You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

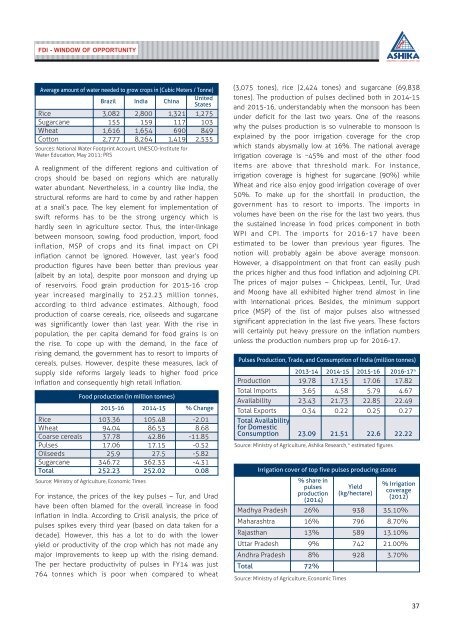

FDI - WINDOW OF OPPORTUNITY<br />

Average amount of water needed to grow crops in (Cubic Meters / Tonne)<br />

Brazil India China<br />

United<br />

States<br />

Rice 3,082 2,800 1,321 1,275<br />

Sugarcane 155 159 117 103<br />

Wheat 1,616 1,654 690 849<br />

Cotton 2,777 8,264 1,419 2,535<br />

Sources: National Water Footprint Account, UNESCO-Institute for<br />

Water Education, May 2011; PRS<br />

A realignment of the different regions and cultivation of<br />

crops should be based on regions which are naturally<br />

water abundant. Nevertheless, in a country like India, the<br />

structural reforms are hard to come by and rather happen<br />

at a snail’s pace. The key element for implementation of<br />

swift reforms has to be the strong urgency which is<br />

hardly seen in agriculture sector. Thus, the inter-linkage<br />

between monsoon, sowing, food production, import, food<br />

inflation, MSP of crops and its final impact on CPI<br />

inflation cannot be ignored. However, last year’s food<br />

production figures have been better than previous year<br />

(albeit by an iota), despite poor monsoon and drying up<br />

of reservoirs. Food grain production for 2015-16 crop<br />

year increased marginally to 252.23 million tonnes,<br />

according to third advance estimates. Although, food<br />

production of coarse cereals, rice, oilseeds and sugarcane<br />

was significantly lower than last year. With the rise in<br />

population, the per capita demand for food grains is on<br />

the rise. To cope up with the demand, in the face of<br />

rising demand, the government has to resort to imports of<br />

cereals, pulses. However, despite these measures, lack of<br />

supply side reforms largely leads to higher food price<br />

inflation and consequently high retail inflation.<br />

Food production (in million tonnes)<br />

2015-16<br />

2014-15 % Change<br />

Rice 103.36 105.48 -2.01<br />

Wheat 94.04 86.53 8.68<br />

Coarse cereals 37.78 42.86 -11.85<br />

Pulses 17.06 17.15 -0.52<br />

Oilseeds 25.9 27.5 -5.82<br />

Sugarcane 346.72 362.33 -4.31<br />

Total 252.23 252.02 0.08<br />

Source: Ministry of Agriculture, Economic Times<br />

For instance, the prices of the key pulses – Tur, and Urad<br />

have been often blamed for the overall increase in food<br />

inflation in India. According to Crisil analysis, the price of<br />

pulses spikes every third year (based on data taken for a<br />

decade). However, this has a lot to do with the lower<br />

yield or productivity of the crop which has not made any<br />

major improvements to keep up with the rising demand.<br />

The per hectare productivity of pulses in FY14 was just<br />

764 tonnes which is poor when compared to wheat<br />

(3,075 tones), rice (2,424 tones) and sugarcane (69,838<br />

tones). The production of pulses declined both in 2014-15<br />

and 2015-16, understandably when the monsoon has been<br />

under deficit for the last two years. One of the reasons<br />

why the pulses production is so vulnerable to monsoon is<br />

explained by the poor irrigation coverage for the crop<br />

which stands abysmally low at 16%. The national average<br />

irrigation coverage is ~45% and most of the other food<br />

items are above that threshold mark. For instance,<br />

irrigation coverage is highest for sugarcane (90%) while<br />

Wheat and rice also enjoy good irrigation coverage of over<br />

50%. To make up for the shortfall in production, the<br />

government has to resort to imports. The imports in<br />

volumes have been on the rise for the last two years, thus<br />

the sustained increase in food prices component in both<br />

WPI and CPI. The imports for <strong>2016</strong>-17 have been<br />

estimated to be lower than previous year figures. The<br />

notion will probably again be above average monsoon.<br />

However, a disappointment on that front can easily push<br />

the prices higher and thus food inflation and adjoining CPI.<br />

The prices of major pulses – Chickpeas, Lentil, Tur, Urad<br />

and Moong have all exhibited higher trend almost in line<br />

with international prices. Besides, the minimum support<br />

price (MSP) of the list of major pulses also witnessed<br />

significant appreciation in the last five years. These factors<br />

will certainly put heavy pressure on the inflation numbers<br />

unless the production numbers prop up for <strong>2016</strong>-17.<br />

Pulses Production, Trade, and Consumption of India (million tonnes)<br />

2013-14 2014-15 2015-16 <strong>2016</strong>-17*<br />

Production 19.78 17.15 17.06 17.82<br />

Total Imports 3.65 4.58 5.79 4.67<br />

Availability 23.43 21.73 22.85 22.49<br />

Total Exports 0.34 0.22 0.25 0.27<br />

Total Availability<br />

for Domestic<br />

Consumption 23.09 21.51 22.6 22.22<br />

Source: Ministry of Agriculture, <strong>Ashika</strong> Research,* estimated figures<br />

Irrigation cover of top five pulses producing states<br />

% share in<br />

pulses<br />

production<br />

(2014)<br />

Madhya Pradesh 26% 938 35.10%<br />

Maharashtra 16% 796 8.70%<br />

Rajasthan 13% 589 13.10%<br />

Uttar Pradesh 9% 742 21.00%<br />

Andhra Pradesh 8% 928 3.70%<br />

Total 72%<br />

Source: Ministry of Agriculture, Economic Times<br />

Yield<br />

(kg/hectare)<br />

% Irrigation<br />

coverage<br />

(2012)<br />

37