Governance - Xstrata

Governance - Xstrata

Governance - Xstrata

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

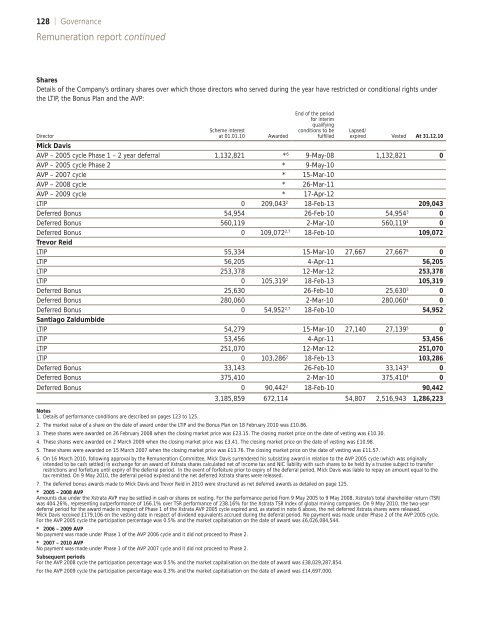

128 | <strong>Governance</strong><br />

Remuneration report continued<br />

Shares<br />

Details of the Company’s ordinary shares over which those directors who served during the year have restricted or conditional rights under<br />

the LTIP, the Bonus Plan and the AVP:<br />

Director<br />

Scheme interest<br />

at 01.01.10 Awarded<br />

End of the period<br />

for interim<br />

qualifying<br />

conditions to be<br />

fulfilled<br />

Lapsed/<br />

expired Vested At 31.12.10<br />

Mick Davis<br />

AVP – 2005 cycle Phase 1 – 2 year deferral 1,132,821 * 6 9-May-08 1,132,821 0<br />

AVP – 2005 cycle Phase 2 * 9-May-10<br />

AVP – 2007 cycle * 15-Mar-10<br />

AVP – 2008 cycle * 26-Mar-11<br />

AVP – 2009 cycle * 17-Apr-12<br />

LTIP 0 209,0432 18-Feb-13 209,043<br />

Deferred Bonus 54,954 26-Feb-10 54,9543 0<br />

Deferred Bonus 560,119 2-Mar-10 560,1194 0<br />

Deferred Bonus 0 109,0722,7 Trevor Reid<br />

18-Feb-10 109,072<br />

LTIP 55,334 15-Mar-10 27,667 27,6675 0<br />

LTIP 56,205 4-Apr-11 56,205<br />

LTIP 253,378 12-Mar-12 253,378<br />

LTIP 0 105,3192 18-Feb-13 105,319<br />

Deferred Bonus 25,630 26-Feb-10 25,6303 0<br />

Deferred Bonus 280,060 2-Mar-10 280,0604 0<br />

Deferred Bonus 0 54,9522,7 Santiago Zaldumbide<br />

18-Feb-10 54,952<br />

LTIP 54,279 15-Mar-10 27,140 27,1395 0<br />

LTIP 53,456 4-Apr-11 53,456<br />

LTIP 251,070 12-Mar-12 251,070<br />

LTIP 0 103,2862 18-Feb-13 103,286<br />

Deferred Bonus 33,143 26-Feb-10 33,1433 0<br />

Deferred Bonus 375,410 2-Mar-10 375,4104 0<br />

Deferred Bonus 0 90,4422 18-Feb-10 90,442<br />

3,185,859 672,114 54,807 2,516,943 1,286,223<br />

Notes<br />

1. Details of performance conditions are described on pages 123 to 125.<br />

2. The market value of a share on the date of award under the LTIP and the Bonus Plan on 18 February 2010 was £10.86.<br />

3. These shares were awarded on 26 February 2008 when the closing market price was £23.15. The closing market price on the date of vesting was £10.30.<br />

4. These shares were awarded on 2 March 2009 when the closing market price was £3.41. The closing market price on the date of vesting was £10.98.<br />

5. These shares were awarded on 15 March 2007 when the closing market price was £13.76. The closing market price on the date of vesting was £11.57.<br />

6. On 16 March 2010, following approval by the Remuneration Committee, Mick Davis surrendered his subsisting award in relation to the AVP 2005 cycle (which was originally<br />

intended to be cash settled) in exchange for an award of <strong>Xstrata</strong> shares calculated net of income tax and NIC liability with such shares to be held by a trustee subject to transfer<br />

restrictions and forfeiture until expiry of the deferral period. In the event of forfeiture prior to expiry of the deferral period, Mick Davis was liable to repay an amount equal to the<br />

tax remitted. On 9 May 2010, the deferral period expired and the net deferred <strong>Xstrata</strong> shares were released.<br />

7. The deferred bonus awards made to Mick Davis and Trevor Reid in 2010 were structured as net deferred awards as detailed on page 125.<br />

* 2005 – 2008 AVP<br />

Amounts due under the <strong>Xstrata</strong> AVP may be settled in cash or shares on vesting. For the performance period from 9 May 2005 to 9 May 2008, <strong>Xstrata</strong>’s total shareholder return (TSR)<br />

was 404.26%, representing outperformance of 166.1% over TSR performance of 238.16% for the <strong>Xstrata</strong> TSR Index of global mining companies. On 9 May 2010, the two-year<br />

deferral period for the award made in respect of Phase 1 of the <strong>Xstrata</strong> AVP 2005 cycle expired and, as stated in note 6 above, the net deferred <strong>Xstrata</strong> shares were released.<br />

Mick Davis received £179,106 on the vesting date in respect of dividend equivalents accrued during the deferral period. No payment was made under Phase 2 of the AVP 2005 cycle.<br />

For the AVP 2005 cycle the participation percentage was 0.5% and the market capitalisation on the date of award was £6,026,084,544.<br />

* 2006 – 2009 AVP<br />

No payment was made under Phase 1 of the AVP 2006 cycle and it did not proceed to Phase 2.<br />

* 2007 – 2010 AVP<br />

No payment was made under Phase 1 of the AVP 2007 cycle and it did not proceed to Phase 2.<br />

Subsequent periods<br />

For the AVP 2008 cycle the participation percentage was 0.5% and the market capitalisation on the date of award was £38,029,287,854.<br />

For the AVP 2009 cycle the participation percentage was 0.3% and the market capitalisation on the date of award was £14,697,000.