to period on or before the date of balance sheet as per therequirement of Schedule VI of the Companies Act, 1956.(j) Taxes on IncomeTax expense comprises of current, deferred and fringe benefittax. Current income tax and fringe benefit tax is measuredat the amount expected to be paid to the tax authorities inaccordance with the Indian Income Tax Act. Deferred incometaxes reflects the impact of current year timing differencesbetween taxable income and accounting income for the yearand reversal of timing differences of earlier years.Deferred tax is measured based on the tax rates and thetax laws enacted or substantively enacted at the balancesheet date. Deferred tax assets are recognised only to theextent that there is reasonable certainty that sufficient futuretaxable income will be available against which such deferredtax assets can be realised. In situations where the Companyhas unabsorbed depreciation or carry forward tax losses,all deferred tax assets are recognised only if there is virtualcertainty supported by convincing evidence that they can berealised against future taxable profits.At each balance sheet date the Company re-assessesunrecognised deferred tax assets. It recognisesunrecognised deferred tax assets to the extent that it hasbecome reasonably certain or virtually certain, as the casemay be that sufficient future taxable income will be availableagainst which such deferred tax assets can be realised.The carrying amount of deferred tax assets are reviewedat each balance sheet date. The Company writes-down thecarrying amount of a deferred tax asset to the extent that itis no longer reasonably certain or virtually certain, as thecase may be, that sufficient future taxable income will beavailable against which deferred tax asset can be realised.Any such write-down is reversed to the extent that it becomesreasonably certain or virtually certain, as the case may be,that sufficient future taxable income will be available.(k) InventoriesRaw Materials, Production Consumables, Stores andSpares is valued at lower of cost and net realizable value.However, materials other than items held for use in theproduction of inventories are not written down below cost ifthe finished products in which they will be incorporated areexpected to be sold above cost. Cost is determined on aFirst in first out (FIFO) basis. Work-in-progress and finishedgoods is valued at lower of cost and net realisable value.Cost includes direct material and labour and a proportion ofmanufacturing overheads based on normal capacity. Valueof finished goods also include excise duty. Net realizablevalue is the estimated selling price in the ordinary course ofbusiness less estimated cost of completion and cost to makethe sale.(l) InvestmentsInvestments that are readily realisable and intended tobe held for not more than a year are classified as currentinvestments. All other investments are classified as longterminvestments. Current investments are carried atlower of cost and fair value determined on an individualinvestment basis. Long-term investments are carried at cost.However, provision for diminution in value, if any, is made torecognise a decline other than temporary in the value of theinvestments.(m) Foreign Currency Transactions(i) Initial RecognitionForeign currency transactions are recorded in thereporting currency, by applying to the foreign currencyamount the exchange rate between the reportingcurrency and the foreign currency at the date of thetransaction.(ii) ConversionForeign currency monetary items are reported usingthe closing rate. Non-monetary items which are carriedin terms of historical cost denominated in a foreigncurrency are reported using the exchange rate atthe date of the transaction; and non-monetary itemswhich are carried at fair value or other similar valuationdenominated in a foreign currency are reported usingthe exchange rates that existed when the values weredetermined.(iii) Exchange DifferenceExchange differences arising on the settlement ofmonetary items at rates different from those at whichthey were initially recorded during the year, or reportedin previous financial statements, are recognised asincome or as expenses in the year in which they arise.Exchange differences arising in respect of fixed assetsacquired from outside India on or before accountingperiod commencing after December 7, 2006 arecapitalized as a part of fixed asset.