20495_Debenhams_AR_151104

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

CONTINUED<br />

For the financial year year ended ended 29 29 August August 2015 2015<br />

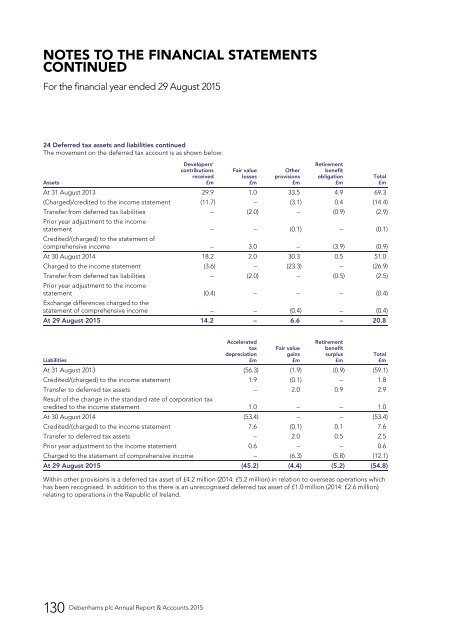

24 Deferred tax assets and liabilities continued<br />

The movement on the deferred tax account is as shown below:<br />

Assets<br />

Developers’<br />

contributions<br />

received<br />

£m<br />

Fair value<br />

losses<br />

£m<br />

Other<br />

provisions<br />

£m<br />

Retirement<br />

benefit<br />

obligation<br />

£m<br />

At 31 August 2013 29.9 1.0 33.5 4.9 69.3<br />

(Charged)/credited to the income statement (11.7) – (3.1) 0.4 (14.4)<br />

Transfer from deferred tax liabilities – (2.0) – (0.9) (2.9)<br />

Prior year adjustment to the income<br />

statement – – (0.1) – (0.1)<br />

Credited/(charged) to the statement of<br />

comprehensive income – 3.0 – (3.9) (0.9)<br />

At 30 August 2014 18.2 2.0 30.3 0.5 51.0<br />

Charged to the income statement (3.6) – (23.3) – (26.9)<br />

Transfer from deferred tax liabilities – (2.0) – (0.5) (2.5)<br />

Prior year adjustment to the income<br />

statement (0.4) – – – (0.4)<br />

Exchange differences charged to the<br />

statement of comprehensive income – – (0.4) – (0.4)<br />

At 29 August 2015 14.2 – 6.6 – 20.8<br />

Total<br />

£m<br />

Liabilities<br />

Accelerated<br />

tax<br />

depreciation<br />

£m<br />

Fair value<br />

gains<br />

£m<br />

Retirement<br />

benefit<br />

surplus<br />

£m<br />

Total<br />

£m<br />

At 31 August 2013 (56.3) (1.9) (0.9) (59.1)<br />

Credited/(charged) to the income statement 1.9 (0.1) – 1.8<br />

Transfer to deferred tax assets – 2.0 0.9 2.9<br />

Result of the change in the standard rate of corporation tax<br />

credited to the income statement 1.0 – – 1.0<br />

At 30 August 2014 (53.4) – – (53.4)<br />

Credited/(charged) to the income statement 7.6 (0.1) 0.1 7.6<br />

Transfer to deferred tax assets – 2.0 0.5 2.5<br />

Prior year adjustment to the income statement 0.6 – – 0.6<br />

Charged to the statement of comprehensive income – (6.3) (5.8) (12.1)<br />

At 29 August 2015 (45.2) (4.4) (5.2) (54.8)<br />

Within other provisions is a deferred tax asset of £4.2 million (2014: £5.2 million) in relation to overseas operations which<br />

has been recognised. In addition to this there is an unrecognised deferred tax asset of £1.0 million (2014: £2.6 million)<br />

relating to operations in the Republic of Ireland.<br />

130<br />

<strong>Debenhams</strong> plc Annual Report & Accounts & Accounts 2015 2015