Governance - Xstrata

Governance - Xstrata

Governance - Xstrata

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

award linked to TSR will vest (although up to 50% of the overall<br />

combined award could vest depending on the extent to which the<br />

cost saving targets are met).<br />

It should be noted that these amounts are based on the Group’s<br />

results at this provisional stage and do not necessarily reflect the<br />

eventual outcome.<br />

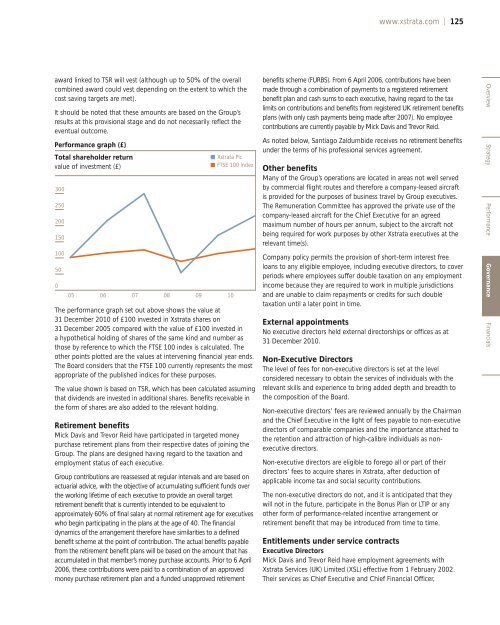

Performance graph (£)<br />

Total shareholder return<br />

value of investment (£)<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

05<br />

06<br />

07<br />

08<br />

09<br />

<strong>Xstrata</strong> Plc<br />

FTSE 100 Index<br />

The performance graph set out above shows the value at<br />

31 December 2010 of £100 invested in <strong>Xstrata</strong> shares on<br />

31 December 2005 compared with the value of £100 invested in<br />

a hypothetical holding of shares of the same kind and number as<br />

those by reference to which the FTSE 100 index is calculated. The<br />

other points plotted are the values at intervening financial year ends.<br />

The Board considers that the FTSE 100 currently represents the most<br />

appropriate of the published indices for these purposes.<br />

The value shown is based on TSR, which has been calculated assuming<br />

that dividends are invested in additional shares. Benefits receivable in<br />

the form of shares are also added to the relevant holding.<br />

Retirement benefits<br />

Mick Davis and Trevor Reid have participated in targeted money<br />

purchase retirement plans from their respective dates of joining the<br />

Group. The plans are designed having regard to the taxation and<br />

employment status of each executive.<br />

Group contributions are reassessed at regular intervals and are based on<br />

actuarial advice, with the objective of accumulating sufficient funds over<br />

the working lifetime of each executive to provide an overall target<br />

retirement benefit that is currently intended to be equivalent to<br />

approximately 60% of final salary at normal retirement age for executives<br />

who begin participating in the plans at the age of 40. The financial<br />

dynamics of the arrangement therefore have similarities to a defined<br />

benefit scheme at the point of contribution. The actual benefits payable<br />

from the retirement benefit plans will be based on the amount that has<br />

accumulated in that member’s money purchase accounts. Prior to 6 April<br />

2006, these contributions were paid to a combination of an approved<br />

money purchase retirement plan and a funded unapproved retirement<br />

10<br />

www.xstrata.com | 125<br />

benefits scheme (FURBS). From 6 April 2006, contributions have been<br />

made through a combination of payments to a registered retirement<br />

benefit plan and cash sums to each executive, having regard to the tax<br />

limits on contributions and benefits from registered UK retirement benefits<br />

plans (with only cash payments being made after 2007). No employee<br />

contributions are currently payable by Mick Davis and Trevor Reid.<br />

As noted below, Santiago Zaldumbide receives no retirement benefits<br />

under the terms of his professional services agreement.<br />

Other benefits<br />

Many of the Group’s operations are located in areas not well served<br />

by commercial flight routes and therefore a company-leased aircraft<br />

is provided for the purposes of business travel by Group executives.<br />

The Remuneration Committee has approved the private use of the<br />

company-leased aircraft for the Chief Executive for an agreed<br />

maximum number of hours per annum, subject to the aircraft not<br />

being required for work purposes by other <strong>Xstrata</strong> executives at the<br />

relevant time(s).<br />

Company policy permits the provision of short-term interest free<br />

loans to any eligible employee, including executive directors, to cover<br />

periods where employees suffer double taxation on any employment<br />

income because they are required to work in multiple jurisdictions<br />

and are unable to claim repayments or credits for such double<br />

taxation until a later point in time.<br />

External appointments<br />

No executive directors held external directorships or offices as at<br />

31 December 2010.<br />

Non-Executive Directors<br />

The level of fees for non-executive directors is set at the level<br />

considered necessary to obtain the services of individuals with the<br />

relevant skills and experience to bring added depth and breadth to<br />

the composition of the Board.<br />

Non-executive directors’ fees are reviewed annually by the Chairman<br />

and the Chief Executive in the light of fees payable to non-executive<br />

directors of comparable companies and the importance attached to<br />

the retention and attraction of high-calibre individuals as nonexecutive<br />

directors.<br />

Non-executive directors are eligible to forego all or part of their<br />

directors’ fees to acquire shares in <strong>Xstrata</strong>, after deduction of<br />

applicable income tax and social security contributions.<br />

The non-executive directors do not, and it is anticipated that they<br />

will not in the future, participate in the Bonus Plan or LTIP or any<br />

other form of performance-related incentive arrangement or<br />

retirement benefit that may be introduced from time to time.<br />

Entitlements under service contracts<br />

Executive Directors<br />

Mick Davis and Trevor Reid have employment agreements with<br />

<strong>Xstrata</strong> Services (UK) Limited (XSL) effective from 1 February 2002.<br />

Their services as Chief Executive and Chief Financial Officer,<br />

Overview Strategy Performance <strong>Governance</strong> Financials