Outstanding

to download - Paladin Labs

to download - Paladin Labs

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

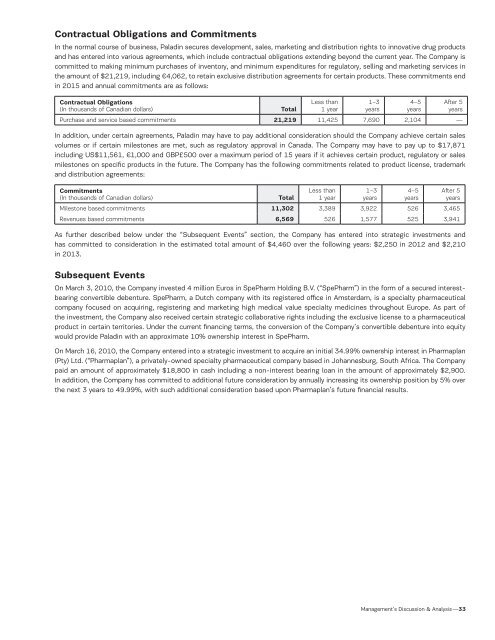

Contractual Obligations and Commitments<br />

In the normal course of business, Paladin secures development, sales, marketing and distribution rights to innovative drug products<br />

and has entered into various agreements, which include contractual obligations extending beyond the current year. The Company is<br />

committed to making minimum purchases of inventory, and minimum expenditures for regulatory, selling and marketing services in<br />

the amount of $21,219, including €4,062, to retain exclusive distribution agreements for certain products. These commitments end<br />

in 2015 and annual commitments are as follows:<br />

Contractual Obligations<br />

(In thousands of Canadian dollars)<br />

Total<br />

Less than<br />

1 year<br />

Purchase and service based commitments 21,219 11,425 7,690 2,104 —<br />

In addition, under certain agreements, Paladin may have to pay additional consideration should the Company achieve certain sales<br />

volumes or if certain milestones are met, such as regulatory approval in Canada. The Company may have to pay up to $17,871<br />

including US$11,561, €1,000 and GBP£500 over a maximum period of 15 years if it achieves certain product, regulatory or sales<br />

milestones on specific products in the future. The Company has the following commitments related to product license, trademark<br />

and distribution agreements:<br />

Commitments<br />

(In thousands of Canadian dollars)<br />

Total<br />

Less than<br />

1 year<br />

Milestone based commitments 11,302 3,389 3,922 526 3,465<br />

Revenues based commitments 6,569 526 1,577 525 3,941<br />

As further described below under the “Subsequent Events” section, the Company has entered into strategic investments and<br />

has committed to consideration in the estimated total amount of $4,460 over the following years: $2,250 in 2012 and $2,210<br />

in 2013.<br />

Subsequent Events<br />

On March 3, 2010, the Company invested 4 million Euros in SpePharm Holding B.V. (“SpePharm”) in the form of a secured interestbearing<br />

convertible debenture. SpePharm, a Dutch company with its registered office in Amsterdam, is a specialty pharmaceutical<br />

company focused on acquiring, registering and marketing high medical value specialty medicines throughout Europe. As part of<br />

the investment, the Company also received certain strategic collaborative rights including the exclusive license to a pharmaceutical<br />

product in certain territories. Under the current financing terms, the conversion of the Company’s convertible debenture into equity<br />

would provide Paladin with an approximate 10% ownership interest in SpePharm.<br />

On March 16, 2010, the Company entered into a strategic investment to acquire an initial 34.99% ownership interest in Pharmaplan<br />

(Pty) Ltd. (“Pharmaplan”), a privately-owned specialty pharmaceutical company based in Johannesburg, South Africa. The Company<br />

paid an amount of approximately $18,800 in cash including a non-interest bearing loan in the amount of approximately $2,900.<br />

In addition, the Company has committed to additional future consideration by annually increasing its ownership position by 5% over<br />

the next 3 years to 49.99%, with such additional consideration based upon Pharmaplan’s future financial results.<br />

1–3<br />

years<br />

1–3<br />

years<br />

4–5<br />

years<br />

4–5<br />

years<br />

After 5<br />

years<br />

After 5<br />

years<br />

Management’s Discussion & Analysis —33