Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

JULY <strong>2016</strong><br />

FOREIGN DIRECT INVESTMENT<br />

pharmaceuticals and civil aviation, among others, thereby<br />

adding to growth and employment”.<br />

FICCI Secretary General A Didar Singh said: “The Modi<br />

administration through these moves has once again<br />

highlighted that reform is a continuous process in order<br />

to capitalise on the potential India offers.” Singh felt that<br />

“there is no doubt that India today is the most preferred<br />

investment destination in the world. While the attraction<br />

of our market is known to all, there is now even more<br />

reason for global investors to commit themselves for<br />

making and doing business in India”.<br />

Assocham Secretary General D S Rawat said the decision<br />

will help in bringing investment and advanced technology<br />

into the defence sector, potentially leading to inflow of<br />

capital and setting up of entities of original equipment<br />

manufacturers (OEMs) and their suppliers through<br />

technology transfer.<br />

Girish Vanvari, head of the tax practice at KPMG in India,<br />

said the government’s move to ease the FDI regime was<br />

well-timed. “It actually opens up the country to the global<br />

world. The liberalization of limits in defence, brownfield<br />

pharma, airports, private security services, food processing<br />

etc can be game changers and be a huge source of<br />

employment creation. The move to prescribe a small<br />

negative list for FDI with most sectors under the automatic<br />

route is a big mindset shift”.<br />

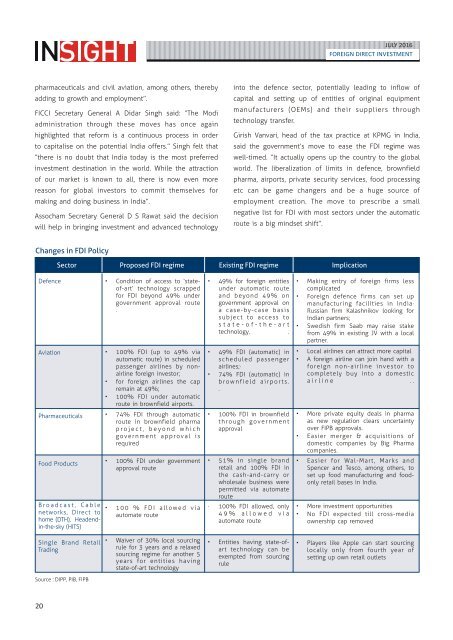

Changes in FDI Policy<br />

Sector Proposed FDI regime Existing FDI regime Implication<br />

Defence<br />

Aviation<br />

Pharmaceuticals<br />

Food Products<br />

B r o a d c a s t , C a b l e<br />

networks, Direct to<br />

home (DTH), Headendin-the-sky<br />

(HITS)<br />

• Condition of access to ‘stateof-art’<br />

technology scrapped<br />

for FDI beyond 49% under<br />

government approval route<br />

.<br />

• 100% FDI (up to 49% via<br />

automatic route) in scheduled<br />

passenger airlines by nonairline<br />

foreign investor;<br />

• for foreign airlines the cap<br />

remain at 49%;<br />

• 100% FDI under automatic<br />

route in brownfield airports.<br />

• 74% FDI through automatic<br />

route in brownfield pharma<br />

p r o j e c t , b e y o n d w h i c h<br />

g ove r n m e n t a p p rov a l i s<br />

required<br />

• 100% FDI under government<br />

approval route<br />

• 1 0 0 % F D I a l l owe d v i a<br />

automate route<br />

• 49% for foreign entities<br />

under automatic route<br />

and beyond 49% on<br />

government approval on<br />

a case-by-case basis<br />

subject to access to<br />

s t a t e - o f - t h e - a r t<br />

technology. .<br />

• 49% FDI (automatic) in<br />

scheduled passenger<br />

airlines;·<br />

• 74% FDI (automatic) in<br />

b row n f i e l d a i r p o r t s .<br />

.<br />

• 100% FDI in brownfield<br />

t h ro u g h gove r n m e n t<br />

approval<br />

• 51% in single brand<br />

retail and 100% FDI in<br />

the cash-and-carry or<br />

wholesale business were<br />

permitted via automate<br />

route<br />

· 100% FDI allowed, only<br />

4 9 % a l l o w e d v i a<br />

automate route<br />

• Making entry of foreign firms less<br />

complicated<br />

• Foreign defence firms can set up<br />

manufacturing facilities in India·<br />

Russian firm Kalashnikov looking for<br />

Indian partners;<br />

• Swedish firm Saab may raise stake<br />

from 49% in existing JV with a local<br />

partner.<br />

• Local airlines can attract more capital<br />

• A foreign airline can join hand with a<br />

foreign non-airline investor to<br />

completely buy into a domestic<br />

a i r l i n e . .<br />

• More private equity deals in pharma<br />

as new regulation clears uncertainty<br />

over FIPB approvals.<br />

• Easier merger & acquisitions of<br />

domestic companies by Big Pharma<br />

companies.<br />

• Easier for Wal-Mart, Marks and<br />

Spencer and Tesco, among others, to<br />

set up food manufacturing and foodonly<br />

retail bases in India.<br />

• More investment opportunities<br />

• No FDI expected till cross-media<br />

ownership cap removed<br />

Single Brand Retail<br />

Trading<br />

• Waiver of 30% local sourcing<br />

rule for 3 years and a relaxed<br />

sourcing regime for another 5<br />

years for entities having<br />

state-of-art technology<br />

• Entities having state-ofart<br />

technology can be<br />

exempted from sourcing<br />

rule<br />

• Players like Apple can start sourcing<br />

locally only from fourth year of<br />

setting up own retail outlets<br />

Source : DIPP, PIB, FIPB<br />

20