Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

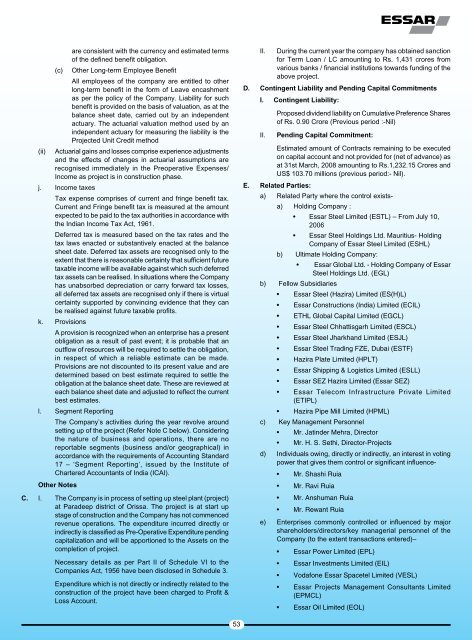

are consistent with the currency and estimated termsof the defined benefit obligation.(c) Other Long-term Employee BenefitAll employees of the company are entitled to otherlong-term benefit in the form of Leave encashmentas per the policy of the Company. Liability for suchbenefit is provided on the basis of valuation, as at thebalance sheet date, carried out by an independentactuary. The actuarial valuation method used by anindependent actuary for measuring the liability is theProjected Unit Credit method(ii) Actuarial gains and losses comprise experience adjustmentsand the effects of changes in actuarial assumptions arerecognised immediately in the Preoperative Expenses/Income as project is in construction phase.j. Income taxesTax expense comprises of current and fringe benefit tax.Current and Fringe benefit tax is measured at the amountexpected to be paid to the tax authorities in accordance withthe Indian Income Tax Act, 1961.Deferred tax is measured based on the tax rates and thetax laws enacted or substantively enacted at the balancesheet date. Deferred tax assets are recognised only to theextent that there is reasonable certainty that sufficient futuretaxable income will be available against which such deferredtax assets can be realised. In situations where the Companyhas unabsorbed depreciation or carry forward tax losses,all deferred tax assets are recognised only if there is virtualcertainty supported by convincing evidence that they canbe realised against future taxable profits.k. ProvisionsA provision is recognized when an enterprise has a presentobligation as a result of past event; it is probable that anoutflow of resources will be required to settle the obligation,in respect of which a reliable estimate can be made.Provisions are not discounted to its present value and aredetermined based on best estimate required to settle theobligation at the balance sheet date. These are reviewed ateach balance sheet date and adjusted to reflect the currentbest estimates.l. Segment ReportingThe Company’s activities during the year revolve aroundsetting up of the project (Refer Note C below). Consideringthe nature of business and operations, there are noreportable segments (business and/or geographical) inaccordance with the requirements of Accounting Standard17 – ‘Segment Reporting’, issued by the Institute ofChartered Accountants of India (ICAI).Other NotesC. I. The Company is in process of setting up steel plant (project)at Paradeep district of Orissa. The project is at start upstage of construction and the Company has not commencedrevenue operations. The expenditure incurred directly orindirectly is classified as Pre-Operative Expenditure pendingcapitalization and will be apportioned to the Assets on thecompletion of project.Necessary details as per Part II of Schedule VI to theCompanies Act, 1956 have been disclosed in Schedule 3.Expenditure which is not directly or indirectly related to theconstruction of the project have been charged to Profit &Loss Account.II. During the current year the company has obtained sanctionfor Term Loan / LC amounting to Rs. 1,431 crores fromvarious banks / financial institutions towards funding of theabove project.D. Contingent Liability and Pending Capital CommitmentsI. Contingent Liability:II.Proposed dividend liability on Cumulative Preference Sharesof Rs. 0.90 Crore (Previous period :-Nil)Pending Capital Commitment:Estimated amount of Contracts remaining to be executedon capital account and not provided for (net of advance) asat 31st March, 2008 amounting to Rs.1,232.15 Crores andUS$ 103.70 millions (previous period:- Nil).E. Related Parties:a) Related Party where the control existsa)Holding Company :• Essar Steel Limited (ESTL) – From July 10,2006• Essar Steel Holdings Ltd. Mauritius- HoldingCompany of Essar Steel Limited (ESHL)b) Ultimate Holding Company:• Essar Global Ltd. - Holding Company of EssarSteel Holdings Ltd. (EGL)b) Fellow Subsidiaries• Essar Steel (Hazira) Limited (ES(H)L)• Essar Constructions (India) Limited (ECIL)• ETHL Global Capital Limited (EGCL)• Essar Steel Chhattisgarh Limited (ESCL)• Essar Steel Jharkhand Limited (ESJL)• Essar Steel Trading FZE, Dubai (ESTF)• Hazira Plate Limited (HPLT)• Essar Shipping & Logistics Limited (ESLL)• Essar SEZ Hazira Limited (Essar SEZ)• Essar Telecom Infrastructure Private Limited(ETIPL)• Hazira Pipe Mill Limited (HPML)c) Key Management Personnel• Mr. Jatinder Mehra, Director• Mr. H. S. Sethi, Director-Projectsd) Individuals owing, directly or indirectly, an interest in votingpower that gives them control or significant influence-• Mr. Shashi Ruia• Mr. Ravi Ruia• Mr. Anshuman Ruia• Mr. Rewant Ruiae) Enterprises commonly controlled or influenced by majorshareholders/directors/key managerial personnel of theCompany (to the extent transactions entered)–• Essar Power Limited (EPL)• Essar Investments Limited (EIL)• Vodafone Essar Spacetel Limited (VESL)• Essar Projects Management Consultants Limited(EPMCL)• Essar Oil Limited (EOL)53