IMPACT OF TAXES AND TRANSFERS

n?u=RePEc:tul:ceqwps:25&r=lam

n?u=RePEc:tul:ceqwps:25&r=lam

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Enami, Lustig, Aranda, No. 25, November 2016<br />

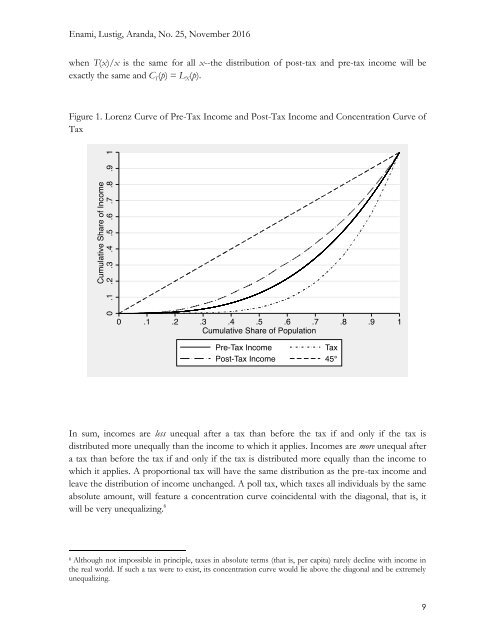

when T(x)/x is the same for all x--the distribution of post-tax and pre-tax income will be<br />

exactly the same and C T (p) = L X (p).<br />

Figure 1. Lorenz Curve of Pre-Tax Income and Post-Tax Income and Concentration Curve of<br />

Tax<br />

In sum, incomes are less unequal after a tax than before the tax if and only if the tax is<br />

distributed more unequally than the income to which it applies. Incomes are more unequal after<br />

a tax than before the tax if and only if the tax is distributed more equally than the income to<br />

which it applies. A proportional tax will have the same distribution as the pre-tax income and<br />

leave the distribution of income unchanged. A poll tax, which taxes all individuals by the same<br />

absolute amount, will feature a concentration curve coincidental with the diagonal, that is, it<br />

will be very unequalizing. 6<br />

6 Although not impossible in principle, taxes in absolute terms (that is, per capita) rarely decline with income in<br />

the real world. If such a tax were to exist, its concentration curve would lie above the diagonal and be extremely<br />

unequalizing.<br />

9