We seal damp and protect

1o0Rrof

1o0Rrof

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE GROUP IN BRIEF<br />

A largely<br />

satisfying year<br />

A<br />

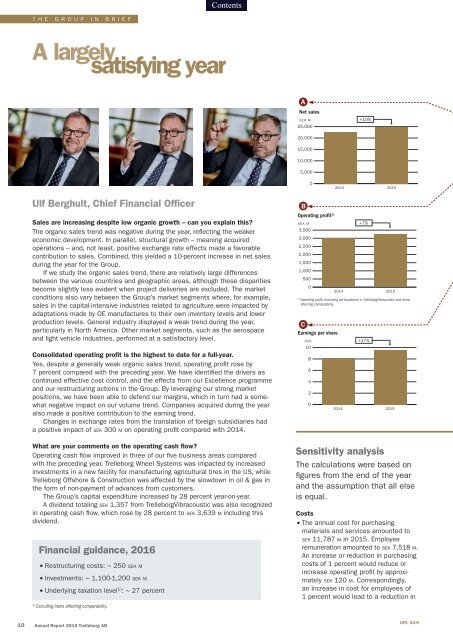

Net sales<br />

SEK M +10%<br />

25,000<br />

20,000<br />

15,000<br />

10,000<br />

5,000<br />

0<br />

2014 2015<br />

Ulf Berghult, Chief Financial Officer<br />

Sales are increasing despite low organic growth – can you explain this?<br />

The organic sales trend was negative during the year, reflecting the weaker<br />

economic development. In parallel, structural growth – meaning acquired<br />

operations – <strong>and</strong>, not least, positive exchange rate effects made a favorable<br />

contribution to sales. Combined, this yielded a 10-percent increase in net sales<br />

during the year for the Group.<br />

If we study the organic sales trend, there are relatively large differences<br />

between the various countries <strong>and</strong> geographic areas, although these disparities<br />

become slightly less evident when project deliveries are excluded. The market<br />

conditions also vary between the Group’s market segments where, for example,<br />

sales in the capital-intensive industries related to agriculture were impacted by<br />

adaptations made by OE manufactures to their own inventory levels <strong>and</strong> lower<br />

production levels. General industry displayed a weak trend during the year,<br />

particularly in North America. Other market segments, such as the aerospace<br />

<strong>and</strong> light vehicle industries, performed at a satisfactory level.<br />

Consolidated operating profit is the highest to date for a full-year.<br />

Yes, despite a generally weak organic sales trend, operating profit rose by<br />

7 percent compared with the preceding year. <strong>We</strong> have identified the drivers as<br />

continued effective cost control, <strong>and</strong> the effects from our Excellence programme<br />

<strong>and</strong> our restructuring actions in the Group. By leveraging our strong market<br />

positions, we have been able to defend our margins, which in turn had a somewhat<br />

negative impact on our volume trend. Companies acquired during the year<br />

also made a positive contribution to the earning trend.<br />

Changes in exchange rates from the translation of foreign subsidiaries had<br />

a positive impact of sek 300 m on operating profit compared with 2014.<br />

What are your comments on the operating cash flow?<br />

Operating cash flow improved in three of our five business areas compared<br />

with the preceding year. Trelleborg Wheel Systems was impacted by increased<br />

investments in a new facility for manufacturing agricultural tires in the US, while<br />

Trelleborg Offshore & Construction was affected by the slowdown in oil & gas in<br />

the form of non-payment of advances from customers.<br />

The Group’s capital expenditure increased by 28 percent year-on-year.<br />

A dividend totaling sek 1,357 from TrelleborgVibracoustic was also recognized<br />

in operating cash flow, which rose by 28 percent to sek 3,639 m including this<br />

dividend.<br />

Financial guidance, 2016<br />

• Restructuring costs: ~ 250 sek m<br />

• Investments: ~ 1,100-1,200 sek m<br />

• Underlying taxation level 1) : ~ 27 percent<br />

1)<br />

Excluding items affecting comparability.<br />

B<br />

Operating profit 1)<br />

SEK M<br />

3,500<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

C<br />

Earnings per share<br />

SEK +17%<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

2014<br />

2014 2015<br />

Sensitivity analysis<br />

2015<br />

1)<br />

Operating profit, excluding participations in TrelleborgVibracoustic <strong>and</strong> items<br />

affecting comparability.<br />

+7%<br />

The calculations were based on<br />

figures from the end of the year<br />

<strong>and</strong> the assumption that all else<br />

is equal.<br />

Costs<br />

• The annual cost for purchasing<br />

mate rials <strong>and</strong> services amounted to<br />

sek 11,787 m in 2015. Employee<br />

remuneration amounted to sek 7,518 m.<br />

An increase or reduction in purchasing<br />

costs of 1 percent would reduce or<br />

increase operating profit by approximately<br />

sek 120 m. Correspondingly,<br />

an increase in cost for employees of<br />

1 percent would lead to a reduction in<br />

10 Annual Report 2015 Trelleborg AB<br />

GRI: G4-9