Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCE<br />

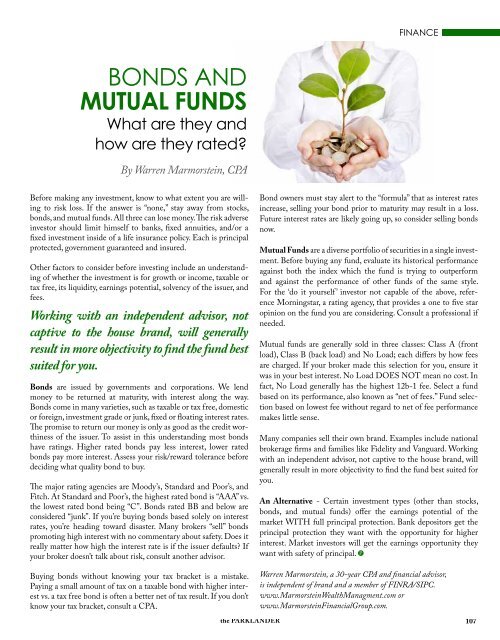

BONDS AND<br />

MUTUAL FUNDS<br />

What are they and<br />

how are they rated?<br />

By Warren Marmorstein, CPA<br />

Before making any investment, know to what extent you are willing<br />

to risk loss. If the answer is “none,” stay away from stocks,<br />

bonds, and mutual funds. All three can lose money. The risk adverse<br />

investor should limit himself to banks, fixed annuities, and/or a<br />

fixed investment inside of a life insurance policy. Each is principal<br />

protected, government guaranteed and insured.<br />

Other factors to consider before investing include an understanding<br />

of whether the investment is for growth or income, taxable or<br />

tax free, its liquidity, earnings potential, solvency of the issuer, and<br />

fees.<br />

Working with an independent advisor, not<br />

captive to the house brand, will generally<br />

result in more objectivity to find the fund best<br />

suited for you.<br />

Bonds are issued by governments and corporations. We lend<br />

money to be returned at maturity, with interest along the way.<br />

Bonds come in many varieties, such as taxable or tax free, domestic<br />

or foreign, investment grade or junk, fixed or floating interest rates.<br />

The promise to return our money is only as good as the credit worthiness<br />

of the issuer. To assist in this understanding most bonds<br />

have ratings. Higher rated bonds pay less interest, lower rated<br />

bonds pay more interest. Assess your risk/reward tolerance before<br />

deciding what quality bond to buy.<br />

The major rating agencies are Moody’s, Standard and Poor’s, and<br />

Fitch. At Standard and Poor’s, the highest rated bond is “AAA” vs.<br />

the lowest rated bond being “C”. Bonds rated BB and below are<br />

considered “junk”. If you’re buying bonds based solely on interest<br />

rates, you’re heading toward disaster. Many brokers “sell” bonds<br />

promoting high interest with no commentary about safety. Does it<br />

really matter how high the interest rate is if the issuer defaults? If<br />

your broker doesn’t talk about risk, consult another advisor.<br />

Buying bonds without knowing your tax bracket is a mistake.<br />

Paying a small amount of tax on a taxable bond with higher interest<br />

vs. a tax free bond is often a better net of tax result. If you don’t<br />

know your tax bracket, consult a CPA.<br />

Bond owners must stay alert to the “formula” that as interest rates<br />

increase, selling your bond prior to maturity may result in a loss.<br />

Future interest rates are likely going up, so consider selling bonds<br />

now.<br />

Mutual Funds are a diverse portfolio of securities in a single investment.<br />

Before buying any fund, evaluate its historical performance<br />

against both the index which the fund is trying to outperform<br />

and against the performance of other funds of the same style.<br />

For the ‘do it yourself ’ investor not capable of the above, reference<br />

Morningstar, a rating agency, that provides a one to five star<br />

opinion on the fund you are considering. Consult a professional if<br />

needed.<br />

Mutual funds are generally sold in three classes: Class A (front<br />

load), Class B (back load) and No Load; each differs by how fees<br />

are charged. If your broker made this selection for you, ensure it<br />

was in your best interest. No Load DOES NOT mean no cost. In<br />

fact, No Load generally has the highest 12b-1 fee. Select a fund<br />

based on its performance, also known as “net of fees.” Fund selection<br />

based on lowest fee without regard to net of fee performance<br />

makes little sense.<br />

Many companies sell their own brand. Examples include national<br />

brokerage firms and families like Fidelity and Vanguard. Working<br />

with an independent advisor, not captive to the house brand, will<br />

generally result in more objectivity to find the fund best suited for<br />

you.<br />

An Alternative - Certain investment types (other than stocks,<br />

bonds, and mutual funds) offer the earnings potential of the<br />

market WITH full principal protection. Bank depositors get the<br />

principal protection they want with the opportunity for higher<br />

interest. Market investors will get the earnings opportunity they<br />

want with safety of principal. P<br />

Warren Marmorstein, a 30-year CPA and financial advisor,<br />

is independent of brand and a member of FINRA/SIPC.<br />

www.MarmorsteinWealthManagment.com or<br />

www.MarmorsteinFinancialGroup.com.<br />

the PARKLANDER 107