LAKELAND COLLEGE Annual Repor t 2008 - 2009

LAKELAND COLLEGE annual Report 2008 - 2009

LAKELAND COLLEGE annual Report 2008 - 2009

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT <strong>2008</strong>-<strong>2009</strong><br />

Conditional grants increased by $2.4 million, due primarily to infrastructure spending on various repair and maintenance projects<br />

throughout Lakeland. In addition, $12.7 million in infrastructure grants that were received in <strong>2008</strong>-<strong>2009</strong> were not spent as of June 30,<br />

<strong>2009</strong>. This money will be utilized for projects in future periods.<br />

Tuition<br />

Tuition revenue increased about $440,000 due to a significant increase in credit tuition fee revenue along with a decrease in non-credit<br />

programming tuition revenue. Credit tuition revenue increased by $1 million. This figure corresponds with the 6.5 per cent increase<br />

from the previous year in Full Load Equivalents (FLE). In addition, credit tuition fees were increased by the maximum allowable amount<br />

of 4.6 per cent for existing programs.<br />

New programs including event coordinator, renewable energy and conservation, pre-employment electrician, pre-employment<br />

welder and sign language interpretation accounted for 29 per cent of the FLE increase. The remaining growth is attributed to current<br />

programming particularly in the university studies and applied degree areas. Non-credit tuition decreased approximately $826,000<br />

which is reflective of the shift in the emergency training centre’s programming to credit programming and the closure of the<br />

Strathcona County learning centre.<br />

Amortization of deferred capital contributions<br />

In <strong>2008</strong>-<strong>2009</strong>, amortization of deferred capital contributions increased by $714,000 to $3.3 million. This reflects increased externally<br />

restricted funding provided for capital asset acquisitions which are subject to amortization. The opening of the Bill Kondro Wing in<br />

September <strong>2008</strong> accounted for the majority of the increase.<br />

Investment income<br />

Lakeland’s total investment income increased $31,000 to $1.6 million in <strong>2008</strong>-<strong>2009</strong> (see Note 17 of the audited financial statements).<br />

A significant portion of this investment income relates to the unspent grant funds. The investment income received from these funds<br />

was allocated to deferred contributions and deferred capital contributions as opposed to being reflected as investment income on<br />

the statement of operations. This is why investment income as reported in the statement of operations is $877,000 which is down<br />

$184,000 from the 2007-<strong>2008</strong> total of $1,061,000. This decline in investment income is a result of the volatility and weakening of the<br />

markets in <strong>2008</strong>-<strong>2009</strong>. Investment market challenges contributed to the $1.6 million reduction of Lakeland’s investment portfolios as<br />

detailed in Note 11 of the audited financial statements.<br />

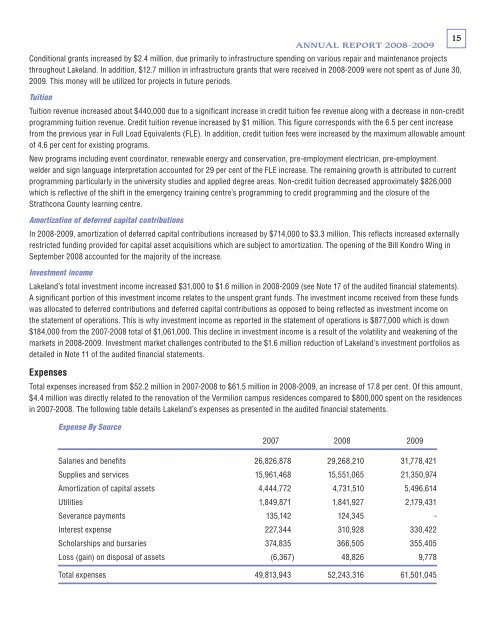

Expenses<br />

Total expenses increased from $52.2 million in 2007-<strong>2008</strong> to $61.5 million in <strong>2008</strong>-<strong>2009</strong>, an increase of 17.8 per cent. Of this amount,<br />

$4.4 million was directly related to the renovation of the Vermilion campus residences compared to $800,000 spent on the residences<br />

in 2007-<strong>2008</strong>. The following table details Lakeland’s expenses as presented in the audited financial statements.<br />

15<br />

Expense By Source<br />

2007 <strong>2008</strong> <strong>2009</strong><br />

Salaries and benefits 26,826,878 29,268,210 31,778,421<br />

Supplies and services 15,961,468 15,551,065 21,350,974<br />

Amortization of capital assets 4,444,772 4,731,510 5,496,614<br />

Utilities 1,849,871 1,841,927 2,179,431<br />

Severance payments 135,142 124,345 -<br />

Interest expense 227,344 310,928 330,422<br />

Scholarships and bursaries 374,835 366,505 355,405<br />

Loss (gain) on disposal of assets (6,367) 48,826 9,778<br />

Total expenses 49,813,943 52,243,316 61,501,045