PHDT Annual Report 2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

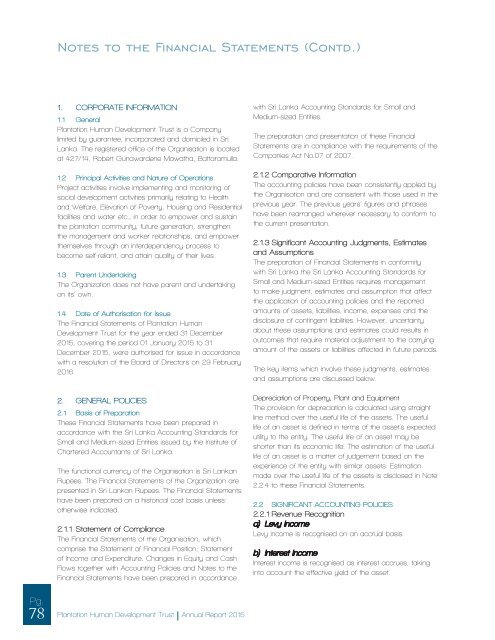

Notes to the Financial Statements (Contd.)<br />

1. CORPORATE INFORMATION<br />

1.1 General<br />

Plantation Human Development Trust is a Company<br />

limited by guarantee, incorporated and domiciled in Sri<br />

Lanka. The registered office of the Organisation is located<br />

at 427/14, Robert Gunawardene Mawatha, Battaramulla.<br />

1.2 Principal Activities and Nature of Operations<br />

Project activities involve implementing and monitoring of<br />

social development activities primarily relating to Health<br />

and Welfare, Elevation of Poverty, Housing and Residential<br />

facilities and water etc., in order to empower and sustain<br />

the plantation community, future generation, strengthen<br />

the management and worker relationships, and empower<br />

themselves through an interdependency process to<br />

become self-reliant, and attain quality of their lives.<br />

1.3 Parent Undertaking<br />

The Organization does not have parent and undertaking<br />

on its’ own.<br />

1.4 Date of Authorisation for Issue<br />

The Financial Statements of Plantation Human<br />

Development Trust for the year ended 31 December<br />

<strong>2015</strong>, covering the period 01 January <strong>2015</strong> to 31<br />

December <strong>2015</strong>, were authorised for issue in accordance<br />

with a resolution of the Board of Directors on 29 February<br />

2016.<br />

2. GENERAL POLICIES<br />

2.1 Basis of Preparation<br />

These Financial Statements have been prepared in<br />

accordance with the Sri Lanka Accounting Standards for<br />

Small and Medium-sized Entities issued by the Institute of<br />

Chartered Accountants of Sri Lanka.<br />

The functional currency of the Organisation is Sri Lankan<br />

Rupees. The Financial Statements of the Organization are<br />

presented in Sri Lankan Rupees. The Financial Statements<br />

have been prepared on a historical cost basis unless<br />

otherwise indicated.<br />

2.1.1 Statement of Compliance<br />

The Financial Statements of the Organisation, which<br />

comprise the Statement of Financial Position, Statement<br />

of Income and Expenditure, Changes in Equity and Cash<br />

Flows together with Accounting Policies and Notes to the<br />

Financial Statements have been prepared in accordance<br />

with Sri Lanka Accounting Standards for Small and<br />

Medium-sized Entities.<br />

The preparation and presentation of these Financial<br />

Statements are in compliance with the requirements of the<br />

Companies Act No.07 of 2007.<br />

2.1.2 Comparative Information<br />

The accounting policies have been consistently applied by<br />

the Organisation and are consistent with those used in the<br />

previous year. The previous years’ figures and phrases<br />

have been rearranged wherever necessary to conform to<br />

the current presentation.<br />

2.1.3 Significant Accounting Judgments, Estimates<br />

and Assumptions<br />

The preparation of Financial Statements in conformity<br />

with Sri Lanka the Sri Lanka Accounting Standards for<br />

Small and Medium-sized Entities requires management<br />

to make judgment, estimates and assumption that affect<br />

the application of accounting policies and the reported<br />

amounts of assets, liabilities, income, expenses and the<br />

disclosure of contingent liabilities. However, uncertainty<br />

about these assumptions and estimates could results in<br />

outcomes that require material adjustment to the carrying<br />

amount of the assets or liabilities affected in future periods.<br />

The key items which involve these judgments, estimates<br />

and assumptions are discussed below.<br />

Depreciation of Property, Plant and Equipment<br />

The provision for depreciation is calculated using straight<br />

line method over the useful life of the assets. The useful<br />

life of an asset is defined in terms of the asset’s expected<br />

utility to the entity. The useful life of an asset may be<br />

shorter than its economic life. The estimation of the useful<br />

life of an asset is a matter of judgement based on the<br />

experience of the entity with similar assets. Estimation<br />

made over the useful life of the assets is disclosed in Note<br />

2.2.4 to these Financial Statements.<br />

2.2 SIGNIFICANT ACCOUNTING POLICIES<br />

2.2.1 Revenue Recognition<br />

a) Levy Income<br />

Levy income is recognised on an accrual basis.<br />

b) Interest Income<br />

Interest income is recognised as interest accrues, taking<br />

into account the effective yield of the asset.<br />

Pg.<br />

78 Plantation Human Development Trust <strong>Annual</strong> <strong>Report</strong> <strong>2015</strong>