LAKELAND COLLEGE Annual Repor t 2008 - 2009

LAKELAND COLLEGE annual Report 2008 - 2009

LAKELAND COLLEGE annual Report 2008 - 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT <strong>2008</strong>-<strong>2009</strong><br />

25<br />

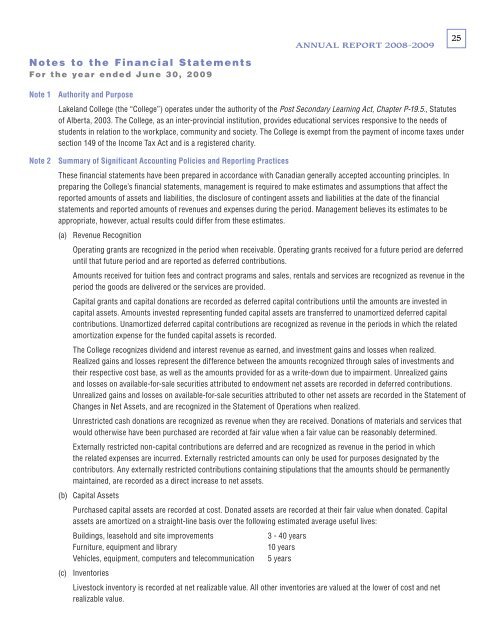

N otes to t h e Fi n a n cial S tate m e nts<br />

Fo r t h e ye a r e n d e d J u n e 3 0 , 2 0 0 9<br />

Note 1 Authority and Purpose<br />

Lakeland College (the “College”) operates under the authority of the Post Secondary Learning Act, Chapter P-19.5., Statutes<br />

of Alberta, 2003. The College, as an inter-provincial institution, provides educational services responsive to the needs of<br />

students in relation to the workplace, community and society. The College is exempt from the payment of income taxes under<br />

section 149 of the Income Tax Act and is a registered charity.<br />

Note 2 Summary of Significant Accounting Policies and <strong>Repor</strong>ting Practices<br />

These financial statements have been prepared in accordance with Canadian generally accepted accounting principles. In<br />

preparing the College’s financial statements, management is required to make estimates and assumptions that affect the<br />

reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial<br />

statements and reported amounts of revenues and expenses during the period. Management believes its estimates to be<br />

appropriate, however, actual results could differ from these estimates.<br />

(a) Revenue Recognition<br />

Operating grants are recognized in the period when receivable. Operating grants received for a future period are deferred<br />

until that future period and are reported as deferred contributions.<br />

Amounts received for tuition fees and contract programs and sales, rentals and services are recognized as revenue in the<br />

period the goods are delivered or the services are provided.<br />

Capital grants and capital donations are recorded as deferred capital contributions until the amounts are invested in<br />

capital assets. Amounts invested representing funded capital assets are transferred to unamortized deferred capital<br />

contributions. Unamortized deferred capital contributions are recognized as revenue in the periods in which the related<br />

amortization expense for the funded capital assets is recorded.<br />

The College recognizes dividend and interest revenue as earned, and investment gains and losses when realized.<br />

Realized gains and losses represent the difference between the amounts recognized through sales of investments and<br />

their respective cost base, as well as the amounts provided for as a write-down due to impairment. Unrealized gains<br />

and losses on available-for-sale securities attributed to endowment net assets are recorded in deferred contributions.<br />

Unrealized gains and losses on available-for-sale securities attributed to other net assets are recorded in the Statement of<br />

Changes in Net Assets, and are recognized in the Statement of Operations when realized.<br />

Unrestricted cash donations are recognized as revenue when they are received. Donations of materials and services that<br />

would otherwise have been purchased are recorded at fair value when a fair value can be reasonably determined.<br />

Externally restricted non-capital contributions are deferred and are recognized as revenue in the period in which<br />

the related expenses are incurred. Externally restricted amounts can only be used for purposes designated by the<br />

contributors. Any externally restricted contributions containing stipulations that the amounts should be permanently<br />

maintained, are recorded as a direct increase to net assets.<br />

(b) Capital Assets<br />

Purchased capital assets are recorded at cost. Donated assets are recorded at their fair value when donated. Capital<br />

assets are amortized on a straight-line basis over the following estimated average useful lives:<br />

Buildings, leasehold and site improvements<br />

3 - 40 years<br />

Furniture, equipment and library<br />

10 years<br />

Vehicles, equipment, computers and telecommunication 5 years<br />

(c) Inventories<br />

Livestock inventory is recorded at net realizable value. All other inventories are valued at the lower of cost and net<br />

realizable value.