Annual Report 2014/2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

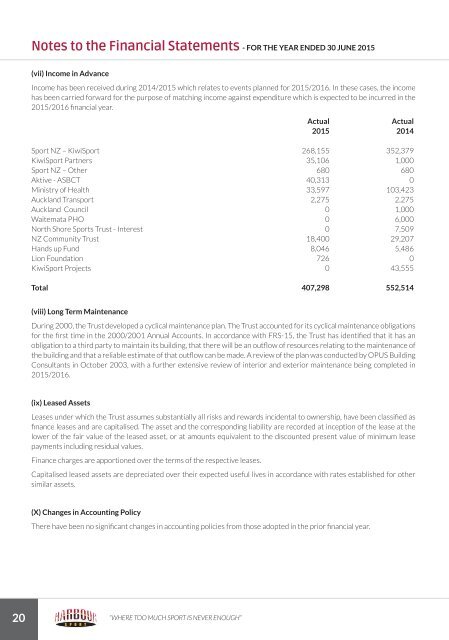

Notes to the Financial Statements - FOR THE YEAR ENDED 30 JUNE <strong>2015</strong><br />

(vii) Income in Advance<br />

Income has been received during <strong>2014</strong>/<strong>2015</strong> which relates to events planned for <strong>2015</strong>/2016. In these cases, the income<br />

has been carried forward for the purpose of matching income against expenditure which is expected to be incurred in the<br />

<strong>2015</strong>/2016 financial year.<br />

Actual<br />

Actual<br />

<strong>2015</strong> <strong>2014</strong><br />

Sport NZ – KiwiSport 268,155 352,379<br />

KiwiSport Partners 35,106 1,000<br />

Sport NZ – Other 680 680<br />

Aktive - ASBCT 40,313 0<br />

Ministry of Health 33,597 103,423<br />

Auckland Transport 2,275 2,275<br />

Auckland Council 0 1,000<br />

Waitemata PHO 0 6,000<br />

North Shore Sports Trust - Interest 0 7,509<br />

NZ Community Trust 18,400 29,207<br />

Hands up Fund 8,046 5,486<br />

Lion Foundation 726 0<br />

KiwiSport Projects 0 43,555<br />

Total 407,298 552,514<br />

(viii) Long Term Maintenance<br />

During 2000, the Trust developed a cyclical maintenance plan. The Trust accounted for its cyclical maintenance obligations<br />

for the first time in the 2000/2001 <strong>Annual</strong> Accounts. In accordance with FRS-15, the Trust has identified that it has an<br />

obligation to a third party to maintain its building, that there will be an outflow of resources relating to the maintenance of<br />

the building and that a reliable estimate of that outflow can be made. A review of the plan was conducted by OPUS Building<br />

Consultants in October 2003, with a further extensive review of interior and exterior maintenance being completed in<br />

<strong>2015</strong>/2016.<br />

(ix) Leased Assets<br />

Leases under which the Trust assumes substantially all risks and rewards incidental to ownership, have been classified as<br />

finance leases and are capitalised. The asset and the corresponding liability are recorded at inception of the lease at the<br />

lower of the fair value of the leased asset, or at amounts equivalent to the discounted present value of minimum lease<br />

payments including residual values.<br />

Finance charges are apportioned over the terms of the respective leases.<br />

Capitalised leased assets are depreciated over their expected useful lives in accordance with rates established for other<br />

similar assets.<br />

(X) Changes in Accounting Policy<br />

There have been no significant changes in accounting policies from those adopted in the prior financial year.<br />

20<br />

“WHERE TOO MUCH SPORT IS NEVER ENOUGH”