4108 Deeboyar Ave Positioning Analysis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

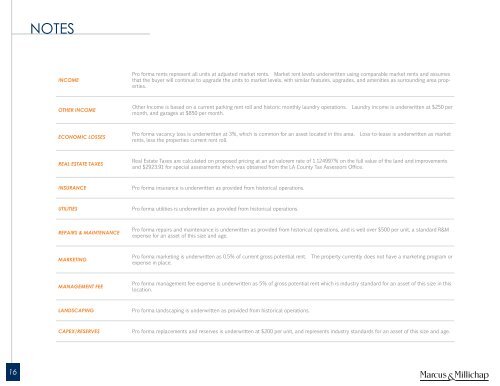

NOTES<br />

INCOME<br />

Pro forma rents represent all units at adjusted market rents. Market rent levels underwritten using comparable market rents and assumes<br />

that the buyer will continue to upgrade the units to market levels, with similar features, upgrades, and amenities as surrounding area properties.<br />

OTHER INCOME<br />

Other Income is based on a current parking rent roll and historic monthly laundry operations. Laundry income is underwritten at $250 per<br />

month, and garages at $850 per month.<br />

ECONOMIC LOSSES<br />

Pro forma vacancy loss is underwritten at 3%, which is common for an asset located in this area. Loss-to-lease is underwritten as market<br />

rents, less the properties current rent roll.<br />

REAL ESTATE TAXES<br />

Real Estate Taxes are calculated on proposed pricing at an ad valorem rate of 1.124997% on the full value of the land and improvements<br />

and $2923.91 for special assessments which was obtained from the LA County Tax Assessors Office.<br />

INSURANCE<br />

Pro forma insurance is underwritten as provided from historical operations.<br />

UTILITIES<br />

Pro forma utilities is underwritten as provided from historical operations.<br />

REPAIRS & MAINTENANCE<br />

Pro forma repairs and maintenance is underwritten as provided from historical operations, and is well over $500 per unit, a standard R&M<br />

expense for an asset of this size and age.<br />

MARKETING<br />

Pro forma marketing is underwritten as 0.5% of current gross potential rent. The property currently does not have a marketing program or<br />

expense in place.<br />

MANAGEMENT FEE<br />

Pro forma management fee expense is underwritten as 5% of gross potential rent which is industry standard for an asset of this size in this<br />

location.<br />

LANDSCAPING<br />

Pro forma landscaping is underwritten as provided from historical operations.<br />

CAPEX/RESERVES<br />

Pro forma replacements and reserves is underwritten at $200 per unit, and represents industry standards for an asset of this size and age.<br />

16