Outstanding

to download - Paladin Labs

to download - Paladin Labs

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Liquidity and Capital Resources<br />

The Company believes that its existing cash, cash equivalents and marketable securities, as well as cash generated from operations<br />

are sufficient to finance its current operations, working capital requirements and future product acquisitions. At present, the Company<br />

is actively pursuing acquisitions that may require the use of substantial capital resources. There are no present agreements or<br />

commitments with respect to such acquisitions except as disclosed in the “Subsequent Events” section below.<br />

The Company has entered into a one-year $2,000 revolving unsecured credit facility with one of the Company’s bankers effective<br />

August 10, 2009. The credit facility may be used for general corporate purposes including financing acquisitions.<br />

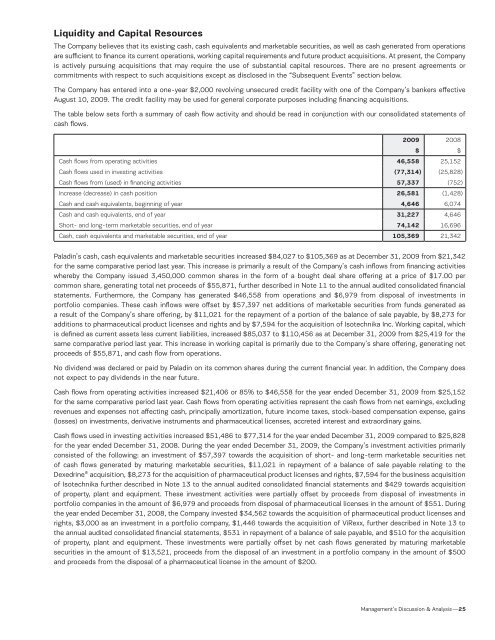

The table below sets forth a summary of cash flow activity and should be read in conjunction with our consolidated statements of<br />

cash flows.<br />

2009 2008<br />

$ $<br />

Cash flows from operating activities 46,558 25,152<br />

Cash flows used in investing activities (77,314) (25,828)<br />

Cash flows from (used) in financing activities 57,337 (752)<br />

Increase (decrease) in cash position 26,581 (1,428)<br />

Cash and cash equivalents, beginning of year 4,646 6,074<br />

Cash and cash equivalents, end of year 31,227 4,646<br />

Short- and long-term marketable securities, end of year 74,142 16,696<br />

Cash, cash equivalents and marketable securities, end of year 105,369 21,342<br />

Paladin’s cash, cash equivalents and marketable securities increased $84,027 to $105,369 as at December 31, 2009 from $21,342<br />

for the same comparative period last year. This increase is primarily a result of the Company’s cash inflows from financing activities<br />

whereby the Company issued 3,450,000 common shares in the form of a bought deal share offering at a price of $17.00 per<br />

common share, generating total net proceeds of $55,871, further described in Note 11 to the annual audited consolidated financial<br />

statements. Furthermore, the Company has generated $46,558 from operations and $6,979 from disposal of investments in<br />

portfolio companies. These cash inflows were offset by $57,397 net additions of marketable securities from funds generated as<br />

a result of the Company’s share offering, by $11,021 for the repayment of a portion of the balance of sale payable, by $8,273 for<br />

additions to pharmaceutical product licenses and rights and by $7,594 for the acquisition of Isotechnika Inc. Working capital, which<br />

is defined as current assets less current liabilities, increased $85,037 to $110,456 as at December 31, 2009 from $25,419 for the<br />

same comparative period last year. This increase in working capital is primarily due to the Company’s share offering, generating net<br />

proceeds of $55,871, and cash flow from operations.<br />

No dividend was declared or paid by Paladin on its common shares during the current financial year. In addition, the Company does<br />

not expect to pay dividends in the near future.<br />

Cash flows from operating activities increased $21,406 or 85% to $46,558 for the year ended December 31, 2009 from $25,152<br />

for the same comparative period last year. Cash flows from operating activities represent the cash flows from net earnings, excluding<br />

revenues and expenses not affecting cash, principally amortization, future income taxes, stock-based compensation expense, gains<br />

(losses) on investments, derivative instruments and pharmaceutical licenses, accreted interest and extraordinary gains.<br />

Cash flows used in investing activities increased $51,486 to $77,314 for the year ended December 31, 2009 compared to $25,828<br />

for the year ended December 31, 2008. During the year ended December 31, 2009, the Company’s investment activities primarily<br />

consisted of the following: an investment of $57,397 towards the acquisition of short- and long-term marketable securities net<br />

of cash flows generated by maturing marketable securities, $11,021 in repayment of a balance of sale payable relating to the<br />

Dexedrine ® acquisition, $8,273 for the acquisition of pharmaceutical product licenses and rights, $7,594 for the business acquisition<br />

of Isotechnika further described in Note 13 to the annual audited consolidated financial statements and $429 towards acquisition<br />

of property, plant and equipment. These investment activities were partially offset by proceeds from disposal of investments in<br />

portfolio companies in the amount of $6,979 and proceeds from disposal of pharmaceutical licenses in the amount of $551. During<br />

the year ended December 31, 2008, the Company invested $34,562 towards the acquisition of pharmaceutical product licenses and<br />

rights, $3,000 as an investment in a portfolio company, $1,446 towards the acquisition of ViRexx, further described in Note 13 to<br />

the annual audited consolidated financial statements, $531 in repayment of a balance of sale payable, and $510 for the acquisition<br />

of property, plant and equipment. These investments were partially offset by net cash flows generated by maturing marketable<br />

securities in the amount of $13,521, proceeds from the disposal of an investment in a portfolio company in the amount of $500<br />

and proceeds from the disposal of a pharmaceutical license in the amount of $200.<br />

Management’s Discussion & Analysis —25