Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

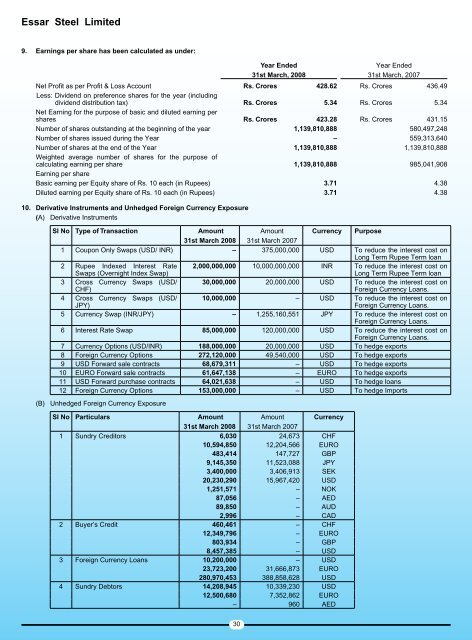

Essar Steel Limited9. Earnings per share has been calculated as under:Year Ended31st March, 2008Year Ended31st March, 2007Net Profit as per Profit & Loss Account Rs. Crores 428.62 Rs. Crores 436.49Less: Dividend on preference shares for the year (includingdividend distribution tax) Rs. Crores 5.34 Rs. Crores 5.34Net Earning for the purpose of basic and diluted earning pershares Rs. Crores 423.28 Rs. Crores 431.15Number of shares outstanding at the beginning of the year 1,139,810,888 580,497,248Number of shares issued during the Year – 559,313,640Number of shares at the end of the Year 1,139,810,888 1,139,810,888Weighted average number of shares for the purpose ofcalculating earning per share 1,139,810,888 985,041,908Earning per shareBasic earning per Equity share of Rs. 10 each (in Rupees) 3.71 4.38Diluted earning per Equity share of Rs. 10 each (in Rupees) 3.71 4.3810. Derivative Instruments and Unhedged Foreign Currency Exposure(A) Derivative InstrumentsSI No Type of Transaction AmountAmount Currency Purpose31st March 2008 31st March 20071 Coupon Only Swaps (USD/ INR) – 375,000,000 USD To reduce the interest cost onLong Term Rupee Term loan2 Rupee Indexed Interest Rate 2,000,000,000 10,000,000,000 INR To reduce the interest cost onSwaps (Overnight Index Swap)Long Term Rupee Term loan3 Cross Currency Swaps (USD/CHF)30,000,000 20,000,000 USD To reduce the interest cost onForeign Currency Loans.4 Cross Currency Swaps (USD/JPY)10,000,000 – USD To reduce the interest cost onForeign Currency Loans.5 Currency Swap (INR/JPY) – 1,255,160,551 JPY To reduce the interest cost onForeign Currency Loans.6 Interest Rate Swap 85,000,000 120,000,000 USD To reduce the interest cost onForeign Currency Loans.7 Currency Options (USD/INR) 188,000,000 20,000,000 USD To hedge exports8 Foreign Currency Options 272,120,000 49,540,000 USD To hedge exports9 USD Forward sale contracts 68,679,311 – USD To hedge exports10 EURO Forward sale contracts 61,647,138 – EURO To hedge exports11 USD Forward purchase contracts 64,021,638 – USD To hedge loans12 Foreign Currency Options 153,000,000 – USD To hedge Imports(B) Unhedged Foreign Currency ExposureSI No Particulars AmountAmount Currency31st March 2008 31st March 20071 Sundry Creditors 6,030 24,673 CHF10,594,850 12,204,566 EURO483,414 147,727 GBP9,145,350 11,523,088 JPY3,400,000 3,406,913 SEK20,230,290 15,967,420 USD1,251,571 – NOK87,056 – AED89,850 – AUD2,996 – CAD2 Buyer’s Credit 460,461 – CHF12,349,796 – EURO803,934 – GBP8,457,385 – USD3 Foreign Currency Loans 10,200,000 – USD23,723,200 31,666,873 EURO280,970,453 388,858,628 USD4 Sundry Debtors 14,208,945 10,339,230 USD12,500,680 7,352,862 EURO– 960 AED30