We seal damp and protect

1o0Rrof

1o0Rrof

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CONSOLIDATED BALANCE SHEETS<br />

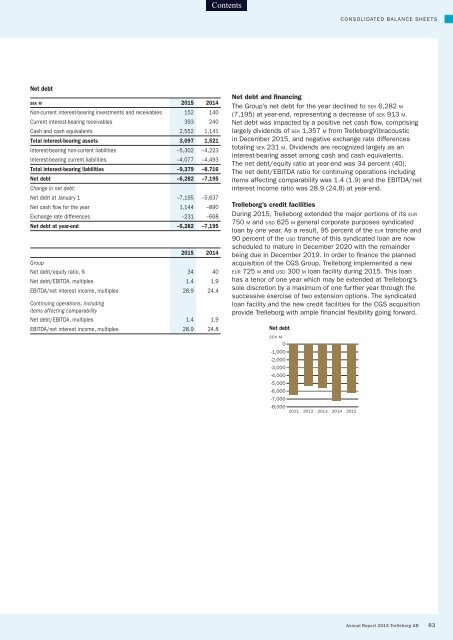

Net debt<br />

sek m 2015 2014<br />

Non-current interest-bearing investments <strong>and</strong> receivables 152 140<br />

Current interest-bearing receivables 393 240<br />

Cash <strong>and</strong> cash equivalents 2,552 1,141<br />

Total interest-bearing assets 3,097 1,521<br />

Interest-bearing non-current liabilities –5,302 –4,223<br />

Interest-bearing current liabilities –4,077 –4,493<br />

Total interest-bearing liabilities –9,379 –8,716<br />

Net debt –6,282 –7,195<br />

Change in net debt:<br />

Net debt at January 1 –7,195 –5,637<br />

Net cash flow for the year 1,144 –890<br />

Exchange rate differences –231 –668<br />

Net debt at year-end –6,282 –7,195<br />

2015 2014<br />

Group<br />

Net debt/equity ratio, % 34 40<br />

Net debt/EBITDA, multiples 1.4 1.9<br />

EBITDA/net interest income, multiples 28.9 24.4<br />

Continuing operations, including<br />

items affecting comparability<br />

Net debt/EBITDA, multiples 1.4 1.9<br />

EBITDA/net interest income, multiples 28.9 24.8<br />

Net debt <strong>and</strong> financing<br />

The Group’s net debt for the year declined to sek 6,282 m<br />

(7,195) at year-end, representing a decrease of sek 913 m.<br />

Net debt was impacted by a positive net cash flow, comprising<br />

largely dividends of sek 1,357 m from TrelleborgVibracoustic<br />

in December 2015, <strong>and</strong> negative exchange rate differences<br />

totaling sek 231 m. Dividends are recognized largely as an<br />

interest-bearing asset among cash <strong>and</strong> cash equivalents.<br />

The net debt/equity ratio at year-end was 34 percent (40).<br />

The net debt/EBITDA ratio for continuing operations including<br />

items affecting comparability was 1.4 (1.9) <strong>and</strong> the EBITDA/net<br />

interest income ratio was 28.9 (24.8) at year-end.<br />

Trelleborg’s credit facilities<br />

During 2015, Trelleborg extended the major portions of its eur<br />

750 m <strong>and</strong> usd 625 m general corporate purposes syndicated<br />

loan by one year. As a result, 95 percent of the eur tranche <strong>and</strong><br />

90 percent of the usd tranche of this syndicated loan are now<br />

scheduled to mature in December 2020 with the remainder<br />

being due in December 2019. In order to finance the planned<br />

acquisition of the CGS Group, Trelleborg implemented a new<br />

eur 725 m <strong>and</strong> usd 300 m loan facility during 2015. This loan<br />

has a tenor of one year which may be extended at Trelleborg’s<br />

sole discretion by a maximum of one further year through the<br />

successive exercise of two extension options. The syndicated<br />

loan facility <strong>and</strong> the new credit facilities for the CGS acqusition<br />

provide Trelleborg with ample financial flexibility going forward.<br />

Net debt<br />

SEK M<br />

0<br />

-1,000<br />

-2,000<br />

-3,000<br />

-4,000<br />

-5,000<br />

-6,000<br />

-7,000<br />

-8,000<br />

2011 2012 2013 2014 2015<br />

Annual Report 2015 Trelleborg AB 83