Essar Steel Jharkhand Limited<strong>Form</strong>erly known as Essar Steel (Jharkhand) LimitedToThe Members of Essar Steel Jharkhand Limited,Your Directors have pleasure in presenting the Third Annual Report onthe working of the Company together with the Audited Accounts for thefinancial year ended 31st March, 2008.1. OPERATIONSDuring the year under review, the Company has initiated action forsetting up the Steel Plant at Chaibasa in the state of Jharkhand.2. DIRECTORSShri Jatinder Mehra retires by rotation at the ensuing Annual GeneralMeeting and being eligible offer himself for reappointment. The Boardrecommends his reappointment.3. AUDITORSM/s. S.R. Batliboi & Co., Chartered Accountants, Auditors of theCompany retires at the conclusion of Annual General Meeting andbeing eligible offer themselves for re-appointment.4. PERSONNELThere are no employees working on the roll of the Company as requiredby the provisions of section 217(2A) of the Companies Act, 1956 readwith the Company’s (Particulars of Employees) Rules, 1975.5. CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION ANDFOREIGN EXCHANGE EARNINGS/OUTGOAs the Company has not undertaken any manufacturing activity duringthe year, additional information on conservation of energy, technologyabsorption and foreign exchange as required to be disclosed in terms ofSection 217(1)(e) of the Companies Act, 1956, read with the Companies(Disclosure of Particulars in the report of the Board of Directors) Rules,1988 is not applicable.6. AUDITORS’ REPORTThere are no qualifications/adverse observations in the Auditors’ Reportrequiring information and explanations u/s 217(3) of the CompaniesAct, 1956. However with regard to delay in payment of tax deducted atToThe Members of Essar Steel Jharkhand Limited1. We have audited the attached Balance Sheet of Essar SteelJharkhand Limited (‘the Company’) as at March 31, 2008 andalso the Profit and Loss account and the cash flow statementfor the year ended on that date annexed thereto. These financialstatements are the responsibility of the Company’s management.Our responsibility is to express an opinion on these financialstatements based on our audit.2. We conducted our audit in accordance with auditing standardsgenerally accepted in India. Those Standards require that weplan and perform the audit to obtain reasonable assurance aboutwhether the financial statements are free of material misstatement.An audit includes examining, on a test basis, evidence supportingthe amounts and disclosures in the financial statements. Anaudit also includes assessing the accounting principles used andsignificant estimates made by management, as well as evaluatingthe overall financial statement presentation. We believe that ouraudit provides a reasonable basis for our opinion.3. As required by the Companies (Auditor’s Report) Order, 2003 (asamended) (‘the order’) issued by the Central Government of Indiain terms of sub-section (4A) of Section 227 of the Companies Act,1956, we enclose in the Annexure a statement on the mattersspecified in paragraphs 4 and 5 of the said Order.4. Further to our comments in the Annexure referred to above, wereport that:i. We have obtained all the information and explanations, whichto the best of our knowledge and belief were necessary forthe purposes of our audit;ii. In our opinion, proper books of account as required by lawhave been kept by the Company so far as appears from ourDIRECTORS’ REPORTAuditors’ Reportsource, Company has taken necessary steps by formulating suitablecontrol / reporting system to ensure timely deposit of statutory dues.7. DIRECTORS’ RESPONSIBILITY STATEMENTPursuant to the requirement under section 217(2AA) of the CompaniesAct, 1956, with respect to Directors’ Responsibility Statement, it ishereby confirmed;(i) that in the preparation of the accounts for the financial year ended31st March, 2008 the applicable accounting standards havebeen followed along with proper explanation relating to materialdepartures;(ii) that the Directors have selected such accounting policies andapplied them consistently and made judgments and estimates thatwere reasonable and prudent so as to give a true and fair view ofthe state of affairs of the Company as at 31st March, 2008 underreview;(iii) that the Directors have taken proper and sufficient care for themaintenance of adequate accounting records in accordance withthe provisions of the Companies Act, 1956, for safeguarding theassets of the Company and for preventing and detecting fraudand other irregularities; and(iv) that the Directors have prepared the accounts for the financialyear ended 31st March, 2008 on a ‘going concern’ basis.8. SUBSIDIARY COMPANYDuring the year under review your Company continues to be thesubsidiary of Essar Steel Limited.9. ACKNOWLEDGEMENTYour directors wish to place on record their appreciation for the variousdepartments of Central and State Governments and its bankers for theircooperation and support.For and on behalf of the Board of Directors(V.G. Raghavan) (N. B. Vyas)DirectorDirectorPlace MumbaiDate : August 27, 2008examination of those books;iii. The balance sheet, profit and loss account and cash flowstatement dealt with by this report are in agreement with thebooks of account;iv. In our opinion, the balance sheet, profit and loss accountand cash flow statement dealt with by this report comply withthe accounting standards referred to in sub-section (3C) ofSection 211 of the Companies Act, 1956.v. On the basis of the written representations received fromthe directors, as on March 31, 2008, and taken on record bythe Board of Directors, we report