Governance - Xstrata

Governance - Xstrata

Governance - Xstrata

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

106 | <strong>Governance</strong><br />

Directors’ report continued<br />

Directors’ liabilities<br />

The Company has granted qualifying third party indemnities to each<br />

of its directors against any liability that attaches to them in defending<br />

proceedings brought against them, to the extent permitted by the<br />

Companies Acts. In addition, directors and officers of the Company<br />

and its subsidiaries are covered by Directors & Officers liability insurance.<br />

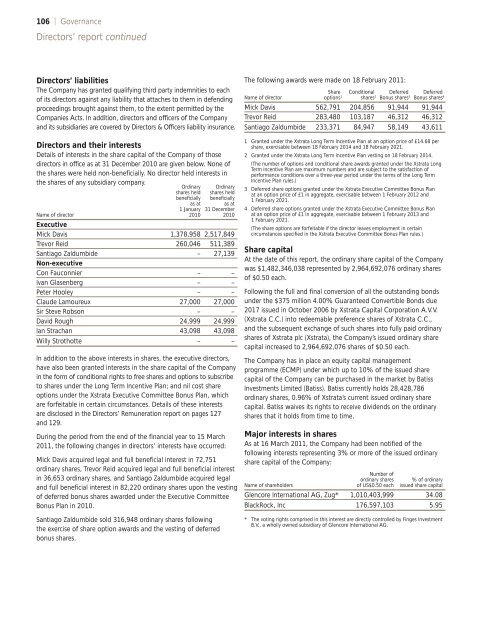

Directors and their interests<br />

Details of interests in the share capital of the Company of those<br />

directors in office as at 31 December 2010 are given below. None of<br />

the shares were held non-beneficially. No director held interests in<br />

the shares of any subsidiary company.<br />

Name of director<br />

Ordinary<br />

shares held<br />

beneficially<br />

as at<br />

1 January<br />

2010<br />

Ordinary<br />

shares held<br />

beneficially<br />

as at<br />

31 December<br />

2010<br />

Executive<br />

Mick Davis 1,378,958 2,517,849<br />

Trevor Reid 260,046 511,389<br />

Santiago Zaldumbide<br />

Non-executive<br />

– 27,139<br />

Con Fauconnier – –<br />

Ivan Glasenberg – –<br />

Peter Hooley – –<br />

Claude Lamoureux 27,000 27,000<br />

Sir Steve Robson – –<br />

David Rough 24,999 24,999<br />

Ian Strachan 43,098 43,098<br />

Willy Strothotte – –<br />

In addition to the above interests in shares, the executive directors,<br />

have also been granted interests in the share capital of the Company<br />

in the form of conditional rights to free shares and options to subscribe<br />

to shares under the Long Term Incentive Plan; and nil cost share<br />

options under the <strong>Xstrata</strong> Executive Committee Bonus Plan, which<br />

are forfeitable in certain circumstances. Details of these interests<br />

are disclosed in the Directors’ Remuneration report on pages 127<br />

and 129.<br />

During the period from the end of the financial year to 15 March<br />

2011, the following changes in directors’ interests have occurred:<br />

Mick Davis acquired legal and full beneficial interest in 72,751<br />

ordinary shares, Trevor Reid acquired legal and full beneficial interest<br />

in 36,653 ordinary shares, and Santiago Zaldumbide acquired legal<br />

and full beneficial interest in 82,220 ordinary shares upon the vesting<br />

of deferred bonus shares awarded under the Executive Committee<br />

Bonus Plan in 2010.<br />

Santiago Zaldumbide sold 316,948 ordinary shares following<br />

the exercise of share option awards and the vesting of deferred<br />

bonus shares.<br />

The following awards were made on 18 February 2011:<br />

Name of director<br />

Share<br />

options 1<br />

Conditional<br />

shares 2<br />

Deferred<br />

Bonus shares 3<br />

Deferred<br />

Bonus shares 4<br />

Mick Davis 562,791 204,856 91,944 91,944<br />

Trevor Reid 283,480 103,187 46,312 46,312<br />

Santiago Zaldumbide 233,371 84,947 58,149 43,611<br />

1 Granted under the <strong>Xstrata</strong> Long Term Incentive Plan at an option price of £14.68 per<br />

share, exercisable between 18 February 2014 and 18 February 2021.<br />

2 Granted under the <strong>Xstrata</strong> Long Term Incentive Plan vesting on 18 February 2014.<br />

(The number of options and conditional share awards granted under the <strong>Xstrata</strong> Long<br />

Term Incentive Plan are maximum numbers and are subject to the satisfaction of<br />

performance conditions over a three-year period under the terms of the Long Term<br />

Incentive Plan rules.)<br />

3 Deferred share options granted under the <strong>Xstrata</strong> Executive Committee Bonus Plan<br />

at an option price of £1 in aggregate, exercisable between 1 February 2012 and<br />

1 February 2021.<br />

4 Deferred share options granted under the <strong>Xstrata</strong> Executive Committee Bonus Plan<br />

at an option price of £1 in aggregate, exercisable between 1 February 2013 and<br />

1 February 2021.<br />

(The share options are forfeitable if the director leaves employment in certain<br />

circumstances specified in the <strong>Xstrata</strong> Executive Committee Bonus Plan rules.)<br />

Share capital<br />

At the date of this report, the ordinary share capital of the Company<br />

was $1,482,346,038 represented by 2,964,692,076 ordinary shares<br />

of $0.50 each.<br />

Following the full and final conversion of all the outstanding bonds<br />

under the $375 million 4.00% Guaranteed Convertible Bonds due<br />

2017 issued in October 2006 by <strong>Xstrata</strong> Capital Corporation A.V.V.<br />

(<strong>Xstrata</strong> C.C.) into redeemable preference shares of <strong>Xstrata</strong> C.C.,<br />

and the subsequent exchange of such shares into fully paid ordinary<br />

shares of <strong>Xstrata</strong> plc (<strong>Xstrata</strong>), the Company’s issued ordinary share<br />

capital increased to 2,964,692,076 shares of $0.50 each.<br />

The Company has in place an equity capital management<br />

programme (ECMP) under which up to 10% of the issued share<br />

capital of the Company can be purchased in the market by Batiss<br />

Investments Limited (Batiss). Batiss currently holds 28,428,786<br />

ordinary shares, 0.96% of <strong>Xstrata</strong>’s current issued ordinary share<br />

capital. Batiss waives its rights to receive dividends on the ordinary<br />

shares that it holds from time to time.<br />

Major interests in shares<br />

As at 16 March 2011, the Company had been notified of the<br />

following interests representing 3% or more of the issued ordinary<br />

share capital of the Company:<br />

Number of<br />

ordinary shares % of ordinary<br />

Name of shareholders<br />

of US$0.50 each issued share capital<br />

Glencore International AG, Zug* 1,010,403,999 34.08<br />

BlackRock, Inc 176,597,103 5.95<br />

* The voting rights comprised in this interest are directly controlled by Finges Investment<br />

B.V., a wholly owned subsidiary of Glencore International AG.