 – –Properties held for resale 0.4 0.4 0.2 –Other debtors 47.0 8.7 – 0.2Pension prepayments (see note 10) 38.2 – – –Other prepayments and accrued income 14.9 4.6 0.1 0.2Deferred tax asset 15.2 3.6 – 1.1339.3 93.2 0.3 1.5The deferred tax asset for the <strong>Group</strong> is included within the analysis in note 24. The Company’s deferred tax asset relates tocapital losses carried forward.<strong>Group</strong> debtors recoverable after more than one year total £66.0 million (2003: £5.6 million) including £2.5 million (2003:£1.6 million) in respect of amounts recoverable on contracts, £15.2 million (2003: £3.6 million) in respect of deferred tax, and£38.2 million (2003: £Nil) in respect of pension prepayments.