IMPACT OF TAXES AND TRANSFERS

n?u=RePEc:tul:ceqwps:25&r=lam

n?u=RePEc:tul:ceqwps:25&r=lam

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

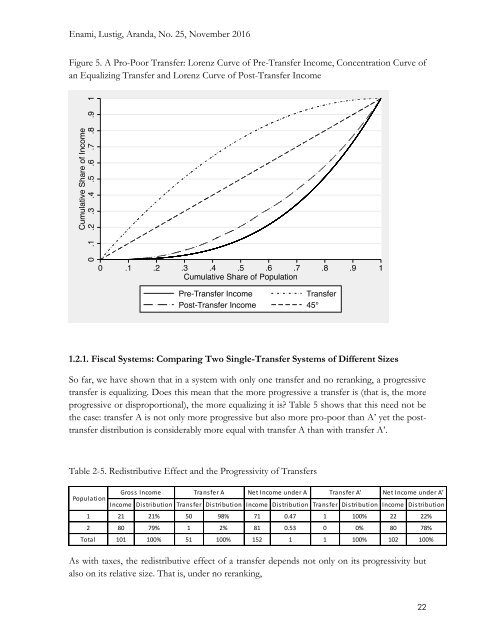

Enami, Lustig, Aranda, No. 25, November 2016<br />

Figure 5. A Pro-Poor Transfer: Lorenz Curve of Pre-Transfer Income, Concentration Curve of<br />

an Equalizing Transfer and Lorenz Curve of Post-Transfer Income<br />

1.2.1. Fiscal Systems: Comparing Two Single-Transfer Systems of Different Sizes<br />

So far, we have shown that in a system with only one transfer and no reranking, a progressive<br />

transfer is equalizing. Does this mean that the more progressive a transfer is (that is, the more<br />

progressive or disproportional), the more equalizing it is? Table 5 shows that this need not be<br />

the case: transfer A is not only more progressive but also more pro-poor than A’ yet the posttransfer<br />

distribution is considerably more equal with transfer A than with transfer A’.<br />

Table 2-5. Redistributive Effect and the Progressivity of Transfers<br />

Population<br />

Gross Income<br />

Transfer A<br />

Net Income under A Transfer A’ Net Income under A’<br />

Income Distribution Transfer Distribution Income Distribution Transfer Distribution Income Distribution<br />

1 21 21% 50 98% 71 0.47 1 100% 22 22%<br />

2 80 79% 1 2% 81 0.53 0 0% 80 78%<br />

Total 101 100% 51 100% 152 1 1 100% 102 100%<br />

As with taxes, the redistributive effect of a transfer depends not only on its progressivity but<br />

also on its relative size. That is, under no reranking,<br />

22