We seal damp and protect

1o0Rrof

1o0Rrof

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES – GROUP<br />

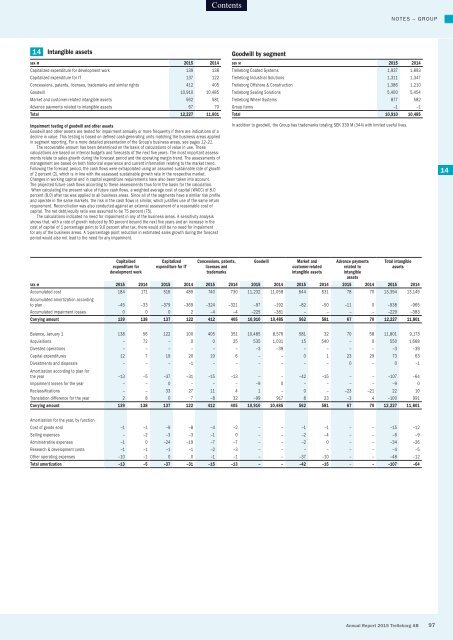

14 Intangible assets<br />

sek m 2015 2014<br />

Capitalized expenditure for development work 139 138<br />

Capitalized expenditure for IT 137 122<br />

Concessions, patents, licenses, trademarks <strong>and</strong> similar rights 412 405<br />

Goodwill 10,910 10,485<br />

Market <strong>and</strong> customer-related intangible assets 562 581<br />

Advance payments related to intangible assets 67 70<br />

Total 12,227 11,801<br />

Impairment testing of goodwill <strong>and</strong> other assets<br />

Goodwill <strong>and</strong> other assets are tested for impairment annually or more frequently if there are indications of a<br />

decline in value. This testing is based on defined cash-generating units matching the business areas applied<br />

in segment reporting. For a more detailed presentation of the Group’s business areas, see pages 12–21.<br />

The recoverable amount has been determined on the basis of calculations of value in use. These<br />

calculations are based on internal budgets <strong>and</strong> forecasts of the next five years. The most important assessments<br />

relate to sales growth during the forecast period <strong>and</strong> the operating margin trend. The assessments of<br />

management are based on both historical experience <strong>and</strong> current information relating to the market trend.<br />

Following the forecast period, the cash flows were extrapolated using an assumed sustainable rate of growth<br />

of 2 percent (2), which is in line with the assessed sustainable growth rate in the respective market.<br />

Changes in working capital <strong>and</strong> in capital expenditure requirements have also been taken into account.<br />

The projected future cash flows according to these assessments thus form the basis for the calculation.<br />

When calculating the present value of future cash flows, a weighted average cost of capital (WACC) of 8.0<br />

percent (8.0) after tax was applied to all business areas. Since all of the segments have a similar risk profile<br />

<strong>and</strong> operate in the same markets, the risk in the cash flows is similar, which justifies use of the same return<br />

requirement. Reconciliation was also conducted against an external assessment of a reasonable cost of<br />

capital. The net debt/equity ratio was assumed to be 75 percent (75).<br />

The calculations indicated no need for impairment in any of the business areas. A sensitivity analysis<br />

shows that, with a rate of growth reduced by 50 percent beyond the next five years <strong>and</strong> an increase in the<br />

cost of capital of 1 percentage point to 9.0 percent after tax, there would still be no need for impairment<br />

for any of the business areas. A 1-percentage point reduction in estimated sales growth during the forecast<br />

period would also not lead to the need for any impairment.<br />

Goodwill by segment<br />

sek m 2015 2014<br />

Trelleborg Coated Systems 1,937 1,893<br />

Trelleborg Industrial Solutions 1,311 1,347<br />

Trelleborg Offshore & Construction 1,386 1,210<br />

Trelleborg Sealing Solutions 5,400 5,454<br />

Trelleborg Wheel Systems 877 582<br />

Group items –1 –1<br />

Total 10,910 10,485<br />

In addition to goodwill, the Group has trademarks totaling SEK 339 M (344) with limited useful lives.<br />

14<br />

Capitalized<br />

expenditure for<br />

development work<br />

Capitalized<br />

expenditure for IT<br />

Concessions, patents,<br />

licenses <strong>and</strong><br />

trademarks<br />

Goodwill<br />

Market <strong>and</strong><br />

customer-related<br />

intangible assets<br />

Advance payments<br />

related to<br />

intangible<br />

assets<br />

Total intangible<br />

assets<br />

sek m 2015 2014 2015 2014 2015 2014 2015 2014 2015 2014 2015 2014 2015 2014<br />

Accumulated cost 184 171 516 489 740 730 11,232 11,058 644 631 78 70 13,394 13,149<br />

Accumulated amortization according<br />

to plan –45 –33 –379 –369 –324 –321 –97 –192 –82 –50 –11 0 –938 –965<br />

Accumulated impairment losses 0 0 0 2 –4 –4 –225 –381 – – – – –229 –383<br />

Carrying amount 139 138 137 122 412 405 10,910 10,485 562 581 67 70 12,227 11,801<br />

Balance, January 1 138 56 122 100 405 351 10,485 8,576 581 32 70 58 11,801 9,173<br />

Acquisitions – 72 – 0 0 25 535 1,031 15 540 – 0 550 1,668<br />

Divested operations – – – – – – –3 –39 – – – – –3 –39<br />

Capital expenditures 12 7 19 20 19 6 – – 0 1 23 29 73 63<br />

Divestments <strong>and</strong> disposals – – – –1 – – – – – – 0 – 0 –1<br />

Amortization according to plan for<br />

the year –13 –5 –37 –31 –15 –13 – – –42 –15 – – –107 –64<br />

Impairment losses for the year – – 0 – – – –9 0 – – – – –9 0<br />

Reclassifications – – 33 27 11 4 1 – 0 – –23 –21 22 10<br />

Translation difference for the year 2 8 0 7 –8 32 –99 917 8 23 –3 4 –100 991<br />

Carrying amount 139 138 137 122 412 405 10,910 10,485 562 581 67 70 12,227 11,801<br />

Amortization for the year, by function<br />

Cost of goods sold –1 –1 –9 –8 –4 –2 – – –1 –1 – – –15 –12<br />

Selling expenses – –2 –3 –3 –1 0 – – –2 –4 – – –6 –9<br />

Administrative expenses –1 0 –24 –19 –7 –7 – – –2 0 – – –34 –26<br />

Research & development costs –1 –1 –1 –1 –2 –3 – – – – – – –4 –5<br />

Other operating expenses –10 –1 0 0 –1 –1 – – –37 –10 – – –48 –12<br />

Total amortization –13 –5 –37 –31 –15 –13 – – –42 –15 – – –107 –64<br />

Annual Report 2015 Trelleborg AB 97