You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

JULY <strong>2016</strong><br />

SECTOR OUTLOOK<br />

Colombo, Dubai and Singapore transship the containers,<br />

roads are congested and railways have capacity<br />

constraint. When compared with the international trade<br />

logistics networks, the Indian logistics network lags on all<br />

aspects, be it infrastructure, customs or quality of services<br />

thus, the outcome is high cost, uncertainty in time and<br />

low reliability. India ranks at 54 in the World Bank’s,<br />

Logistics Performance Index, 2014, out of 160 countries,<br />

behind South Africa, Chile, Panama, Vietnam and<br />

Indonesia. China ranks at number nine immediately<br />

behind Switzerland while Germany leads the index.<br />

Government has planned to establish India as a global<br />

manufacturing hub through the program of “Make in<br />

India” and that requires quality logistic infrastructure.<br />

“Make in India” would require more connectivity to<br />

international trade logistic network, so that exporters can<br />

move, store and deliver goods faster and cheaper which<br />

is the only way to retain their competitive advantage<br />

globally. The cost of trading whether by sea, land and air,<br />

play a critical role in determining the price of the end<br />

product, hence poor logistic infrastructure would always<br />

heighten the peril of higher inflation. According to<br />

Mckinsey study, inefficiencies in logistic infrastructure add<br />

an extra cost to the Indian economy by USD 45 billion,<br />

about 4.3% of the GDP every year. Moreover the report<br />

has highlighted the issue that by 2020 freight traffic<br />

demand in India would grow by 2.5 times thus putting<br />

further stress on India’s infrastructure. Thus the scope of<br />

growth in logistic space is very wide and there are<br />

number of logistics companies who have been operating<br />

across several segments in order to provide integrated<br />

solution to the customers. In order to increase the<br />

competitiveness, certain logistic companies have<br />

developed expertise in selected segments of supply chain<br />

such as transportation, dry ports, warehousing, express<br />

distribution and non-vessel operating common carrier<br />

(NVOCC). Many corporate are now outsourcing the logistic<br />

activities to third party in order to improve cost efficiency<br />

& delivery performance and to concentrate on their core<br />

business. Hence with right policies in place, there are<br />

immense opportunities for logistic companies to grow<br />

their business by multifold in coming years.<br />

Sector to benefit from domestic economy revival<br />

Improving Q4FY16 results of corporate and gradual<br />

revival in industrial activities reflected in IIP data, hints<br />

early sign of economic recovery. Logistic sector has strong<br />

correlation with the economic growth, thus any sign of<br />

green shoots in economy would drive the growth for the<br />

sector. One leg of the freight movement belongs to the<br />

primary economy which involves bulk movement of raw<br />

materials (locally sourced and imported) domestically to<br />

production centers. The other leg of country’s freight<br />

movement comes from the secondary economy servicing<br />

the manufactured products. The contribution of the<br />

secondary freight to GDP is greater as the freight is<br />

handled and shipped multiple times and also moves<br />

through networks of terminals and distribution centers. The<br />

recovery in domestic manufacturing sector and<br />

improvement in consumption trend would drive higher<br />

movement in goods which would lead the growth in<br />

logistic companies. Further, Government’s “Make in India”<br />

initiative, which aims to make India a global hub for<br />

manufacturing, innovation and design, can yield success<br />

only if logistics infrastructure in India is developed. There<br />

are tractions in the Indian economy as the global<br />

commodity prices are benign amid economic slowdown in<br />

China and other major consuming nations. Being the net<br />

importer of commodity, India is one of the beneficiaries of<br />

lower commodity prices and is also insulated from global<br />

economic turmoil to some extent. Further, expectation of<br />

above normal monsoon in the current year after two<br />

consecutive drought years would boost rural consumption<br />

which is one of the major driving factors of country’s GDP<br />

growth. Good monsoon is also expected to cool down the<br />

inflation which has just started to head up, thus would<br />

provide room for central bank to reduce the interest rate<br />

in order to propel the growth.<br />

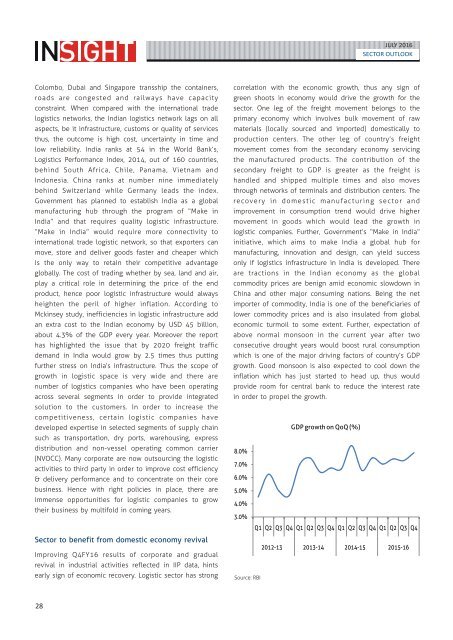

GDP growth on QoQ (%)<br />

8.0%<br />

7.0%<br />

6.0%<br />

5.0%<br />

4.0%<br />

3.0%<br />

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4<br />

2012-13 2013-14 2014-15 2015-16<br />

Source: RBI<br />

28