Outstanding

to download - Paladin Labs

to download - Paladin Labs

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

During the year ended December 31, 2008, the Company redeemed a secured convertible term note in a portfolio company with a<br />

carrying value of $291 for proceeds equal to the face value of $500 resulting in a gain on disposal of $209. During the same period,<br />

the Company as part of its on-going assessment of investment carrying values determined the investment in Verus Pharmaceuticals<br />

Inc. to be permanently impaired and recorded a write-down in the amount of $394, resulting in a net loss on investments in the<br />

amount of $185 for the year ended December 31, 2008.<br />

Foreign exchange loss (gain)<br />

During the year ended December 31, 2009, the Company recorded a foreign exchange loss of $266 on the Company’s foreign<br />

operating results, mainly as a result of the strengthening of the Canadian dollar relative to the US dollar and Euro.<br />

During the year ended December 31, 2008, the Company recorded a foreign exchange gain of $80 on the Company’s foreign<br />

operating results, mainly as a result of the strengthening of the US dollar and Euro relative to the Canadian dollar.<br />

Other income<br />

During the year ended December 31, 2009, the Company out-licensed certain pharmaceutical product licenses and rights for<br />

proceeds of $666, including the receipt of common shares in a portfolio company, having a fair value of $60, representing a net<br />

gain of $666.<br />

During the year ended December 31, 2008, the Company out-licensed a product for $200 and recorded a $200 gain in other income<br />

on the transaction and in a separate transaction, received common shares in a portfolio company having a fair value of $125 in<br />

exchange for out-licensing the exclusive rights to a novel topical pain formulation. In addition, during this same period, the Company<br />

received $75 as a termination payment for certain costs disbursed as part of a previously licensed pharmaceutical product and paid<br />

$70 to settle a disputed client relationship.<br />

Income tax expense<br />

Income tax expense decreased only slightly by $24 or nil% to $6,287 for the year ended December 31, 2009 from $6,311 for the<br />

year ended December 31, 2008. For the year ended December 31, 2009, the effective tax rate was 43% compared to 39% for<br />

the year ended December 31, 2008. The increase in effective rates in the current year is principally due to increases in permanent<br />

differences in comparison to the previous year, mainly: amortization of eligible capital property and stock-based compensation<br />

expense.<br />

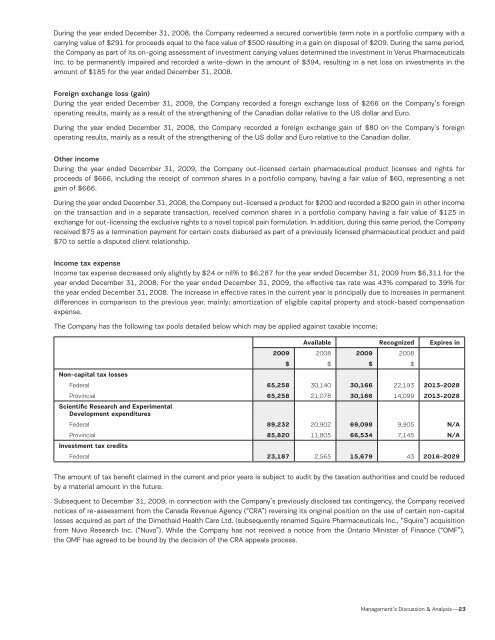

The Company has the following tax pools detailed below which may be applied against taxable income:<br />

Non-capital tax losses<br />

Available Recognized Expires in<br />

2009 2008 2009 2008<br />

$ $ $ $<br />

Federal 65,258 30,140 30,166 22,193 2013–2028<br />

Provincial 65,258 21,078 30,166 14,099 2013–2028<br />

Scientific Research and Experimental<br />

Development expenditures<br />

Federal 89,232 20,902 69,098 9,905 N/A<br />

Provincial 85,820 11,805 66,534 7,145 N/A<br />

Investment tax credits<br />

Federal 23,187 2,565 15,679 43 2016–2029<br />

The amount of tax benefit claimed in the current and prior years is subject to audit by the taxation authorities and could be reduced<br />

by a material amount in the future.<br />

Subsequent to December 31, 2009, in connection with the Company’s previously disclosed tax contingency, the Company received<br />

notices of re-assessment from the Canada Revenue Agency (“CRA”) reversing its original position on the use of certain non-capital<br />

losses acquired as part of the Dimethaid Health Care Ltd. (subsequently renamed Squire Pharmaceuticals Inc., “Squire”) acquisition<br />

from Nuvo Research Inc. (“Nuvo”). While the Company has not received a notice from the Ontario Minister of Finance (“OMF”),<br />

the OMF has agreed to be bound by the decision of the CRA appeals process.<br />

Management’s Discussion & Analysis —23