You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1<br />

23<br />

I n d i r ec t t a x es r em a i n a n i m p or t a n t a n d r el i a b l e<br />

sou r c e of r ev en u e f or g ov er n m en t s<br />

When the first VAT systems were implemented <strong>in</strong> the 1950s, i n d i r ec t t a x es i s sl ow i n g . I n t h e O E C D m em b er c ou n t r i es, V A T /<br />

n o on e w ou l d h a v e t h ou g h t t h a t i n d i r ec t t a x es w ou l d on G S e T d ra a y t es a r e ex p ec t ed t o r em a i n st a b l e i n 20 1 6, w h i l e i n t h e<br />

b ec om e on e of t h e m ost i m p or t a n t sou r c es of r ev en u e f or E um r a op n y ea n U n i on ( E U ) , t h e a v er a g e h a s ev en sl i g h t l y d ec r ea sed<br />

c ou n t r i es a r ou n d t h e w or l d .<br />

b ec a u se R om a n i a r ed u c ed i t s r a t e f r om 24 % t o 20 % . I sr a el h a s<br />

a l so l ow er ed i t s st a n d a r d V A T r a t e f r om 1 8 % t o 1 7 % . T h ese<br />

F or a l on g t i m e, d i r ec t t a x es, p a r t i c u l a r l y c or p or a t e i n c om e<br />

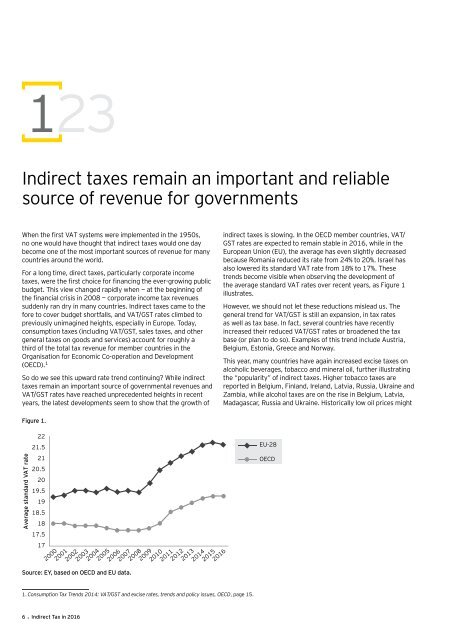

t r en d s b ec om e v i si b l e w h en ob ser v i n g t h e d ev el op m en t of<br />

taxes, were the first choice for f<strong>in</strong>anc<strong>in</strong>g the ever-grow<strong>in</strong>g public<br />

t h e a v er a g e st a n d a r d V A T r a t es ov er r ec en t y ea r s, a s F i g u r e 1<br />

b u d g et . T h i s v i ew c h a n g ed r a p i d l y w h en — a t t h e b eg i n n i n g of<br />

i l l u st r a t es.<br />

the f<strong>in</strong>ancial crisis <strong>in</strong> 2008 — corporate <strong>in</strong>come tax revenues<br />

su d d en l y r a n d r y i n m a n y c ou n t r i es. I n d i r ec t t a x es c a m e H ow t o ev t h er e , w e sh ou l d n ot l et t h ese r ed u c t i on s m i sl ea d u s. T h e<br />

f or e t o c ov er b u d g et sh or t f a l l s, a n d V A T / G S T r a t es c l i m b ed g en ter o a l t r en d f or V A T / G S T i s st i l l a n ex p a n si on , i n t a x r a t es<br />

p r ev i ou sl y u n i m a g i n ed h ei g h t s, esp ec i a l l y i n E u r op e. T od a a y s , w el l a s t a x b a se. I n f a c t , sev er a l c ou n t r i es h a v e r ec en t l y<br />

c on su m p t i on t a x es ( i n c l u d i n g V A T / G S T , sa l es t a x es, a n d i notc rh ea er sed t h ei r r ed u c ed V A T / G S T r a t es or b r oa d en ed t h e t a x<br />

g en er a l t a x es on g ood s a n d ser v i c es) a c c ou n t f or r ou g h l y b aa<br />

se ( or p l a n t o d o so) . E x a m p l es of t h i s t r en d i n c l u d e A u st r i a ,<br />

t h i r d of t h e t ot a l t a x r ev en u e f or m em b er c ou n t r i es i n tB h el e g i u m , E st on i a , G r eec e a n d Nor w a y .<br />

O r g a n i sa t i on f or E c on om i c C o- op er a t i on a n d D ev el op m en t<br />

( O E C D )<br />

1<br />

T h i s y ea r , m a n y c ou n t r i es h a v e a g a i n i n c r ea sed ex c i se t a x es on<br />

.<br />

a l c oh ol i c b ev er a g es, t ob a c c o a n d m i n er a l oi l , f u r t h er i l l u st r a t i n g<br />

S o d o w e see t h i s u p w a r d r a t e t r en d c on t i n u i n g ? W h i l e i nt dh ie r ec “ t p op u l a r i t y ” of i n d i r ec t t a x es. H i g h er t ob a c c o t a x es a r e<br />

t a x es r em a i n a n i m p or t a n t sou r c e of g ov er n m en t a l r ev en ur ep es ora tn ed d i n B el g i u m , F i n l a n d , I r el a n d , L a t v i a , R u ssi a , U k r a i n e a n d<br />

V A T / G S T r a t es h a v e r ea c h ed u n p r ec ed en t ed h ei g h t s i n r ec Zena t m b i a , w h i l e a l c oh ol t a x es a r e on t h e r i se i n B el g i u m , L a t v i a ,<br />

y ea r s, t h e l a t est d ev el op m en t s seem t o sh ow t h a t t h e g M r ow a d a tg h a sc of a r , R u ssi a a n d U k r a i n e. H i st or i c a l l y l ow oi l p r i c es m i g h t<br />

F i g u re 1.<br />

A v erag e stan d ard V A T rat e<br />

22<br />

21 . 5<br />

21<br />

20 . 5<br />

20<br />

1 9 . 5<br />

1 9<br />

1 8 . 5<br />

1 8<br />

1 7 . 5<br />

1 7<br />

S ou rce: E Y , based on O E C D an d E U d at a.<br />

1 . Consumption <strong>Tax</strong> Trends 2014: VAT/GST and excise rates, trends and policy issues, OECD, p a g e 1 5 .<br />

6 I n d i rect T ax i n <strong>2016</strong><br />

20 0 0<br />

20 0 1<br />

20 0 2<br />

20 0 3<br />

20 0 4<br />

20 0 5<br />

20 0 6<br />

20 0 7<br />

20 0 8<br />

20 0 9<br />

20 1 0<br />

20 1 1<br />

20 1 2<br />

20 1 3<br />

20 1 4<br />

20 1 5<br />

20 1 6<br />

E U - 28<br />

O E C D