LAKELAND COLLEGE Annual Repor t 2008 - 2009

LAKELAND COLLEGE annual Report 2008 - 2009

LAKELAND COLLEGE annual Report 2008 - 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

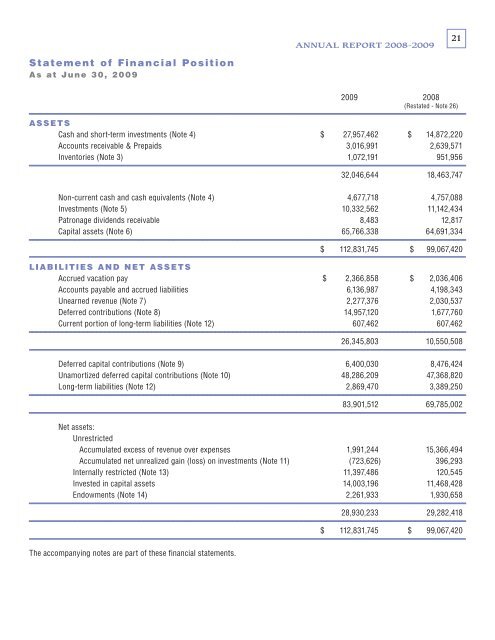

ANNUAL REPORT <strong>2008</strong>-<strong>2009</strong><br />

21<br />

S tate m e nt of Fi n a n cial Position<br />

A s a t J u n e 3 0 , 2 0 0 9<br />

<strong>2009</strong> <strong>2008</strong><br />

(Restated - Note 26)<br />

AS S E T S<br />

Cash and short-term investments (Note 4) $ 27,957,462 $ 14,872,220<br />

Accounts receivable & Prepaids 3,016,991 2,639,571<br />

Inventories (Note 3) 1,072,191 951,956<br />

32,046,644 18,463,747<br />

Non-current cash and cash equivalents (Note 4) 4,677,718 4,757,088<br />

Investments (Note 5) 10,332,562 11,142,434<br />

Patronage dividends receivable 8,483 12,817<br />

Capital assets (Note 6) 65,766,338 64,691,334<br />

$ 112,831,745 $ 99,067,420<br />

liABiliti E S A N D N E T AS S E T S<br />

Accrued vacation pay $ 2,366,858 $ 2,036,406<br />

Accounts payable and accrued liabilities 6,136,987 4,198,343<br />

Unearned revenue (Note 7) 2,277,376 2,030,537<br />

Deferred contributions (Note 8) 14,957,120 1,677,760<br />

Current portion of long-term liabilities (Note 12) 607,462 607,462<br />

26,345,803 10,550,508<br />

Deferred capital contributions (Note 9) 6,400,030 8,476,424<br />

Unamortized deferred capital contributions (Note 10) 48,286,209 47,368,820<br />

Long-term liabilities (Note 12) 2,869,470 3,389,250<br />

83,901,512 69,785,002<br />

Net assets:<br />

Unrestricted<br />

Accumulated excess of revenue over expenses 1,991,244 15,366,494<br />

Accumulated net unrealized gain (loss) on investments (Note 11) (723,626) 396,293<br />

Internally restricted (Note 13) 11,397,486 120,545<br />

Invested in capital assets 14,003,196 11,468,428<br />

Endowments (Note 14) 2,261,933 1,930,658<br />

28,930,233 29,282,418<br />

$ 112,831,745 $ 99,067,420<br />

The accompanying notes are part of these financial statements.