Guinness Peat Group plc

Notes to Financial Statements - Guinness Peat Group plc

Notes to Financial Statements - Guinness Peat Group plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

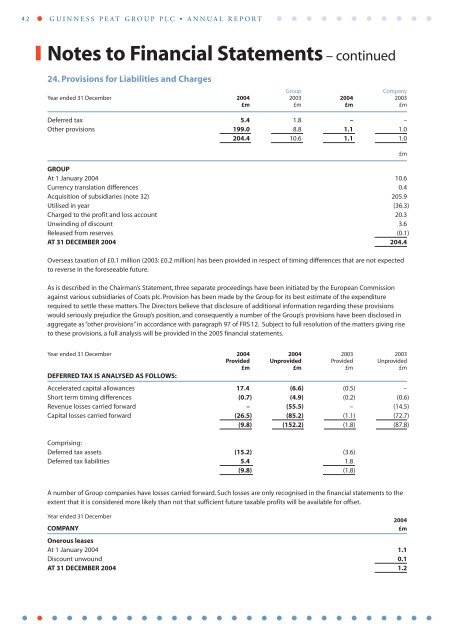

42 GUINNESS PEAT GROUP PLC • ANNUAL REPORTNotes to Financial Statements – continued24. Provisions for Liabilities and Charges<strong>Group</strong>CompanyYear ended 31 December 2004 2003 2004 2003£m £m £m £mDeferred tax 5.4 1.8 – –Other provisions 199.0 8.8 1.1 1.0204.4 10.6 1.1 1.0GROUPAt 1 January 2004 10.6Currency translation differences 0.4Acquisition of subsidiaries (note 32) 205.9Utilised in year (36.3)Charged to the profit and loss account 20.3Unwinding of discount 3.6Released from reserves (0.1)AT 31 DECEMBER 2004 204.4Overseas taxation of £0.1 million (2003: £0.2 million) has been provided in respect of timing differences that are not expectedto reverse in the foreseeable future.As is described in the Chairman’s Statement, three separate proceedings have been initiated by the European Commissionagainst various subsidiaries of Coats <strong>plc</strong>. Provision has been made by the <strong>Group</strong> for its best estimate of the expenditurerequired to settle these matters. The Directors believe that disclosure of additional information regarding these provisionswould seriously prejudice the <strong>Group</strong>’s position, and consequently a number of the <strong>Group</strong>’s provisions have been disclosed inaggregate as “other provisions” in accordance with paragraph 97 of FRS 12. Subject to full resolution of the matters giving riseto these provisions, a full analysis will be provided in the 2005 financial statements.£mYear ended 31 December 2004 2004 2003 2003Provided Unprovided Provided Unprovided£m £m £m £mDEFERRED TAX IS ANALYSED AS FOLLOWS:Accelerated capital allowances 17.4 (6.6) (0.5) –Short term timing differences (0.7) (4.9) (0.2) (0.6)Revenue losses carried forward – (55.5) – (14.5)Capital losses carried forward (26.5) (85.2) (1.1) (72.7)(9.8) (152.2) (1.8) (87.8)Comprising:Deferred tax assets (15.2) (3.6)Deferred tax liabilities 5.4 1.8(9.8) (1.8)A number of <strong>Group</strong> companies have losses carried forward. Such losses are only recognised in the financial statements to theextent that it is considered more likely than not that sufficient future taxable profits will be available for offset.Year ended 31 December2004COMPANY £mOnerous leasesAt 1 January 2004 1.1Discount unwound 0.1AT 31 DECEMBER 2004 1.2