(iv) Forward Exchange Contracts not intended for trading orspeculation purposesThe premium or discount arising at the inception offorward exchange contracts is amortised as expenseor income over the life of the contract. Exchangedifferences on such contracts are recognised in thestatement of profit and loss account in the year in whichthe exchange rates change. Any profit or loss arising oncancellation or renewal of forward exchange contract isrecognised as income or as expense for the year.(n) Earnings Per ShareBasic earnings per share are calculated by dividing the netprofit or loss for the period attributable to equity shareholders(after deducting preference dividends and attributable taxes)by the weighted average number of equity shares outstandingduring the period. Partly paid equity shares are treated as afraction of an equity share to the extent that they were entitledto participate in dividends relative to a fully paid equity shareduring the reporting period. The weighted average numberof equity shares outstanding during the period are adjustedfor events of bonus issue; bonus element in a rights issueto existing shareholders; share split; and reverse share split(consolidation of shares).For the purpose of calculating diluted earnings per share,the net profit or loss for the period attributable to equityshareholders and the weighted average number of sharesoutstanding during the period are adjusted for the effects ofall dilutive potential equity shares.(o) ProvisionsA provision is recognised when an enterprise has a presentobligation as a result of past event; it is probable that anoutflow of resources will be required to settle the obligation,in respect of which a reliable estimate can be made.Provisions are not discounted to its present value and aredetermined based on best estimate required to settle theobligation at the balance sheet date. These are reviewed ateach balance sheet date and adjusted to reflect the currentbest estimates.(p) Cash and Cash equivalentsCash and cash equivalents in the balance sheet comprisecash in hand and at bank in current account. Margin depositand term deposit are considered as cash equivalent.(q) Derivative InstrumentsAs per the ICAI announcement, accounting for derivativecontract, other than those covered under AS 11, aremarked to market on a portfolio basis, and the net loss afterconsidering the offsetting effect on the underlying hedge itemis charged to the income statement. Net gains are ignored.(r) Retirement and other employee benefitsRetirement benefits in the form of Provident Fund is a definedcontribution scheme and the contributions are charged to theProfit and Loss Account of the year when the contributions tothe respective funds are due. There are no other obligationsother than the contribution payable to the respective fund.Gratuity liability are defined benefit obligations and areprovided for on the basis of an actuarial valuation onprojected unit credit method made at the end of eachfinancial year.23

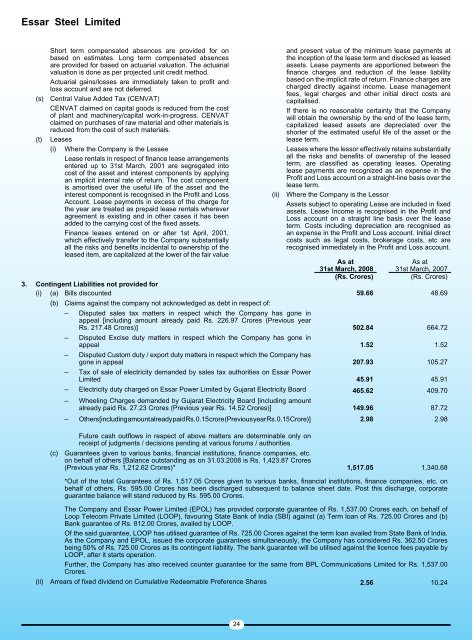

Essar Steel LimitedShort term compensated absences are provided for onbased on estimates. Long term compensated absencesare provided for based on actuarial valuation. The actuarialvaluation is done as per projected unit credit method.Actuarial gains/losses are immediately taken to profit andloss account and are not deferred.(s) Central Value Added Tax (CENVAT)CENVAT claimed on capital goods is reduced from the costof plant and machinery/capital work-in-progress. CENVATclaimed on purchases of raw material and other materials isreduced from the cost of such materials.