Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

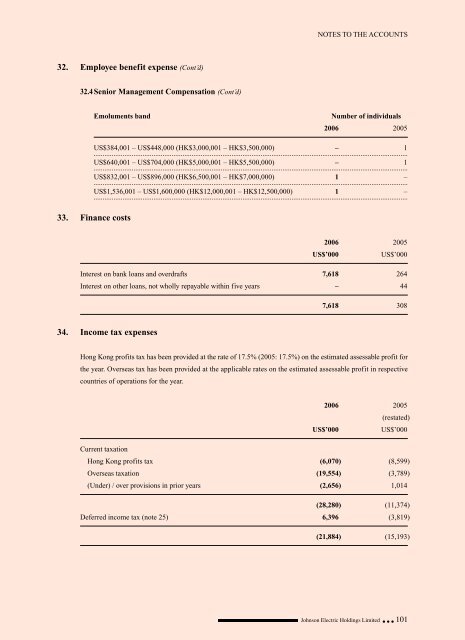

32. Employee benefit expense (Cont’d)<br />

32.4Senior Management Compensation (Cont’d)<br />

NOTES TO THE ACCOUNTS<br />

Emoluments band Number of individuals<br />

2006 2005<br />

US$384,001 – US$448,000 (HK$3,000,001 – HK$3,500,000) – 1<br />

.............................................................................................................................................................................<br />

US$640,001 – US$704,000 (HK$5,000,001 – HK$5,500,000) – 1<br />

.............................................................................................................................................................................<br />

US$832,001 – US$896,000 (HK$6,500,001 – HK$7,000,000) 1 –<br />

.............................................................................................................................................................................<br />

US$1,536,001 – US$1,600,000 (HK$12,000,001 – HK$12,500,000) 1 –<br />

.............................................................................................................................................................................<br />

33. Finance costs<br />

2006 2005<br />

US$’000 US$’000<br />

Interest on bank loans and overdrafts 7,618 264<br />

Interest on other loans, not wholly repayable within five years – 44<br />

34. Income tax expenses<br />

7,618 308<br />

Hong Kong profits tax has been provided at the rate of 17.5% (2005: 17.5%) on the estimated assessable profit for<br />

the year. Overseas tax has been provided at the applicable rates on the estimated assessable profit in respective<br />

countries of operations for the year.<br />

2006 2005<br />

(restated)<br />

US$’000 US$’000<br />

Current taxation<br />

Hong Kong profits tax (6,070) (8,599)<br />

Overseas taxation (19,554) (3,789)<br />

(Under) / over provisions in prior years (2,656) 1,014<br />

(28,280) (11,374)<br />

Deferred income tax (note 25) 6,396 (3,819)<br />

(21,884) (15,193)<br />

<strong>Johnson</strong> <strong>Electric</strong> Holdings Limited 101