You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

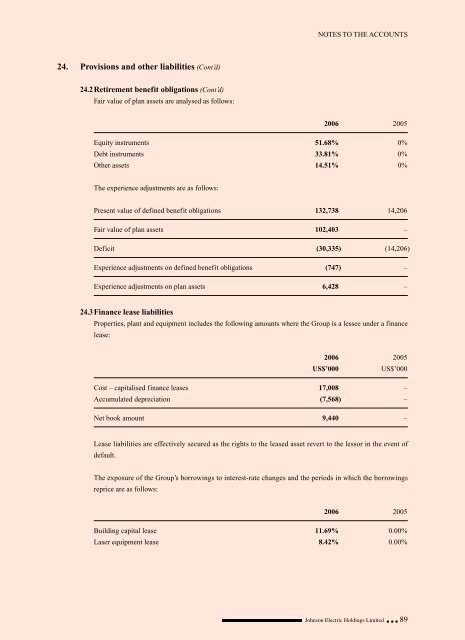

24. Provisions and other liabilities (Cont’d)<br />

24.2Retirement benefit obligations (Cont’d)<br />

Fair value of plan assets are analysed as follows:<br />

NOTES TO THE ACCOUNTS<br />

2006 2005<br />

Equity instruments 51.68% 0%<br />

Debt instruments 33.81% 0%<br />

Other assets 14.51% 0%<br />

The experience adjustments are as follows:<br />

Present value of defined benefit obligations 132,738 14,206<br />

Fair value of plan assets 102,403 –<br />

Deficit (30,335) (14,206)<br />

Experience adjustments on defined benefit obligations (747) –<br />

Experience adjustments on plan assets 6,428 –<br />

24.3Finance lease liabilities<br />

Properties, plant and equipment includes the following amounts where the Group is a lessee under a finance<br />

lease:<br />

2006 2005<br />

US$’000 US$’000<br />

Cost – capitalised finance leases 17,008 –<br />

Accumulated depreciation (7,568) –<br />

Net book amount 9,440 –<br />

Lease liabilities are effectively secured as the rights to the leased asset revert to the lessor in the event of<br />

default.<br />

The exposure of the Group’s borrowings to interest-rate changes and the periods in which the borrowings<br />

reprice are as follows:<br />

2006 2005<br />

Building capital lease 11.69% 0.00%<br />

Laser equipment lease 8.42% 0.00%<br />

<strong>Johnson</strong> <strong>Electric</strong> Holdings Limited 89