(t) Leases(i) Where the Company is the LesseeLease rentals in respect of finance lease arrangementsentered up to 31st March, 2001 are segregated intocost of the asset and interest components by applyingan implicit internal rate of return. The cost componentis amortised over the useful life of the asset and theinterest component is recognised in the Profit and LossAccount. Lease payments in excess of the charge forthe year are treated as prepaid lease rentals whereveragreement is existing and in other cases it has beenadded to the carrying cost of the fixed assets.Finance leases entered on or after 1st April, 2001,which effectively transfer to the Company substantiallyall the risks and benefits incidental to ownership of theleased item, are capitalized at the lower of the fair valueand present value of the minimum lease payments atthe inception of the lease term and disclosed as leasedassets. Lease payments are apportioned between thefinance charges and reduction of the lease liabilitybased on the implicit rate of return. Finance charges arecharged directly against income. Lease managementfees, legal charges and other initial direct costs arecapitalised.If there is no reasonable certainty that the Companywill obtain the ownership by the end of the lease term,capitalized leased assets are depreciated over theshorter of the estimated useful life of the asset or thelease term.Leases where the lessor effectively retains substantiallyall the risks and benefits of ownership of the leasedterm, are classified as operating leases. Operatinglease payments are recognized as an expense in theProfit and Loss account on a straight-line basis over thelease term.(ii) Where the Company is the LessorAssets subject to operating Lease are included in fixedassets. Lease Income is recognised in the Profit andLoss account on a straight line basis over the leaseterm. Costs including depreciation are recognised asan expense in the Profit and Loss account. Initial directcosts such as legal costs, brokerage costs, etc arerecognised immediately in the Profit and Loss account.As at31st March, 2008As at31st March, 2007(Rs. Crores)(Rs. Crores)3. Contingent Liabilities not provided for(i) (a) Bills discounted 59.66 48.69(b) Claims against the company not acknowledged as debt in respect of:– Disputed sales tax matters in respect which the Company has gone inappeal [including amount already paid Rs. 226.97 Crores (Previous yearRs. 217.48 Crores)] 502.84 664.72– Disputed Excise duty matters in respect which the Company has gone inappeal 1.52 1.52– Disputed Custom duty / export duty matters in respect which the Company hasgone in appeal 207.93 105.27– Tax of sale of electricity demanded by sales tax authorities on Essar PowerLimited 45.91 45.91– Electricity duty charged on Essar Power Limited by Gujarat Electricity Board 4<strong>65</strong>.62 409.70– Wheeling Charges demanded by Gujarat Electricity Board [including amountalready paid Rs. 27.23 Crores (Previous year Rs. 14.52 Crores)] 149.96 87.72– Others [including amount already paid Rs. 0.15 crore (Previous year Rs. 0.15 Crore)]2.98 2.98Future cash outflows in respect of above matters are determinable only onreceipt of judgments / decisions pending at various forums / authorities.(c) Guarantees given to various banks, financial institutions, finance companies, etc.on behalf of others [Balance outstanding as on 31.03.2008 is Rs. 1,423.87 Crores(Previous year Rs. 1,212.62 Crores)* 1,517.05 1,340.68*Out of the total Guarantees of Rs. 1,517.05 Crores given to various banks, financial institutions, finance companies, etc. onbehalf of others, Rs. 595.00 Crores has been discharged subsequent to balance sheet date. Post this discharge, corporateguarantee balance will stand reduced by Rs. 595.00 Crores.The Company and Essar Power Limited (EPOL) has provided corporate guarantee of Rs. 1,537.00 Crores each, on behalf ofLoop Telecom Private Limited (LOOP), favouring State Bank of India (SBI) against (a) Term loan of Rs. 725.00 Crores and (b)Bank guarantee of Rs. 812.00 Crores, availed by LOOP.Of the said guarantee, LOOP has utilised guarantee of Rs. 725.00 Crores against the term loan availed from State Bank of India.As the Company and EPOL, issued the corporate guarantees simultaneously, the Company has considered Rs. 362.50 Croresbeing 50% of Rs. 725.00 Crores as its contingent liability. The bank guarantee will be utilised against the licence fees payable byLOOP, after it starts operation.Further, the Company has also received counter guarantee for the same from BPL Communications Limited for Rs. 1,537.00Crores.(ii) Arrears of fixed dividend on Cumulative Redeemable Preference Shares 2.56 10.2424