Annual Report 2001 - Flughafen Wien

Annual Report 2001 - Flughafen Wien

Annual Report 2001 - Flughafen Wien

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> <strong>2001</strong><br />

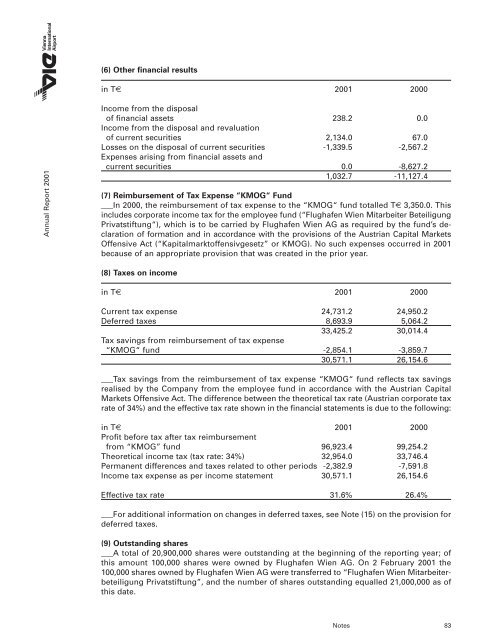

(6) Other financial results<br />

in T€ <strong>2001</strong> 2000<br />

Income from the disposal<br />

of financial assets 238.2 0.0<br />

Income from the disposal and revaluation<br />

of current securities 2,134.0 67.0<br />

Losses on the disposal of current securities -1,339.5 -2,567.2<br />

Expenses arising from financial assets and<br />

current securities 0.0 -8,627.2<br />

1,032.7 -11,127.4<br />

(7) Reimbursement of Tax Expense “KMOG“ Fund<br />

___In 2000, the reimbursement of tax expense to the “KMOG“ fund totalled T€ 3,350.0. This<br />

includes corporate income tax for the employee fund (“<strong>Flughafen</strong> <strong>Wien</strong> Mitarbeiter Beteiligung<br />

Privatstiftung“), which is to be carried by <strong>Flughafen</strong> <strong>Wien</strong> AG as required by the fund’s declaration<br />

of formation and in accordance with the provisions of the Austrian Capital Markets<br />

Offensive Act (“Kapitalmarktoffensivgesetz” or KMOG). No such expenses occurred in <strong>2001</strong><br />

because of an appropriate provision that was created in the prior year.<br />

(8) Taxes on income<br />

in T€ <strong>2001</strong> 2000<br />

Current tax expense 24,731.2 24,950.2<br />

Deferred taxes 8,693.9 5,064.2<br />

33,425.2 30,014.4<br />

Tax savings from reimbursement of tax expense<br />

“KMOG“ fund -2,854.1 -3,859.7<br />

30,571.1 26,154.6<br />

___Tax savings from the reimbursement of tax expense “KMOG“ fund reflects tax savings<br />

realised by the Company from the employee fund in accordance with the Austrian Capital<br />

Markets Offensive Act. The difference between the theoretical tax rate (Austrian corporate tax<br />

rate of 34%) and the effective tax rate shown in the financial statements is due to the following:<br />

in T€ <strong>2001</strong> 2000<br />

Profit before tax after tax reimbursement<br />

from “KMOG” fund 96,923.4 99,254.2<br />

Theoretical income tax (tax rate: 34%) 32,954.0 33,746.4<br />

Permanent differences and taxes related to other periods -2,382.9 -7,591.8<br />

Income tax expense as per income statement 30,571.1 26,154.6<br />

Effective tax rate 31.6% 26.4%<br />

___For additional information on changes in deferred taxes, see Note (15) on the provision for<br />

deferred taxes.<br />

(9) Outstanding shares<br />

___A total of 20,900,000 shares were outstanding at the beginning of the reporting year; of<br />

this amount 100,000 shares were owned by <strong>Flughafen</strong> <strong>Wien</strong> AG. On 2 February <strong>2001</strong> the<br />

100,000 shares owned by <strong>Flughafen</strong> <strong>Wien</strong> AG were transferred to “<strong>Flughafen</strong> <strong>Wien</strong> Mitarbeiterbeteiligung<br />

Privatstiftung”, and the number of shares outstanding equalled 21,000,000 as of<br />

this date.<br />

Notes 83