Guinness Peat Group plc

Notes to Financial Statements - Guinness Peat Group plc

Notes to Financial Statements - Guinness Peat Group plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

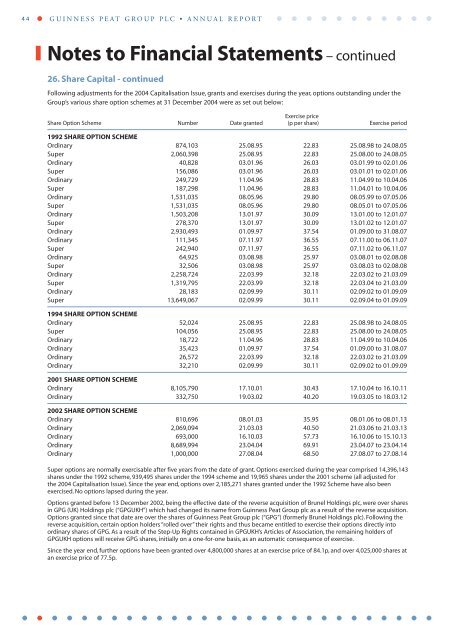

44 GUINNESS PEAT GROUP PLC • ANNUAL REPORTNotes to Financial Statements – continued26. Share Capital - continuedFollowing adjustments for the 2004 Capitalisation Issue, grants and exercises during the year, options outstanding under the<strong>Group</strong>’s various share option schemes at 31 December 2004 were as set out below:Exercise priceShare Option Scheme Number Date granted (p per share) Exercise period1992 SHARE OPTION SCHEMEOrdinary 874,103 25.08.95 22.83 25.08.98 to 24.08.05Super 2,060,398 25.08.95 22.83 25.08.00 to 24.08.05Ordinary 40,828 03.01.96 26.03 03.01.99 to 02.01.06Super 156,086 03.01.96 26.03 03.01.01 to 02.01.06Ordinary 249,729 11.04.96 28.83 11.04.99 to 10.04.06Super 187,298 11.04.96 28.83 11.04.01 to 10.04.06Ordinary 1,531,035 08.05.96 29.80 08.05.99 to 07.05.06Super 1,531,035 08.05.96 29.80 08.05.01 to 07.05.06Ordinary 1,503,208 13.01.97 30.09 13.01.00 to 12.01.07Super 278,370 13.01.97 30.09 13.01.02 to 12.01.07Ordinary 2,930,493 01.09.97 37.54 01.09.00 to 31.08.07Ordinary 111,345 07.11.97 36.55 07.11.00 to 06.11.07Super 242,940 07.11.97 36.55 07.11.02 to 06.11.07Ordinary 64,925 03.08.98 25.97 03.08.01 to 02.08.08Super 32,506 03.08.98 25.97 03.08.03 to 02.08.08Ordinary 2,258,724 22.03.99 32.18 22.03.02 to 21.03.09Super 1,319,795 22.03.99 32.18 22.03.04 to 21.03.09Ordinary 28,183 02.09.99 30.11 02.09.02 to 01.09.09Super 13,649,067 02.09.99 30.11 02.09.04 to 01.09.091994 SHARE OPTION SCHEMEOrdinary 52,024 25.08.95 22.83 25.08.98 to 24.08.05Super 104,056 25.08.95 22.83 25.08.00 to 24.08.05Ordinary 18,722 11.04.96 28.83 11.04.99 to 10.04.06Ordinary 35,423 01.09.97 37.54 01.09.00 to 31.08.07Ordinary 26,572 22.03.99 32.18 22.03.02 to 21.03.09Ordinary 32,210 02.09.99 30.11 02.09.02 to 01.09.092001 SHARE OPTION SCHEMEOrdinary 8,105,790 17.10.01 30.43 17.10.04 to 16.10.11Ordinary 332,750 19.03.02 40.20 19.03.05 to 18.03.122002 SHARE OPTION SCHEMEOrdinary 810,696 08.01.03 35.95 08.01.06 to 08.01.13Ordinary 2,069,094 21.03.03 40.50 21.03.06 to 21.03.13Ordinary 693,000 16.10.03 57.73 16.10.06 to 15.10.13Ordinary 8,689,994 23.04.04 69.91 23.04.07 to 23.04.14Ordinary 1,000,000 27.08.04 68.50 27.08.07 to 27.08.14Super options are normally exercisable after five years from the date of grant. Options exercised during the year comprised 14,396,143shares under the 1992 scheme, 939,495 shares under the 1994 scheme and 19,965 shares under the 2001 scheme (all adjusted forthe 2004 Capitalisation Issue). Since the year end, options over 2,185,271 shares granted under the 1992 Scheme have also beenexercised. No options lapsed during the year.Options granted before 13 December 2002, being the effective date of the reverse acquisition of Brunel Holdings <strong>plc</strong>, were over sharesin GPG (UK) Holdings <strong>plc</strong> (“GPGUKH”) which had changed its name from <strong>Guinness</strong> <strong>Peat</strong> <strong>Group</strong> <strong>plc</strong> as a result of the reverse acquisition.Options granted since that date are over the shares of <strong>Guinness</strong> <strong>Peat</strong> <strong>Group</strong> <strong>plc</strong> (“GPG”) (formerly Brunel Holdings <strong>plc</strong>). Following thereverse acquisition, certain option holders “rolled over” their rights and thus became entitled to exercise their options directly intoordinary shares of GPG. As a result of the Step-Up Rights contained in GPGUKH’s Articles of Association, the remaining holders ofGPGUKH options will receive GPG shares, initially on a one-for-one basis, as an automatic consequence of exercise.Since the year end, further options have been granted over 4,800,000 shares at an exercise price of 84.1p, and over 4,025,000 shares atan exercise price of 77.5p.