Outstanding

to download - Paladin Labs

to download - Paladin Labs

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

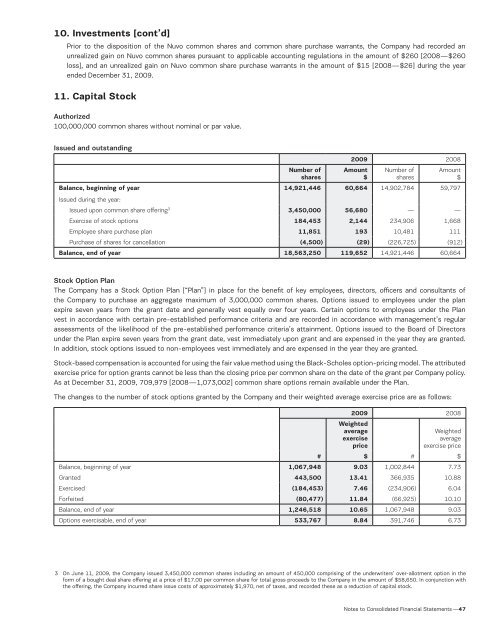

10. Investments [cont’d]<br />

Prior to the disposition of the Nuvo common shares and common share purchase warrants, the Company had recorded an<br />

unrealized gain on Nuvo common shares pursuant to applicable accounting regulations in the amount of $260 [2008 — $260<br />

loss], and an unrealized gain on Nuvo common share purchase warrants in the amount of $15 [2008 — $26] during the year<br />

ended December 31, 2009.<br />

11. Capital Stock<br />

Authorized<br />

100,000,000 common shares without nominal or par value.<br />

Issued and outstanding<br />

Number of<br />

shares<br />

2009 2008<br />

Amount<br />

$<br />

Number of<br />

shares<br />

Amount<br />

$<br />

Balance, beginning of year 14,921,446 60,664 14,902,784 59,797<br />

Issued during the year:<br />

Issued upon common share offering 3 3,450,000 56,680 — —<br />

Exercise of stock options 184,453 2,144 234,906 1,668<br />

Employee share purchase plan 11,851 193 10,481 111<br />

Purchase of shares for cancellation (4,500) (29) (226,725) (912)<br />

Balance, end of year 18,563,250 119,652 14,921,446 60,664<br />

Stock Option Plan<br />

The Company has a Stock Option Plan [“Plan”] in place for the benefit of key employees, directors, officers and consultants of<br />

the Company to purchase an aggregate maximum of 3,000,000 common shares. Options issued to employees under the plan<br />

expire seven years from the grant date and generally vest equally over four years. Certain options to employees under the Plan<br />

vest in accordance with certain pre-established performance criteria and are recorded in accordance with management’s regular<br />

assessments of the likelihood of the pre-established performance criteria’s attainment. Options issued to the Board of Directors<br />

under the Plan expire seven years from the grant date, vest immediately upon grant and are expensed in the year they are granted.<br />

In addition, stock options issued to non-employees vest immediately and are expensed in the year they are granted.<br />

Stock-based compensation is accounted for using the fair value method using the Black-Scholes option-pricing model. The attributed<br />

exercise price for option grants cannot be less than the closing price per common share on the date of the grant per Company policy.<br />

As at December 31, 2009, 709,979 [2008 — 1,073,002] common share options remain available under the Plan.<br />

The changes to the number of stock options granted by the Company and their weighted average exercise price are as follows:<br />

2009 2008<br />

Weighted<br />

average<br />

exercise<br />

price<br />

Weighted<br />

average<br />

exercise price<br />

# $ # $<br />

Balance, beginning of year 1,067,948 9.03 1,002,844 7.73<br />

Granted 443,500 13.41 366,935 10.88<br />

Exercised (184,453) 7.46 (234,906) 6.04<br />

Forfeited (80,477) 11.84 (66,925) 10.10<br />

Balance, end of year 1,246,518 10.65 1,067,948 9.03<br />

Options exercisable, end of year 533,767 8.84 391,746 6.73<br />

3 On June 11, 2009, the Company issued 3,450,000 common shares including an amount of 450,000 comprising of the underwriters’ over-allotment option in the<br />

form of a bought deal share offering at a price of $17.00 per common share for total gross proceeds to the Company in the amount of $58,650. In conjunction with<br />

the offering, the Company incurred share issue costs of approximately $1,970, net of taxes, and recorded these as a reduction of capital stock.<br />

Notes to Consolidated Financial Statements —47