Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

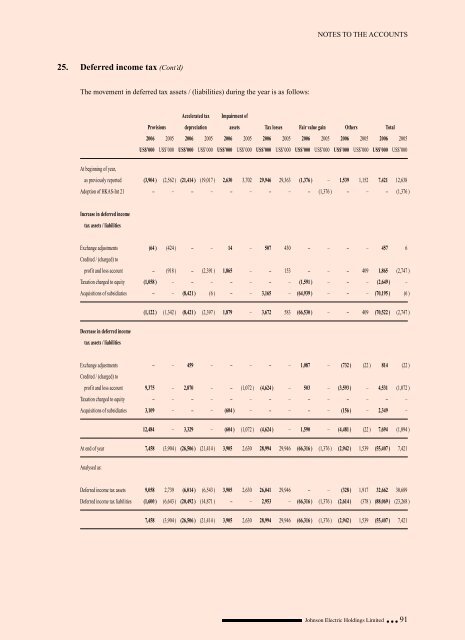

25. Deferred income tax (Cont’d)<br />

The movement in deferred tax assets / (liabilities) during the year is as follows:<br />

NOTES TO THE ACCOUNTS<br />

Accelerated tax Impairment of<br />

Provisions depreciation assets Tax losses Fair value gain Others Total<br />

2006 2005 2006 2005 2006 2005 2006 2005 2006 2005 2006 2005 2006 2005<br />

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000<br />

At beginning of year,<br />

as previously reported (3,904 ) (2,562 ) (21,414 ) (19,017 ) 2,630 3,702 29,946 29,363 (1,376 ) – 1,539 1,152 7,421 12,638<br />

Adoption of HKAS-Int 21 – – – – – – – – – (1,376 ) – – – (1,376 )<br />

Increase in deferred income<br />

tax assets / liabilities<br />

Exchange adjustments<br />

Credited / (charged) to<br />

(64 ) (424 ) – – 14 – 507 430 – – – – 457 6<br />

profit and loss account – (918 ) – (2,391 ) 1,865 – – 153 – – – 409 1,865 (2,747 )<br />

Taxation charged to equity (1,058 ) – – – – – – – (1,591 ) – – – (2,649 ) –<br />

Acquisitions of subsidiaries – – (8,421 ) (6 ) – – 3,165 – (64,939 ) – – – (70,195 ) (6 )<br />

Decrease in deferred income<br />

tax assets / liabilities<br />

(1,122 ) (1,342 ) (8,421 ) (2,397 ) 1,879 – 3,672 583 (66,530 ) – – 409 (70,522 ) (2,747 )<br />

Exchange adjustments<br />

Credited / (charged) to<br />

– – 459 – – – – – 1,087 – (732 ) (22 ) 814 (22 )<br />

profit and loss account 9,375 – 2,870 – – (1,072 ) (4,624 ) – 503 – (3,593 ) – 4,531 (1,072 )<br />

Taxation charged to equity – – – – – – – – – – – – – –<br />

Acquisitions of subsidiaries 3,109 – – – (604 ) – – – – – (156 ) – 2,349 –<br />

12,484 – 3,329 – (604 ) (1,072 ) (4,624 ) – 1,590 – (4,481 ) (22 ) 7,694 (1,094 )<br />

At end of year 7,458 (3,904 ) (26,506 ) (21,414 ) 3,905 2,630 28,994 29,946 (66,316 ) (1,376 ) (2,942 ) 1,539 (55,407 ) 7,421<br />

Analysed as:<br />

Deferred income tax assets 9,058 2,739 (6,014 ) (6,543 ) 3,905 2,630 26,041 29,946 – – (328 ) 1,917 32,662 30,689<br />

Deferred income tax liabilities (1,600 ) (6,643 ) (20,492 ) (14,871 ) – – 2,953 – (66,316 ) (1,376 ) (2,614 ) (378 ) (88,069 ) (23,268 )<br />

7,458 (3,904 ) (26,506 ) (21,414 ) 3,905 2,630 28,994 29,946 (66,316 ) (1,376 ) (2,942 ) 1,539 (55,407 ) 7,421<br />

<strong>Johnson</strong> <strong>Electric</strong> Holdings Limited 91