20495_Debenhams_AR_151104

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

CONTINUED<br />

For the financial year year ended ended 29 29 August August 2015 2015<br />

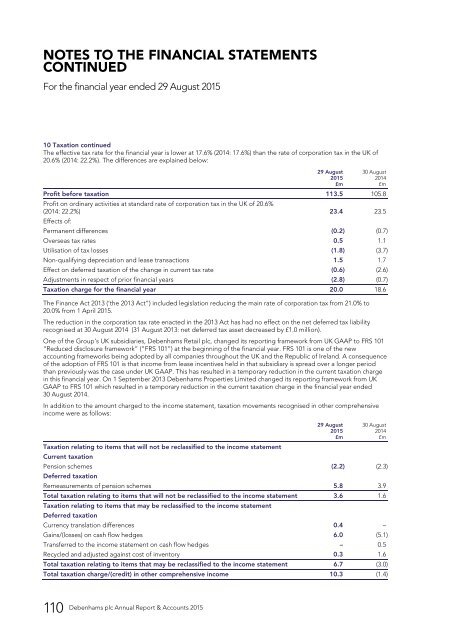

10 Taxation continued<br />

The effective tax rate for the financial year is lower at 17.6% (2014: 17.6%) than the rate of corporation tax in the UK of<br />

20.6% (2014: 22.2%). The differences are explained below:<br />

29 August<br />

2015<br />

£m<br />

30 August<br />

2014<br />

£m<br />

Profit before taxation 113.5 105.8<br />

Profit on ordinary activities at standard rate of corporation tax in the UK of 20.6%<br />

(2014: 22.2%) 23.4 23.5<br />

Effects of:<br />

Permanent differences (0.2) (0.7)<br />

Overseas tax rates 0.5 1.1<br />

Utilisation of tax losses (1.8) (3.7)<br />

Non-qualifying depreciation and lease transactions 1.5 1.7<br />

Effect on deferred taxation of the change in current tax rate (0.6) (2.6)<br />

Adjustments in respect of prior financial years (2.8) (0.7)<br />

Taxation charge for the financial year 20.0 18.6<br />

The Finance Act 2013 (‘the 2013 Act”) included legislation reducing the main rate of corporation tax from 21.0% to<br />

20.0% from 1 April 2015.<br />

The reduction in the corporation tax rate enacted in the 2013 Act has had no effect on the net deferred tax liability<br />

recognised at 30 August 2014 (31 August 2013: net deferred tax asset decreased by £1.0 million).<br />

One of the Group’s UK subsidiaries, <strong>Debenhams</strong> Retail plc, changed its reporting framework from UK GAAP to FRS 101<br />

“Reduced disclosure framework” (“FRS 101”) at the beginning of the financial year. FRS 101 is one of the new<br />

accounting frameworks being adopted by all companies throughout the UK and the Republic of Ireland. A consequence<br />

of the adoption of FRS 101 is that income from lease incentives held in that subsidiary is spread over a longer period<br />

than previously was the case under UK GAAP. This has resulted in a temporary reduction in the current taxation charge<br />

in this financial year. On 1 September 2013 <strong>Debenhams</strong> Properties Limited changed its reporting framework from UK<br />

GAAP to FRS 101 which resulted in a temporary reduction in the current taxation charge in the financial year ended<br />

30 August 2014.<br />

In addition to the amount charged to the income statement, taxation movements recognised in other comprehensive<br />

income were as follows:<br />

29 August<br />

2015<br />

£m<br />

30 August<br />

2014<br />

£m<br />

Taxation relating to items that will not be reclassified to the income statement<br />

Current taxation<br />

Pension schemes (2.2) (2.3)<br />

Deferred taxation<br />

Remeasurements of pension schemes 5.8 3.9<br />

Total taxation relating to items that will not be reclassified to the income statement 3.6 1.6<br />

Taxation relating to items that may be reclassified to the income statement<br />

Deferred taxation<br />

Currency translation differences 0.4 –<br />

Gains/(losses) on cash flow hedges 6.0 (5.1)<br />

Transferred to the income statement on cash flow hedges – 0.5<br />

Recycled and adjusted against cost of inventory 0.3 1.6<br />

Total taxation relating to items that may be reclassified to the income statement 6.7 (3.0)<br />

Total taxation charge/(credit) in other comprehensive income 10.3 (1.4)<br />

110<br />

<strong>Debenhams</strong> plc Annual Report & Accounts & Accounts 2015 2015