that none of the directors isdisqualified as on March 31, 2008 from being appointed asa director in terms of clause (g) of sub-section (1) of Section274 of the Companies Act, 1956.vi. In our opinion and to the best of our information andaccording to the explanations given to us, the said accountsgive the information required by the Companies Act, 1956,in the manner so required and give a true and fair view inconformity with the accounting principles generally acceptedin India;a) in the case of the balance sheet, of the state of affairsof the Company as at March 31, 2008;b) in the case of the profit and loss account, of the lossfor the year ended on that date; andc) in the case of cash flow statement, of the cash flowsfor the year ended on that date.S. R. Batliboi & Co.Chartered AccountantsPartnerPlace: Mumbaiper Hemal ShahDate: August 27, 2008 Membership No.: 42<strong>65</strong>039

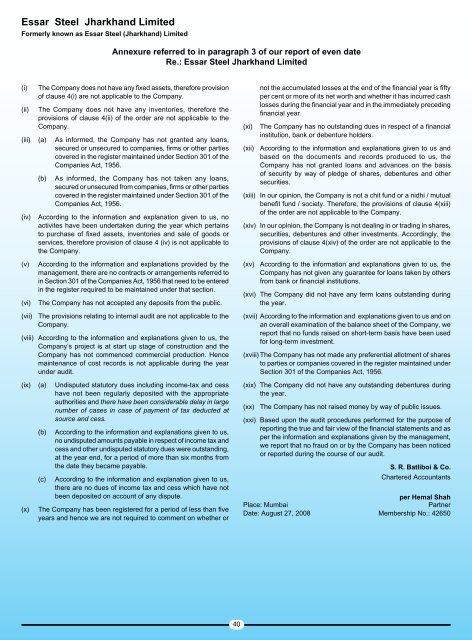

Essar Steel Jharkhand Limited<strong>Form</strong>erly known as Essar Steel (Jharkhand) LimitedAnnexure referred to in paragraph 3 of our report of even dateRe.: Essar Steel Jharkhand Limited(i)(ii)The Company does not have any fixed assets, therefore provisionof clause 4(i) are not applicable to the Company.The Company does not have any inventories, therefore theprovisions of clause 4(ii) of the order are not applicable to theCompany.(iii) (a) As informed, the Company has not granted any loans,secured or unsecured to companies, firms or other partiescovered in the register maintained under Section 301 of theCompanies Act, 1956.(iv)(v)(vi)(b)As informed, the Company has not taken any loans,secured or unsecured from companies, firms or other partiescovered in the register maintained under Section 301 of theCompanies Act, 1956.According to the information and explanation given to us, noactivites have been undertaken during the year which pertainsto purchase of fixed assets, inventories and sale of goods orservices, therefore provision of clause 4 (iv) is not applicable tothe Company.According to the information and explanations provided by themanagement, there are no contracts or arrangements referred toin Section 301 of the Companies Act, 1956 that need to be enteredin the register required to be maintained under that section.The Company has not accepted any deposits from the public.(vii) The provisions relating to internal audit are not applicable to theCompany.(viii) According to the information and explanations given to us, theCompany’s project is at start up stage of construction and theCompany has not commenced commercial production. Hencemaintenance of cost records is not applicable during the yearunder audit.(ix) (a) Undisputed statutory dues including income-tax and cesshave not been regularly deposited with the appropriateauthorities and there have been considerable delay in largenumber of cases in case of payment of tax deducted atsource and cess.(x)(b)(c)According to the information and explanations given to us,no undisputed amounts payable in respect of income tax andcess and other undisputed statutory dues were outstanding,at the year end, for a period of more than six months fromthe date they became payable.According to the information and explanation given to us,there are no dues of income tax and cess which have notbeen deposited on account of any dispute.The Company has been registered for a period of less than fiveyears and hence we are not required to comment on whether or(xi)not the accumulated losses at the end of the financial year is fiftyper cent or more of its net worth and whether it has incurred cashlosses during the financial year and in the immediately precedingfinancial year.The Company has no outstanding dues in respect of a financialinstitution, bank or debenture holders.(xii) According to the information and explanations given to us andbased on the documents and records produced to us, theCompany has not granted loans and advances on the basisof security by way of pledge of shares, debentures and othersecurities.(xiii) In our opinion, the Company is not a chit fund or a nidhi / mutualbenefit fund / society. Therefore, the provisions of clause 4(xiii)of the order are not applicable to the Company.(xiv) In our opinion, the Company is not dealing in or trading in shares,securities, debentures and other investments. Accordingly, theprovisions of clause 4(xiv) of the order are not applicable to theCompany.(xv) According to the information and explanations given to us, theCompany has not given any guarantee for loans taken by othersfrom bank or financial institutions.(xvi) The Company did not have any term loans outstanding duringthe year.(xvii) According to the information and explanations given to us and onan overall examination of the balance sheet of the Company, wereport that no funds raised on short-term basis have been usedfor long-term investment.(xviii) The Company has not made any preferential allotment of sharesto parties or companies covered in the register maintained underSection 301 of the Companies Act, 1956.(xix) The Company did not have any outstanding debentures duringthe year.(xx) The Company has not raised money by way of public issues.(xxi) Based upon the audit procedures performed for the purpose ofreporting the true and fair view of the financial statements and asper the information and explanations given by the management,we report that no fraud on or by the Company has been noticedor reported during the course of our audit.S. R. Batliboi & Co.Chartered Accountantsper Hemal ShahPlace: MumbaiPartnerDate: August 27, 2008 Membership No.: 42<strong>65</strong>040