20495_Debenhams_AR_151104

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

CONTINUED<br />

For the financial year year ended ended 29 29 August August 2015 2015<br />

23 Retirement benefit schemes<br />

Defined contribution pension schemes<br />

The Group operates defined contribution pension schemes for its employees. Group contributions to defined<br />

contribution pension schemes during the financial year were £14.7 million (2014: £14.7 million).<br />

Defined benefit pension schemes<br />

The Group also operates defined benefit type pension schemes, being the <strong>Debenhams</strong> Executive Pension Plan<br />

(“DEPP”) and the <strong>Debenhams</strong> Retirement Scheme (“DRS”) (together “the Group’s pension schemes”), the assets of<br />

which are held in separate trustee-administered funds. The Group’s pension schemes were closed to future service<br />

accrual from 31 October 2006. The closure to future accrual will not affect the pensions of those who have retired or<br />

the deferred benefits of those who have left service or opted out before 31 October 2006.<br />

The Group’s pension schemes are established under trust law and each has a corporate trustee that is required to run<br />

the schemes in accordance with the scheme’s Trust Deed and Rules and to comply with the Pensions Act 2004 and all<br />

relevant legislation. Responsibility for governance of the schemes lies with the trustee of each scheme. Each corporate<br />

trustee is a company whose directors comprise of representatives:<br />

• Appointed by the Group<br />

• Nominated by scheme members<br />

The chair of both corporate trustees is independent from the schemes and from the Group.<br />

The most recent actuarial valuation of the Group’s pension schemes was carried out at 31 March 2014 and has been<br />

used by KPMG LLP, a qualified independent actuary, when calculating the IAS 19 revised “Employee benefits” valuation<br />

at 29 August 2015.<br />

During June 2015, the Group agreed a recovery plan for the Group’s pension schemes, which was intended to restore<br />

the schemes to a fully funded position on an ongoing basis. Under that agreement, the Group agreed to contribute<br />

£9.5 million per annum to the pension schemes for the period from 1 April 2014 to 31 March 2022 increasing by the<br />

percentage increase in RPI over the year to the previous December. The agreement replaced an agreement made in<br />

2012 under which the Group agreed to contribute £8.9 million per annum to the pension schemes for the period from<br />

1 April 2012 to 31 March 2022 increasing by the percentage increase in RPI over the year to the previous December.<br />

Additionally during 2015, the Group agreed to continue to cover the non-investment expenses and levies of the pension<br />

schemes, including those payable to the Pension Protection Fund. Employees make no further contributions to the<br />

schemes. By funding its defined benefit pension schemes, the Group is exposed to the risk that the cost of meeting its<br />

obligations is higher than anticipated. This could occur for several reasons, for example:<br />

• Investment returns on the schemes’ assets may be lower than anticipated, especially if falls in asset values are not<br />

matched by similar falls in the value of the schemes’ liabilities<br />

• The level of price inflation may be higher than that assumed, resulting in higher payments from the schemes<br />

• Scheme members may live longer than assumed<br />

• Legislative changes could lead to an increase in the liabilities of the pension schemes<br />

Investment of the schemes’ assets is managed by Hewitt Risk Management Services Limited under a delegated<br />

consulting service agreement. As at 29 August 2015 most of the schemes’ assets were invested in a delegated<br />

liability fund or a delegated growth fund.<br />

The weighted average duration of the defined benefit obligation is 22 years (2014: 22 years).<br />

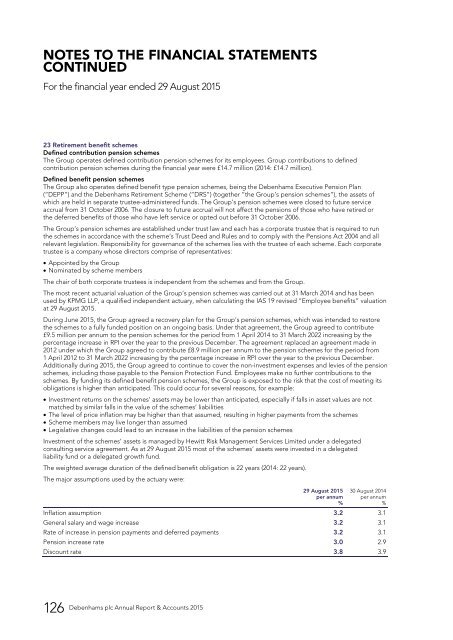

The major assumptions used by the actuary were:<br />

29 August 2015<br />

per annum<br />

%<br />

30 August 2014<br />

per annum<br />

%<br />

Inflation assumption 3.2 3.1<br />

General salary and wage increase 3.2 3.1<br />

Rate of increase in pension payments and deferred payments 3.2 3.1<br />

Pension increase rate 3.0 2.9<br />

Discount rate 3.8 3.9<br />

126<br />

<strong>Debenhams</strong> plc Annual Report & Accounts & Accounts 2015 2015