Outstanding

to download - Paladin Labs

to download - Paladin Labs

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

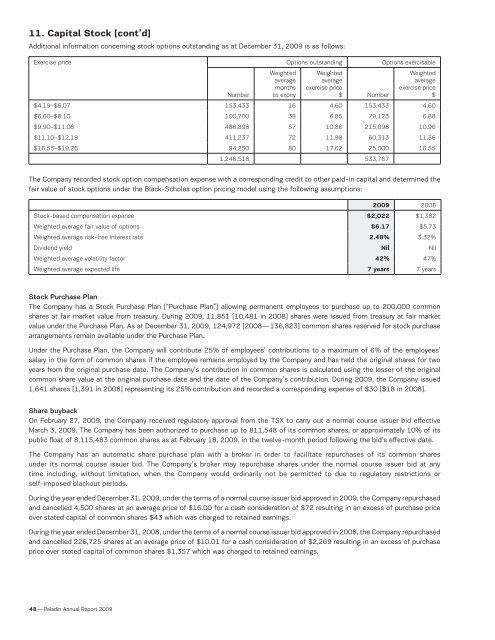

11. Capital Stock [cont’d]<br />

Additional information concerning stock options outstanding as at December 31, 2009 is as follows:<br />

Exercise price Options outstanding Options exercisable<br />

Number<br />

Weighted<br />

average<br />

months<br />

to expiry<br />

Weighted<br />

average<br />

exercise price<br />

$ Number<br />

Weighted<br />

average<br />

exercise price<br />

$<br />

$4.19–$6.07 153,433 16 4.60 153,433 4.60<br />

$6.60–$8.10 100,700 38 6.85 79,123 6.88<br />

$9.90–$11.06 486,898 57 10.86 215,898 10.96<br />

$11.10–$12.19 411,237 72 11.98 60,313 11.36<br />

$16.55–$19.26 94,250 80 17.62 25,000 16.55<br />

1,246,518 533,767<br />

The Company recorded stock option compensation expense with a corresponding credit to other paid-in capital and determined the<br />

fair value of stock options under the Black-Scholes option pricing model using the following assumptions:<br />

2009 2008<br />

Stock-based compensation expense $2,022 $1,382<br />

Weighted average fair value of options $6.17 $5.73<br />

Weighted average risk-free interest rate 2.48% 3.32%<br />

Dividend yield Nil Nil<br />

Weighted average volatility factor 42% 47%<br />

Weighted average expected life 7 years 7 years<br />

Stock Purchase Plan<br />

The Company has a Stock Purchase Plan [“Purchase Plan”] allowing permanent employees to purchase up to 200,000 common<br />

shares at fair market value from treasury. During 2009, 11,851 [10,481 in 2008] shares were issued from treasury at fair market<br />

value under the Purchase Plan. As at December 31, 2009, 124,972 [2008 — 136,823] common shares reserved for stock purchase<br />

arrangements remain available under the Purchase Plan.<br />

Under the Purchase Plan, the Company will contribute 25% of employees’ contributions to a maximum of 6% of the employees’<br />

salary in the form of common shares if the employee remains employed by the Company and has held the original shares for two<br />

years from the original purchase date. The Company’s contribution in common shares is calculated using the lesser of the original<br />

common share value at the original purchase date and the date of the Company’s contribution. During 2009, the Company issued<br />

1,641 shares [1,391 in 2008] representing its 25% contribution and recorded a corresponding expense of $30 [$18 in 2008].<br />

Share buyback<br />

On February 27, 2009, the Company received regulatory approval from the TSX to carry out a normal course issuer bid effective<br />

March 3, 2009. The Company has been authorized to purchase up to 811,548 of its common shares, or approximately 10% of its<br />

public float of 8,115,483 common shares as at February 18, 2009, in the twelve-month period following the bid’s effective date.<br />

The Company has an automatic share purchase plan with a broker in order to facilitate repurchases of its common shares<br />

under its normal course issuer bid. The Company’s broker may repurchase shares under the normal course issuer bid at any<br />

time including, without limitation, when the Company would ordinarily not be permitted to due to regulatory restrictions or<br />

self-imposed blackout periods.<br />

During the year ended December 31, 2009, under the terms of a normal course issuer bid approved in 2009, the Company repurchased<br />

and cancelled 4,500 shares at an average price of $16.00 for a cash consideration of $72 resulting in an excess of purchase price<br />

over stated capital of common shares $43 which was charged to retained earnings.<br />

During the year ended December 31, 2008, under the terms of a normal course issuer bid approved in 2008, the Company repurchased<br />

and cancelled 226,725 shares at an average price of $10.01 for a cash consideration of $2,269 resulting in an excess of purchase<br />

price over stated capital of common shares $1,357 which was charged to retained earnings.<br />

48 — Paladin Annual Report 2009