IMPACT OF TAXES AND TRANSFERS

n?u=RePEc:tul:ceqwps:25&r=lam

n?u=RePEc:tul:ceqwps:25&r=lam

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Enami, Lustig, Aranda, No. 25, November 2016<br />

(5) П T<br />

K<br />

= C T − G X ,<br />

where C T is the concentration coefficient of the tax t and G X is the Gini coefficient of pre-tax<br />

income. The conditions for a tax to be equalizing, neutral, or unequalizing are П T K > 0, П T K = 0,<br />

and П T K < 0, respectively.<br />

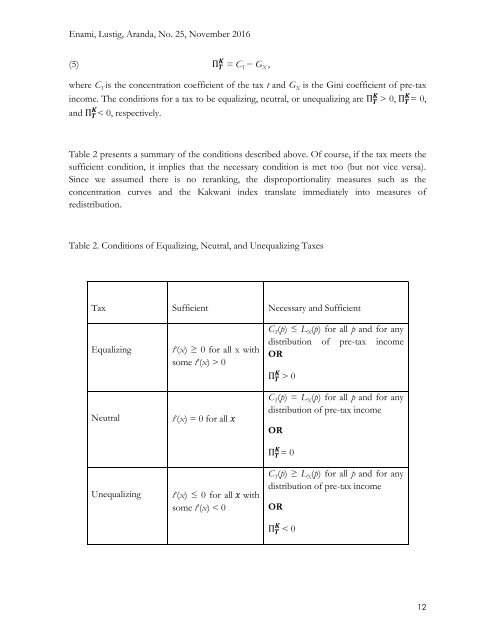

Table 2 presents a summary of the conditions described above. Of course, if the tax meets the<br />

sufficient condition, it implies that the necessary condition is met too (but not vice versa).<br />

Since we assumed there is no reranking, the disproportionality measures such as the<br />

concentration curves and the Kakwani index translate immediately into measures of<br />

redistribution.<br />

Table 2. Conditions of Equalizing, Neutral, and Unequalizing Taxes<br />

Tax Sufficient Necessary and Sufficient<br />

Equalizing<br />

Neutral<br />

Unequalizing<br />

t’(x) ≥ 0 for all x with<br />

some t’(x) > 0<br />

t’(x) = 0 for all x<br />

t’(x) ≤ 0 for all x with<br />

some t’(x) < 0<br />

C T (p) ≤ L X (p) for all p and for any<br />

distribution of pre-tax income<br />

OR<br />

П T K > 0<br />

C T (p) = L X (p) for all p and for any<br />

distribution of pre-tax income<br />

OR<br />

П T K = 0<br />

C T (p) ≥ L X (p) for all p and for any<br />

distribution of pre-tax income<br />

OR<br />

П T K < 0<br />

12