Our journey towards sustainability

6049BmzMV

6049BmzMV

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

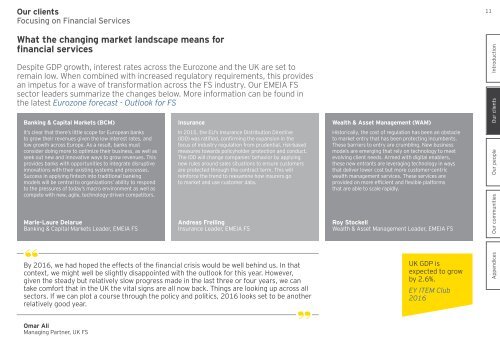

<strong>Our</strong> clients<br />

Focusing on Financial Services<br />

What the changing market landscape means for<br />

financial services<br />

Despite GDP growth, interest rates across the Eurozone and the UK are set to<br />

remain low. When combined with increased regulatory requirements, this provides<br />

an impetus for a wave of transformation across the FS industry. <strong>Our</strong> EMEIA FS<br />

sector leaders summarize the changes below. More information can be found in<br />

the latest Eurozone forecast - Outlook for FS<br />

Banking & Capital Markets (BCM)<br />

It’s clear that there’s little scope for European banks<br />

to grow their revenues given the low interest rates, and<br />

low growth across Europe. As a result, banks must<br />

consider doing more to optimize their business, as well as<br />

seek out new and innovative ways to grow revenues. This<br />

provides banks with opportunities to integrate disruptive<br />

innovations with their existing systems and processes.<br />

Success in applying fintech into traditional banking<br />

models will be central to organizations’ ability to respond<br />

to the pressures of today’s macro environment as well as<br />

compete with new, agile, technology-driven competitors.<br />

Marie-Laure Delarue<br />

Banking & Capital Markets Leader, EMEIA FS<br />

Insurance<br />

In 2015, the EU’s Insurance Distribution Directive<br />

(IDD) was ratified, confirming the expansion in the<br />

focus of industry regulation from prudential, risk-based<br />

measures <strong>towards</strong> policyholder protection and conduct.<br />

The IDD will change companies’ behavior by applying<br />

new rules around sales situations to ensure customers<br />

are protected through the contract term. This will<br />

reinforce the trend to reexamine how insurers go<br />

to market and use customer data.<br />

Andreas Freiling<br />

Insurance Leader, EMEIA FS<br />

By 2016, we had hoped the effects of the financial crisis would be well behind us. In that<br />

context, we might well be slightly disappointed with the outlook for this year. However,<br />

given the steady but relatively slow progress made in the last three or four years, we can<br />

take comfort that in the UK the vital signs are all now back. Things are looking up across all<br />

sectors. If we can plot a course through the policy and politics, 2016 looks set to be another<br />

relatively good year.<br />

Wealth & Asset Management (WAM)<br />

Historically, the cost of regulation has been an obstacle<br />

to market entry that has been protecting incumbents.<br />

These barriers to entry are crumbling. New business<br />

models are emerging that rely on technology to meet<br />

evolving client needs. Armed with digital enablers,<br />

these new entrants are leveraging technology in ways<br />

that deliver lower cost but more customer-centric<br />

wealth management services. These services are<br />

provided on more efficient and flexible platforms<br />

that are able to scale rapidly.<br />

Roy Stockell<br />

Wealth & Asset Management Leader, EMEIA FS<br />

UK GDP is<br />

expected to grow<br />

by 2.6%.<br />

EY ITEM Club<br />

2016<br />

11<br />

Appendices <strong>Our</strong> communities <strong>Our</strong> people <strong>Our</strong> clients Introduction<br />

Omar Ali<br />

Managing Partner, UK FS