Governance - Xstrata

Governance - Xstrata

Governance - Xstrata

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

122 | <strong>Governance</strong><br />

Remuneration report continued<br />

Added Value Incentive Plan<br />

The Added Value Incentive Plan (AVP) was designed to incentivise the<br />

Chief Executive by providing a share of the long-term value he creates<br />

for shareholders over and above the value created by <strong>Xstrata</strong>’s peer<br />

companies and to create alignment with shareholders by means of<br />

share ownership.<br />

During 2010, the AVP terminated in respect of the grant of new<br />

awards with the consequence that no further awards will be granted<br />

under it. The last award under the AVP was made in 2009 and, as<br />

from 2010, the Chief Executive has participated in the LTIP. Only the<br />

plan cycles commencing in 2008 and 2009 remain open under the<br />

AVP. The 2005 plan cycle, which vested in 2008, did not proceed to<br />

Phase 2 and the 2006 and 2007 plan cycles, in each case, neither<br />

vested nor proceeded to Phase 2. The Chief Executive’s participation<br />

in any open plan cycle of the AVP is contingent on his maintaining<br />

a holding of at least 350,000 ordinary <strong>Xstrata</strong> shares.<br />

Payments under the AVP are based upon the growth in the<br />

Company’s total shareholder return (TSR) over the relevant<br />

performance period relative to an index of global mining companies,<br />

which form the <strong>Xstrata</strong> TSR Index. Performance is assessed over<br />

periods of both three years (Phase 1) and five years (Phase 2) from<br />

the date of award.<br />

At the end of a Phase 1 performance period, <strong>Xstrata</strong>’s TSR is<br />

calculated and compared to the <strong>Xstrata</strong> TSR Index which determines<br />

the added value created over the performance period.<br />

If this figure is positive, it is multiplied by a participation percentage<br />

(which is 0.5% for the 2008 plan cycle and 0.3% for the 2009 plan<br />

cycle) to calculate the Phase 1 base reward. No payments will be<br />

made if <strong>Xstrata</strong> underperforms against the <strong>Xstrata</strong> TSR Index.<br />

There is a cap which applies to the calculation at the end of the<br />

Phase 1 performance period. If the cap has been applied then the<br />

Chief Executive will become eligible for Phase 2 of a plan cycle.<br />

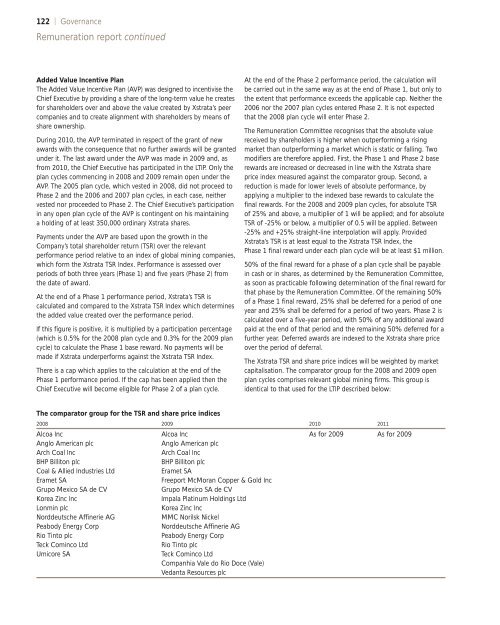

The comparator group for the TSR and share price indices<br />

At the end of the Phase 2 performance period, the calculation will<br />

be carried out in the same way as at the end of Phase 1, but only to<br />

the extent that performance exceeds the applicable cap. Neither the<br />

2006 nor the 2007 plan cycles entered Phase 2. It is not expected<br />

that the 2008 plan cycle will enter Phase 2.<br />

The Remuneration Committee recognises that the absolute value<br />

received by shareholders is higher when outperforming a rising<br />

market than outperforming a market which is static or falling. Two<br />

modifiers are therefore applied. First, the Phase 1 and Phase 2 base<br />

rewards are increased or decreased in line with the <strong>Xstrata</strong> share<br />

price index measured against the comparator group. Second, a<br />

reduction is made for lower levels of absolute performance, by<br />

applying a multiplier to the indexed base rewards to calculate the<br />

final rewards. For the 2008 and 2009 plan cycles, for absolute TSR<br />

of 25% and above, a multiplier of 1 will be applied; and for absolute<br />

TSR of -25% or below, a multiplier of 0.5 will be applied. Between<br />

-25% and +25% straight-line interpolation will apply. Provided<br />

<strong>Xstrata</strong>’s TSR is at least equal to the <strong>Xstrata</strong> TSR Index, the<br />

Phase 1 final reward under each plan cycle will be at least $1 million.<br />

50% of the final reward for a phase of a plan cycle shall be payable<br />

in cash or in shares, as determined by the Remuneration Committee,<br />

as soon as practicable following determination of the final reward for<br />

that phase by the Remuneration Committee. Of the remaining 50%<br />

of a Phase 1 final reward, 25% shall be deferred for a period of one<br />

year and 25% shall be deferred for a period of two years. Phase 2 is<br />

calculated over a five-year period, with 50% of any additional award<br />

paid at the end of that period and the remaining 50% deferred for a<br />

further year. Deferred awards are indexed to the <strong>Xstrata</strong> share price<br />

over the period of deferral.<br />

The <strong>Xstrata</strong> TSR and share price indices will be weighted by market<br />

capitalisation. The comparator group for the 2008 and 2009 open<br />

plan cycles comprises relevant global mining firms. This group is<br />

identical to that used for the LTIP described below:<br />

2008 2009 2010 2011<br />

Alcoa Inc<br />

Anglo American plc<br />

Arch Coal Inc<br />

BHP Billiton plc<br />

Coal & Allied Industries Ltd<br />

Eramet SA<br />

Grupo Mexico SA de CV<br />

Korea Zinc Inc<br />

Lonmin plc<br />

Norddeutsche Affinerie AG<br />

Peabody Energy Corp<br />

Rio Tinto plc<br />

Teck Cominco Ltd<br />

Umicore SA<br />

Alcoa Inc<br />

Anglo American plc<br />

Arch Coal Inc<br />

BHP Billiton plc<br />

Eramet SA<br />

Freeport McMoran Copper & Gold Inc<br />

Grupo Mexico SA de CV<br />

Impala Platinum Holdings Ltd<br />

Korea Zinc Inc<br />

MMC Norilsk Nickel<br />

Norddeutsche Affinerie AG<br />

Peabody Energy Corp<br />

Rio Tinto plc<br />

Teck Cominco Ltd<br />

Companhia Vale do Rio Doce (Vale)<br />

Vedanta Resources plc<br />

As for 2009 As for 2009