Outstanding

to download - Paladin Labs

to download - Paladin Labs

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

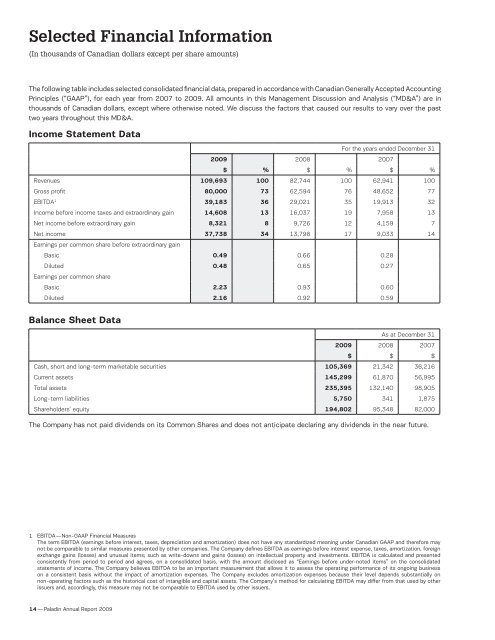

Selected Financial Information<br />

(In thousands of Canadian dollars except per share amounts)<br />

The following table includes selected consolidated financial data, prepared in accordance with Canadian Generally Accepted Accounting<br />

Principles (“GAAP”), for each year from 2007 to 2009. All amounts in this Management Discussion and Analysis (“MD&A”) are in<br />

thousands of Canadian dollars, except where otherwise noted. We discuss the factors that caused our results to vary over the past<br />

two years throughout this MD&A.<br />

Income Statement Data<br />

For the years ended December 31<br />

2009 2008 2007<br />

$ % $ % $ %<br />

Revenues 109,693 100 82,744 100 62,941 100<br />

Gross profit 80,000 73 62,594 76 48,652 77<br />

EBITDA 1 39,183 36 29,021 35 19,913 32<br />

Income before income taxes and extraordinary gain 14,608 13 16,037 19 7,958 13<br />

Net income before extraordinary gain 8,321 8 9,726 12 4,159 7<br />

Net income 37,738 34 13,798 17 9,033 14<br />

Earnings per common share before extraordinary gain<br />

Basic 0.49 0.66 0.28<br />

Diluted 0.48 0.65 0.27<br />

Earnings per common share<br />

Basic 2.23 0.93 0.60<br />

Diluted 2.16 0.92 0.59<br />

Balance Sheet Data<br />

As at December 31<br />

2009 2008 2007<br />

$ $ $<br />

Cash, short and long-term marketable securities 105,369 21,342 36,216<br />

Current assets 145,299 61,870 56,995<br />

Total assets 235,395 132,140 98,905<br />

Long-term liabilities 5,750 341 1,875<br />

Shareholders’ equity 194,802 95,348 82,000<br />

The Company has not paid dividends on its Common Shares and does not anticipate declaring any dividends in the near future.<br />

1 EBITDA — Non-GAAP Financial Measures<br />

The term EBITDA (earnings before interest, taxes, depreciation and amortization) does not have any standardized meaning under Canadian GAAP and therefore may<br />

not be comparable to similar measures presented by other companies. The Company defines EBITDA as earnings before interest expense, taxes, amortization, foreign<br />

exchange gains (losses) and unusual items; such as write-downs and gains (losses) on intellectual property and investments. EBITDA is calculated and presented<br />

consistently from period to period and agrees, on a consolidated basis, with the amount disclosed as “Earnings before under-noted items” on the consolidated<br />

statements of income. The Company believes EBITDA to be an important measurement that allows it to assess the operating performance of its ongoing business<br />

on a consistent basis without the impact of amortization expenses. The Company excludes amortization expenses because their level depends substantially on<br />

non‐operating factors such as the historical cost of intangible and capital assets. The Company’s method for calculating EBITDA may differ from that used by other<br />

issuers and, accordingly, this measure may not be comparable to EBITDA used by other issuers.<br />

14 — Paladin Annual Report 2009