Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE ACCOUNTS<br />

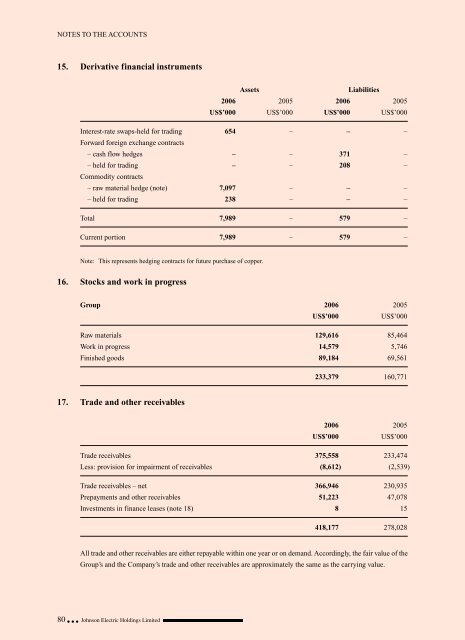

15. Derivative financial instruments<br />

80 <strong>Johnson</strong> <strong>Electric</strong> Holdings Limited<br />

Assets Liabilities<br />

2006 2005 2006 2005<br />

US$’000 US$’000 US$’000 US$’000<br />

Interest-rate swaps-held for trading<br />

Forward foreign exchange contracts<br />

654 – – –<br />

– cash flow hedges – – 371 –<br />

– held for trading<br />

Commodity contracts<br />

– – 208 –<br />

– raw material hedge (note) 7,097 – – –<br />

– held for trading 238 – – –<br />

Total 7,989 – 579 –<br />

Current portion 7,989 – 579 –<br />

Note: This represents hedging contracts for future purchase of copper.<br />

16. Stocks and work in progress<br />

Group 2006 2005<br />

US$’000 US$’000<br />

Raw materials 129,616 85,464<br />

Work in progress 14,579 5,746<br />

Finished goods 89,184 69,561<br />

17. Trade and other receivables<br />

233,379 160,771<br />

2006 2005<br />

US$’000 US$’000<br />

Trade receivables 375,558 233,474<br />

Less: provision for impairment of receivables (8,612) (2,539)<br />

Trade receivables – net 366,946 230,935<br />

Prepayments and other receivables 51,223 47,078<br />

Investments in finance leases (note 18) 8 15<br />

418,177 278,028<br />

All trade and other receivables are either repayable within one year or on demand. Accordingly, the fair value of the<br />

Group’s and the Company’s trade and other receivables are approximately the same as the carrying value.