You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

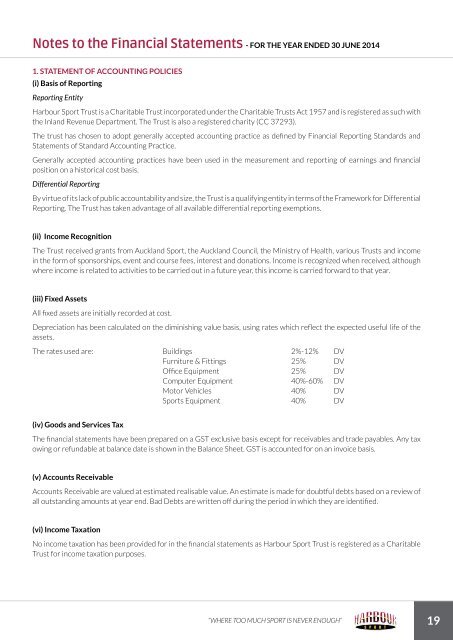

Notes to the Financial Statements - FOR THE YEAR ENDED 30 JUNE 2014<br />

1. STATEMENT OF ACCOUNTING POLICIES<br />

(i) Basis of <strong>Report</strong>ing<br />

<strong>Report</strong>ing Entity<br />

Harbour Sport Trust is a Charitable Trust incorporated under the Charitable Trusts Act 1957 and is registered as such with<br />

the Inland Revenue Department. The Trust is also a registered charity (CC 37293).<br />

The trust has chosen to adopt generally accepted accounting practice as defined by Financial <strong>Report</strong>ing Standards and<br />

Statements of Standard Accounting Practice.<br />

Generally accepted accounting practices have been used in the measurement and reporting of earnings and financial<br />

position on a historical cost basis.<br />

Differential <strong>Report</strong>ing<br />

By virtue of its lack of public accountability and size, the Trust is a qualifying entity in terms of the Framework for Differential<br />

<strong>Report</strong>ing. The Trust has taken advantage of all available differential reporting exemptions.<br />

(ii) Income Recognition<br />

The Trust received grants from Auckland Sport, the Auckland Council, the Ministry of Health, various Trusts and income<br />

in the form of sponsorships, event and course fees, interest and donations. Income is recognized when received, although<br />

where income is related to activities to be carried out in a future year, this income is carried forward to that year.<br />

(iii) Fixed Assets<br />

All fixed assets are initially recorded at cost.<br />

Depreciation has been calculated on the diminishing value basis, using rates which reflect the expected useful life of the<br />

assets.<br />

The rates used are: Buildings 2%-12% DV<br />

Furniture & Fittings 25% DV<br />

Office Equipment 25% DV<br />

Computer Equipment 40%-60% DV<br />

Motor Vehicles 40% DV<br />

Sports Equipment 40% DV<br />

(iv) Goods and Services Tax<br />

The financial statements have been prepared on a GST exclusive basis except for receivables and trade payables. Any tax<br />

owing or refundable at balance date is shown in the Balance Sheet. GST is accounted for on an invoice basis.<br />

(v) Accounts Receivable<br />

Accounts Receivable are valued at estimated realisable value. An estimate is made for doubtful debts based on a review of<br />

all outstanding amounts at year end. Bad Debts are written off during the period in which they are identified.<br />

(vi) Income Taxation<br />

No income taxation has been provided for in the financial statements as Harbour Sport Trust is registered as a Charitable<br />

Trust for income taxation purposes.<br />

“WHERE TOO MUCH SPORT IS NEVER ENOUGH” 19