Banknotes

UGANDA Letter Post Parcel Post - Singapore Post

UGANDA Letter Post Parcel Post - Singapore Post

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

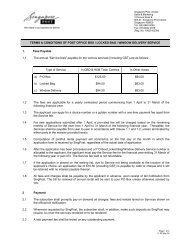

Customs Declaration<br />

Valued up to $700 - Green Label (CN22); valued over $700 – Parcel<br />

Despatch Note in addition to upper part of Green Label. See note below.<br />

Conditions concerning the documentation relating to the entry of goods are:<br />

(a)<br />

Letters and small packets containing goods, and postage stamps for<br />

philatelic purposes:<br />

Firstly, if such an item is despatched to a private person in the United<br />

Kingdom a Green Label must be affixed on the outside or,<br />

alternatively, the upper part of a Green Label must be affixed on the<br />

outside and, in addition, an individual customs declaration must be<br />

fixed, or inserted in it.<br />

Secondly, if such an item is despatched commercially, the upper part<br />

of a Green Label must be affixed on the outside and, in addition, an<br />

individual customs declaration must be fixed or inserted in it. A bill<br />

should also be fixed or inserted in it.<br />

Thirdly, the documents mentioned under firstly and secondly are<br />

required whether the goods are liable to customs duties or not on their<br />

entry to the United Kingdom.<br />

Sending alcohol and tobacco<br />

products by mail<br />

b) Printed Matter - If the contents of an item of printed matter are<br />

liable to customs duties, the documentation required is the same as<br />

for the letters and small packets. If the contents are not liable to<br />

customs duties, customs declaration is not required. In as much as<br />

the above-mentioned requirements are prescribed, their disregard<br />

may lead to the confiscation of the items. It must also be noted that<br />

when individual customs declarations or bills are furnished, customs<br />

clearances may be accelerated if they are fixed to the outside of<br />

items rather than inserted in them.<br />

A recent change in Great Britain’s excise legislation means that excise duty<br />

must be paid on all alcohol and tobacco products, including occasional<br />

gifts, sent through the post to Great Britain from any other country. It is an<br />

offence to sell alcohol or tobacco products on which Great Britain’s excise<br />

duty has not been paid.<br />

From countries outside the European Union (EU)<br />

Like most goods arriving into Great Britain from outside of the EU, alcohol<br />

and tobacco products are liable to customs duty, excise duty and import<br />

VAT. All of these must be paid regardless of whether the goods are<br />

purchased, are for private use, or for sale, or received as a gift.<br />

CN22 and CN23 customs declarations for items destined for Great Britain<br />

should be fully and accurately completed in English (or French) and firmly<br />

attached to the outside of items. The sender should sign and date the<br />

customs declaration and, when using a CN22, the sender’s full name and<br />

address must be clearly written on the front of the item.<br />

From countries within the European Union (EU)<br />

All alcohol and tobacco products sent from another EU member state are<br />

liable to Great Britain excise duty. Senders must make prior arrangements<br />

to account for this duty before the goods are dispatched from the exporting<br />

member state; otherwise, the goods will be liable to forfeiture. For more<br />

information on this please see the “Distance Selling” procedures in HM<br />

Revenue and Customs Notice 203: Registered Excise Dealers and<br />

Shippers, which can be accessed via www.hmrc.gov.uk.<br />

Imports that do not comply with the above conditions will be subject to<br />

forfeiture to HM Revenue and Customs, in which case Royal Mail will not<br />

accept liability and will not pay any compensation.<br />

For further information on sending goods to Great Britain by post please see<br />

HM Revenue and Customs Notice 143: A guide for International Postal<br />

Users which can be accessed via www.hmrc.gov.uk.